Secondaries in venture capital offer investors the chance to buy existing stakes in private companies, providing liquidity and portfolio diversification without waiting for an IPO or acquisition. PIPE (Private Investment in Public Equity) involves investing directly in public companies at a discount, often accelerating capital flow and enhancing shareholder value. Explore the differences in risk, liquidity, and growth potential between these investment strategies to optimize your venture capital portfolio.

Why it is important

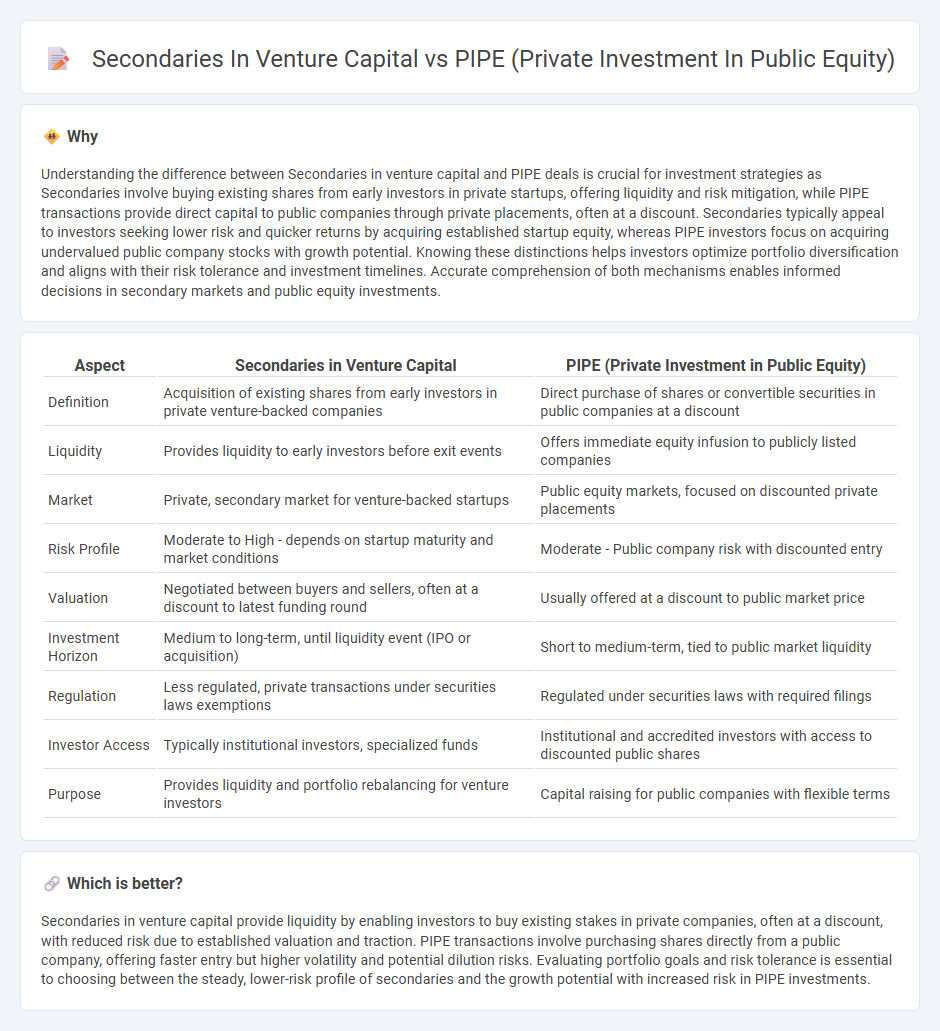

Understanding the difference between Secondaries in venture capital and PIPE deals is crucial for investment strategies as Secondaries involve buying existing shares from early investors in private startups, offering liquidity and risk mitigation, while PIPE transactions provide direct capital to public companies through private placements, often at a discount. Secondaries typically appeal to investors seeking lower risk and quicker returns by acquiring established startup equity, whereas PIPE investors focus on acquiring undervalued public company stocks with growth potential. Knowing these distinctions helps investors optimize portfolio diversification and aligns with their risk tolerance and investment timelines. Accurate comprehension of both mechanisms enables informed decisions in secondary markets and public equity investments.

