Rare whisky bottles trading captures the interest of investors through its combination of cultural value, limited supply, and aging potential, often yielding significant returns in niche markets. Rare coins investment leverages historical significance, rarity, and material value, making it a time-tested asset class renowned for long-term stability and appreciation. Explore the unique advantages and market dynamics of both to determine which rare collectible aligns best with your investment goals.

Why it is important

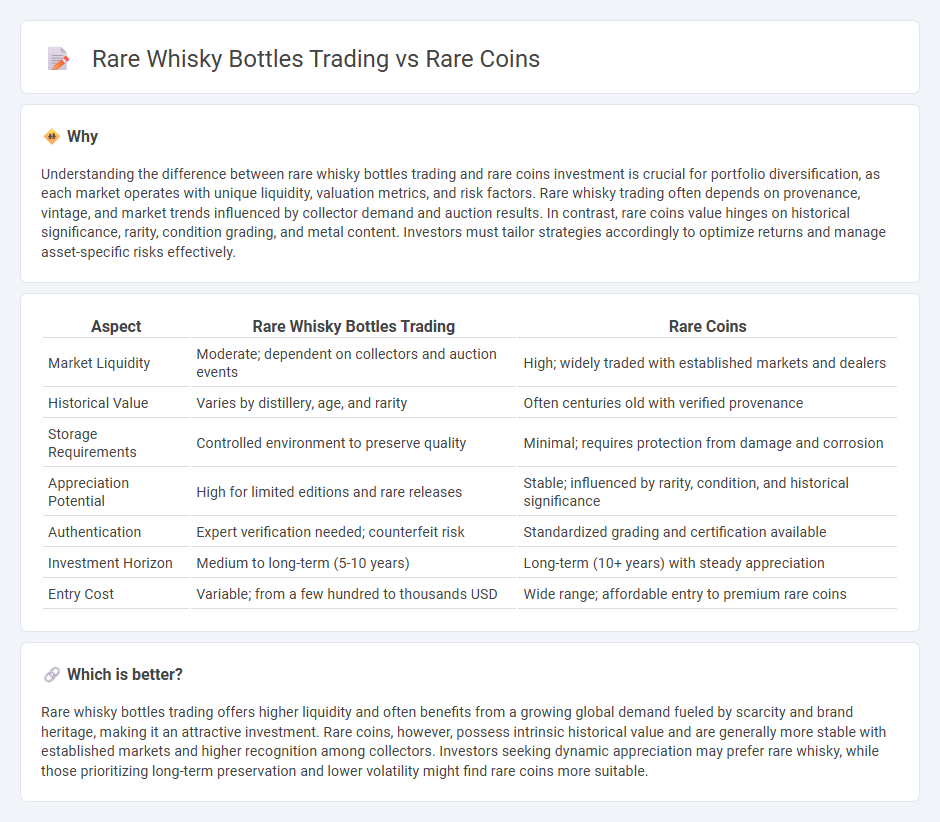

Understanding the difference between rare whisky bottles trading and rare coins investment is crucial for portfolio diversification, as each market operates with unique liquidity, valuation metrics, and risk factors. Rare whisky trading often depends on provenance, vintage, and market trends influenced by collector demand and auction results. In contrast, rare coins value hinges on historical significance, rarity, condition grading, and metal content. Investors must tailor strategies accordingly to optimize returns and manage asset-specific risks effectively.

Comparison Table

| Aspect | Rare Whisky Bottles Trading | Rare Coins |

|---|---|---|

| Market Liquidity | Moderate; dependent on collectors and auction events | High; widely traded with established markets and dealers |

| Historical Value | Varies by distillery, age, and rarity | Often centuries old with verified provenance |

| Storage Requirements | Controlled environment to preserve quality | Minimal; requires protection from damage and corrosion |

| Appreciation Potential | High for limited editions and rare releases | Stable; influenced by rarity, condition, and historical significance |

| Authentication | Expert verification needed; counterfeit risk | Standardized grading and certification available |

| Investment Horizon | Medium to long-term (5-10 years) | Long-term (10+ years) with steady appreciation |

| Entry Cost | Variable; from a few hundred to thousands USD | Wide range; affordable entry to premium rare coins |

Which is better?

Rare whisky bottles trading offers higher liquidity and often benefits from a growing global demand fueled by scarcity and brand heritage, making it an attractive investment. Rare coins, however, possess intrinsic historical value and are generally more stable with established markets and higher recognition among collectors. Investors seeking dynamic appreciation may prefer rare whisky, while those prioritizing long-term preservation and lower volatility might find rare coins more suitable.

Connection

Rare whisky bottles and rare coins share common investment traits, both appealing to collectors seeking tangible assets with historical significance and limited availability. Their market values often appreciate due to rarity, provenance, and condition, attracting investors aiming for portfolio diversification beyond stocks and bonds. Investment in these collectibles requires expertise to authenticate items and assess market trends, ensuring potential high returns and preserving asset value.

Key Terms

Grading (for coins) vs. Age statement (for whisky)

Grading in rare coins assesses factors like wear, luster, and strike quality to determine a coin's overall condition and market value. In contrast, the age statement on whisky bottles highlights the number of years the spirit has matured, impacting its flavor profile and collectibility. Explore the nuances of grading and aging to enhance your trading expertise in both rare coins and whisky.

Provenance

Provenance plays a crucial role in determining the value of rare coins and rare whisky bottles, as documented history authenticates origin and ownership, enhancing collector confidence. Rare coins with verified minting details and historical ownership command premium prices, while whisky bottles with traceable distillery records and limited edition releases attract enthusiasts seeking authenticity. Explore the depths of provenance influence to better understand investment potential in these collectible markets.

Liquidity

Rare coins typically exhibit higher liquidity due to a well-established global marketplace and standardized grading systems that facilitate quicker transactions. Rare whisky bottles often face limited liquidity, influenced by niche demand, storage requirements, and provenance verification complexities. Explore further to understand market dynamics and investment strategies for both collectibles.

Source and External Links

What's My Coin Worth? - This webpage provides a guide to rare coin values, including early eagles and other historically significant coins.

9 Of The World's Most Valuable Coins - An article highlighting some of the most valuable coins in the world, such as the 1794 Flowing Hair Silver Dollar and the 1787 Brasher Doubloon.

Rare Coins for Sale - Offers a selection of rare gold and silver coins for purchase, including historical pieces from Europe and the Americas.

dowidth.com

dowidth.com