Whale watching shares refer to investment opportunities in companies specializing in marine ecotourism, offering potential returns tied to niche market growth and environmental sustainability. Crowdfunding equities involve pooling capital from multiple investors to fund startups or projects, providing diversified risk exposure and access to early-stage ventures. Discover how these distinct investment options can align with your financial goals and risk tolerance.

Why it is important

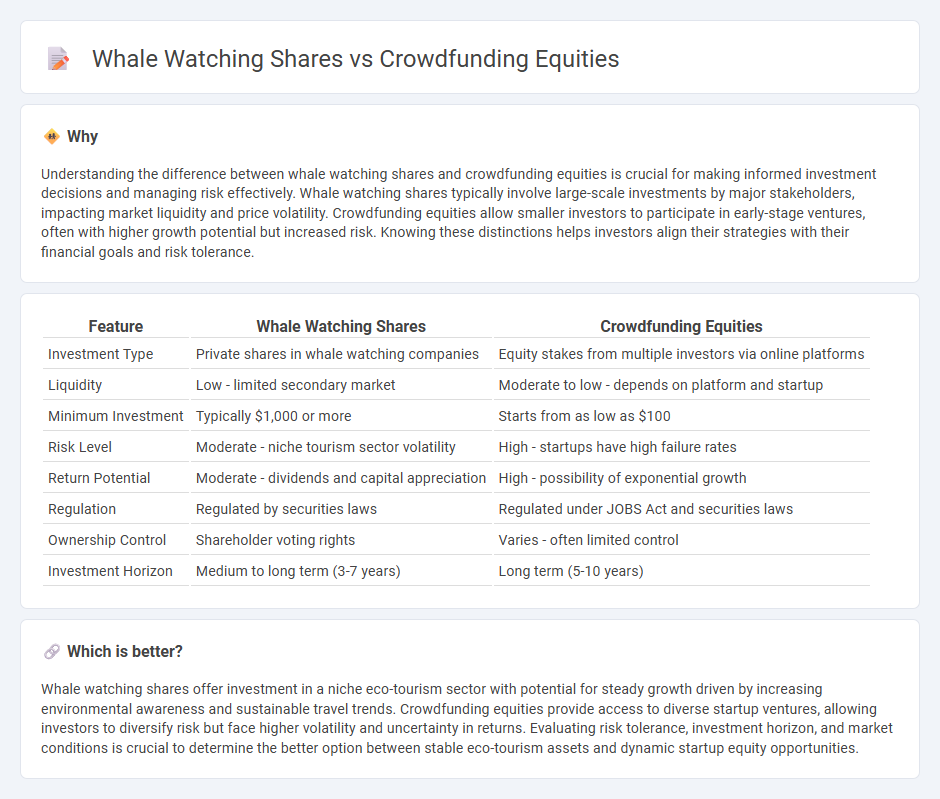

Understanding the difference between whale watching shares and crowdfunding equities is crucial for making informed investment decisions and managing risk effectively. Whale watching shares typically involve large-scale investments by major stakeholders, impacting market liquidity and price volatility. Crowdfunding equities allow smaller investors to participate in early-stage ventures, often with higher growth potential but increased risk. Knowing these distinctions helps investors align their strategies with their financial goals and risk tolerance.

Comparison Table

| Feature | Whale Watching Shares | Crowdfunding Equities |

|---|---|---|

| Investment Type | Private shares in whale watching companies | Equity stakes from multiple investors via online platforms |

| Liquidity | Low - limited secondary market | Moderate to low - depends on platform and startup |

| Minimum Investment | Typically $1,000 or more | Starts from as low as $100 |

| Risk Level | Moderate - niche tourism sector volatility | High - startups have high failure rates |

| Return Potential | Moderate - dividends and capital appreciation | High - possibility of exponential growth |

| Regulation | Regulated by securities laws | Regulated under JOBS Act and securities laws |

| Ownership Control | Shareholder voting rights | Varies - often limited control |

| Investment Horizon | Medium to long term (3-7 years) | Long term (5-10 years) |

Which is better?

Whale watching shares offer investment in a niche eco-tourism sector with potential for steady growth driven by increasing environmental awareness and sustainable travel trends. Crowdfunding equities provide access to diverse startup ventures, allowing investors to diversify risk but face higher volatility and uncertainty in returns. Evaluating risk tolerance, investment horizon, and market conditions is crucial to determine the better option between stable eco-tourism assets and dynamic startup equity opportunities.

Connection

Whale watching shares tap into niche tourism investment, providing opportunities for investors to benefit from increasing eco-tourism demand, while crowdfunding equities enable a broader pool of investors to collectively fund similar ventures. Both investment types leverage public interest and community funding models to democratize access to unique asset classes and support sustainable business growth. The convergence of these strategies highlights a growing trend in diversifying portfolios through experiential and environmental-focused investments.

Key Terms

Equity Ownership

Crowdfunding equities enable individual investors to acquire ownership stakes in startups or small businesses through pooled capital, often with lower entry barriers and diversified risks. Whale watching shares typically refer to investments in established tourism companies offering whale watching experiences, providing potential dividends and exposure to eco-tourism markets. Discover more about the nuances of equity ownership in these sectors and how they impact investor portfolios.

Investor Influence

Investor influence in crowdfunding equities often allows shareholders to have a more direct role in company decisions through voting rights and active participation, fostering a community-driven approach to business growth. Whale watching shares, typically associated with established companies, offer investors limited influence due to concentrated ownership and less frequent shareholder engagement. Explore how these investment avenues differ to determine which aligns best with your desire for impact and control.

Capital Pooling

Crowdfunding equities enable individual investors to pool capital into startups or projects, offering diversified investment opportunities with comparatively lower entry barriers. Whale watching shares, typically issued by established eco-tourism companies, attract larger investors who seek stable returns from niche markets tied to environmental sustainability. Explore the nuances of capital pooling strategies to understand which investment vehicle aligns best with your financial goals.

Source and External Links

Equity Crowdfunding - Definition, Pros, Cons, Regulations - Equity crowdfunding is a method for startups and early-stage companies to raise capital by offering their securities to a large number of investors online, giving each investor a proportional stake in the company.

Equity crowdfunding - Equity crowdfunding is the online sale of private company securities to a broad group of investors, allowing individuals to fund startups and small businesses in exchange for equity ownership, and is regulated as part of capital markets.

Equity Crowdfunding: What It Is and How to Get It - In the U.S., private companies can legally raise up to $5 million annually from both accredited and non-accredited investors through equity crowdfunding, which involves selling shares online without incurring debt or requiring loan repayments.

dowidth.com

dowidth.com