Comparison Table

| Aspect | Secondaries in Venture Capital | PIPE (Private Investment in Public Equity) |

|---|---|---|

| Definition | Acquisition of existing shares from early investors in private venture-backed companies | Direct purchase of shares or convertible securities in public companies at a discount |

| Liquidity | Provides liquidity to early investors before exit events | Offers immediate equity infusion to publicly listed companies |

| Market | Private, secondary market for venture-backed startups | Public equity markets, focused on discounted private placements |

| Risk Profile | Moderate to High - depends on startup maturity and market conditions | Moderate - Public company risk with discounted entry |

| Valuation | Negotiated between buyers and sellers, often at a discount to latest funding round | Usually offered at a discount to public market price |

| Investment Horizon | Medium to long-term, until liquidity event (IPO or acquisition) | Short to medium-term, tied to public market liquidity |

| Regulation | Less regulated, private transactions under securities laws exemptions | Regulated under securities laws with required filings |

| Investor Access | Typically institutional investors, specialized funds | Institutional and accredited investors with access to discounted public shares |

| Purpose | Provides liquidity and portfolio rebalancing for venture investors | Capital raising for public companies with flexible terms |

Which is better?

Secondaries in venture capital provide liquidity by enabling investors to buy existing stakes in private companies, often at a discount, with reduced risk due to established valuation and traction. PIPE transactions involve purchasing shares directly from a public company, offering faster entry but higher volatility and potential dilution risks. Evaluating portfolio goals and risk tolerance is essential to choosing between the steady, lower-risk profile of secondaries and the growth potential with increased risk in PIPE investments.

Connection

Secondaries in venture capital and PIPE transactions both provide liquidity solutions for investors in private and public companies, respectively. Secondaries involve the buying and selling of pre-existing stakes in private startups, allowing early investors to exit and new investors to enter, while PIPE deals enable private investors to acquire public company shares at a discount, facilitating capital infusion. Both mechanisms help manage portfolio risk, enhance investment flexibility, and optimize capital allocation in dynamic market conditions.

Key Terms

Liquidity

PIPE transactions provide immediate liquidity to public companies by allowing private investors to purchase stock at a discount, often accelerating capital infusion and enhancing market confidence. Secondaries in venture capital enable investors to sell existing stakes in private companies or funds, offering liquidity without the need for an IPO or company exit. Explore detailed differences and strategic advantages of PIPEs and VC secondaries to optimize investment liquidity solutions.

Valuation

PIPE transactions in venture capital often present valuation advantages by allowing investors to purchase shares at a negotiated discount to the current market price, providing immediate equity stakes in growing public companies. In contrast, secondaries involve the purchase of existing shares from early investors or employees, where valuations fluctuate based on market conditions and offer less opportunity for negotiated discounts. Explore deeper insights on how these valuation dynamics impact investment strategies and returns in venture capital markets.

Ownership Transfer

PIPE (Private Investment in Public Equity) deals involve private investors purchasing shares directly from a public company, often resulting in new equity issuance and potential ownership dilution. Secondaries in venture capital refer to the transfer of existing ownership stakes from current shareholders to new investors, enabling liquidity without affecting the company's total share count. Explore the nuances of ownership transfer mechanisms in PIPE versus secondaries to better understand their impact on investor control and capital structure.

Source and External Links

Private Investment in Public Equity (PIPE) | Datasite - PIPE is a private placement transaction by a public company to quickly raise capital by selling equity securities to accredited investors, often at a discount or in structured forms like convertible bonds; it is faster and less complex than traditional offerings and often used by SPACs to finance business combinations.

Private investment in public equity - Wikipedia - A PIPE deal involves the sale of publicly traded common stock, preferred stock, or convertible securities to private investors through a private placement rather than a public stock exchange offering, often registered or unregistered with the SEC.

PIPE Offerings | Investor.gov - PIPE offerings are private investments in public companies where investors buy restricted shares at a set price and the company files a registration statement to allow resale to the public, though PIPE deals may dilute existing shareholders' stock value due to increased share supply.

dowidth.com

dowidth.com