Wine funds offer investors exposure to alternative assets through the acquisition and management of fine wine portfolios, capitalizing on market trends and rarity to generate returns. Infrastructure funds focus on investing in large-scale public systems and services such as transportation, energy, and utilities, providing stable cash flows often linked to inflation. Explore in-depth comparisons of risk, return, and market dynamics between wine funds and infrastructure funds to make informed investment decisions.

Why it is important

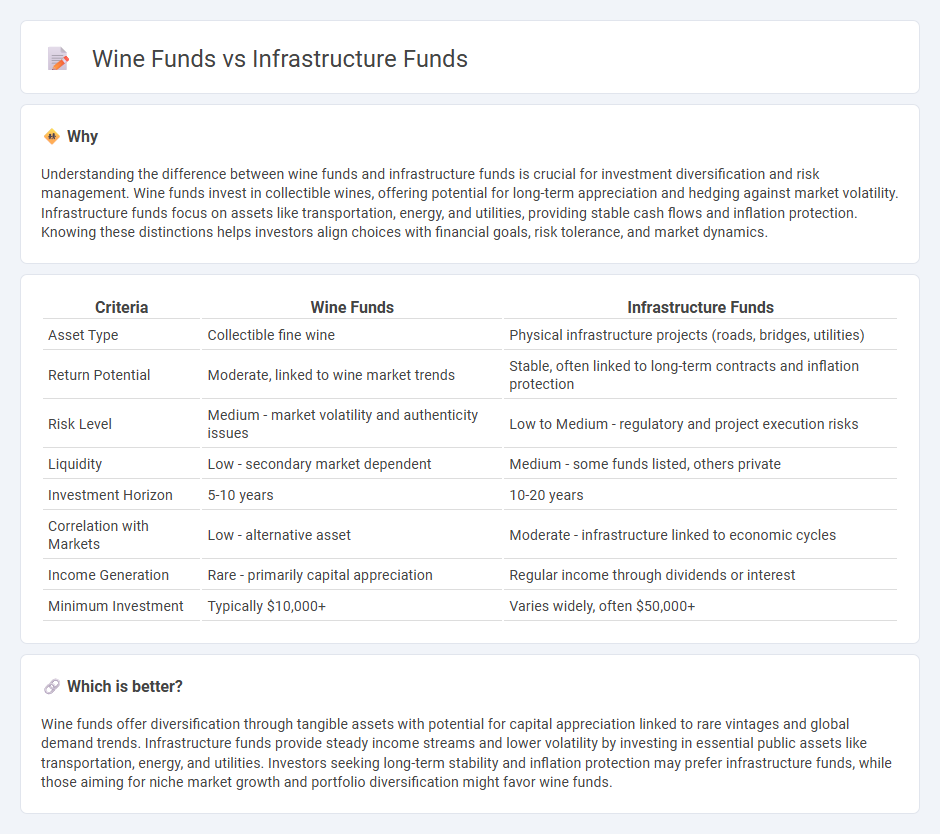

Understanding the difference between wine funds and infrastructure funds is crucial for investment diversification and risk management. Wine funds invest in collectible wines, offering potential for long-term appreciation and hedging against market volatility. Infrastructure funds focus on assets like transportation, energy, and utilities, providing stable cash flows and inflation protection. Knowing these distinctions helps investors align choices with financial goals, risk tolerance, and market dynamics.

Comparison Table

| Criteria | Wine Funds | Infrastructure Funds |

|---|---|---|

| Asset Type | Collectible fine wine | Physical infrastructure projects (roads, bridges, utilities) |

| Return Potential | Moderate, linked to wine market trends | Stable, often linked to long-term contracts and inflation protection |

| Risk Level | Medium - market volatility and authenticity issues | Low to Medium - regulatory and project execution risks |

| Liquidity | Low - secondary market dependent | Medium - some funds listed, others private |

| Investment Horizon | 5-10 years | 10-20 years |

| Correlation with Markets | Low - alternative asset | Moderate - infrastructure linked to economic cycles |

| Income Generation | Rare - primarily capital appreciation | Regular income through dividends or interest |

| Minimum Investment | Typically $10,000+ | Varies widely, often $50,000+ |

Which is better?

Wine funds offer diversification through tangible assets with potential for capital appreciation linked to rare vintages and global demand trends. Infrastructure funds provide steady income streams and lower volatility by investing in essential public assets like transportation, energy, and utilities. Investors seeking long-term stability and inflation protection may prefer infrastructure funds, while those aiming for niche market growth and portfolio diversification might favor wine funds.

Connection

Wine funds and infrastructure funds both attract investors by offering alternative asset classes that provide portfolio diversification beyond traditional equities and bonds. Wine funds capitalize on the increasing global demand for fine wines, leveraging market trends and scarcity to generate returns, while infrastructure funds invest in large-scale public projects like transportation, energy, and utilities, often benefiting from stable cash flows and government contracts. Both fund types share a focus on long-term value appreciation and risk mitigation through tangible, non-correlated assets.

Key Terms

**Infrastructure funds:**

Infrastructure funds invest capital in physical assets such as transportation, energy, and utilities, offering stable cash flows and long-term growth potential. These funds provide diversification benefits and act as a hedge against inflation due to their exposure to essential services. Explore more about how infrastructure funds can enhance your investment portfolio.

Yield

Infrastructure funds typically offer stable, long-term yield driven by investments in essential assets like utilities, transportation, and energy, benefiting from predictable cash flows and inflation protection. Wine funds provide yield potential through the appreciation of fine wine assets, influenced by rarity, vintage quality, and market demand, but returns can be less predictable and more sensitive to market trends. Explore more about how these distinct yield profiles align with your investment goals.

Public-Private Partnership (PPP)

Infrastructure funds primarily invest in large-scale public assets and projects through Public-Private Partnerships (PPP), providing critical capital for transportation, energy, and utilities that deliver stable, long-term returns. Wine funds focus on investing in collectible wines, offering diversification and potential appreciation unrelated to traditional market cycles, but lack the direct impact and social utility associated with PPP infrastructure projects. Explore how combining these investment types can balance risk and enhance portfolio resilience.

Source and External Links

Infrastructure Fund - An infrastructure fund is a privately offered or publicly listed fund that invests directly or indirectly in infrastructure and associated industries, such as transportation systems and power plants.

Cohen & Steers Infrastructure Fund - This fund aims for total return with an emphasis on income through investments in securities issued by infrastructure companies.

PGIM Jennison Global Infrastructure Fund - The fund seeks total return by investing worldwide in companies that own, operate, build, and service infrastructure assets.

Infrastructure Investor 100 - This ranking lists the largest infrastructure fund managers globally, with Brookfield Asset Management currently holding the top position.

dowidth.com

dowidth.com