Vintage video game investing focuses on rare, classic titles and original hardware, often resulting in high value appreciation due to nostalgia and limited availability. Modern video game investing centers around new releases, digital assets, and eSports, leveraging current trends and technological advancements for growth potential. Explore the key differences and opportunities between these two investment strategies to optimize your portfolio.

Why it is important

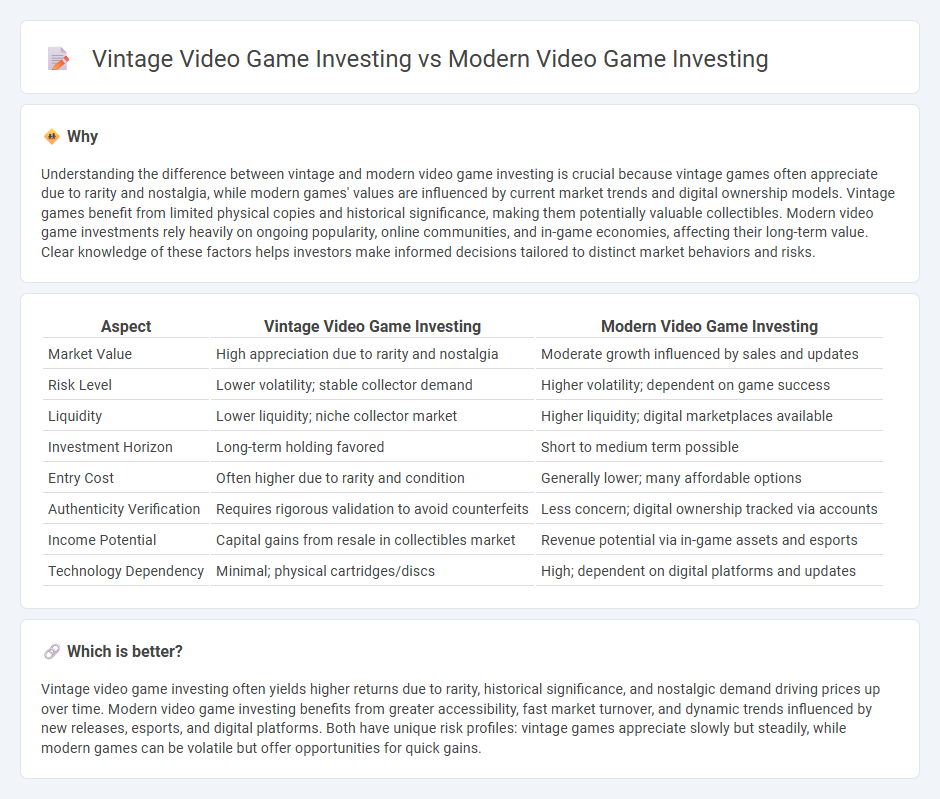

Understanding the difference between vintage and modern video game investing is crucial because vintage games often appreciate due to rarity and nostalgia, while modern games' values are influenced by current market trends and digital ownership models. Vintage games benefit from limited physical copies and historical significance, making them potentially valuable collectibles. Modern video game investments rely heavily on ongoing popularity, online communities, and in-game economies, affecting their long-term value. Clear knowledge of these factors helps investors make informed decisions tailored to distinct market behaviors and risks.

Comparison Table

| Aspect | Vintage Video Game Investing | Modern Video Game Investing |

|---|---|---|

| Market Value | High appreciation due to rarity and nostalgia | Moderate growth influenced by sales and updates |

| Risk Level | Lower volatility; stable collector demand | Higher volatility; dependent on game success |

| Liquidity | Lower liquidity; niche collector market | Higher liquidity; digital marketplaces available |

| Investment Horizon | Long-term holding favored | Short to medium term possible |

| Entry Cost | Often higher due to rarity and condition | Generally lower; many affordable options |

| Authenticity Verification | Requires rigorous validation to avoid counterfeits | Less concern; digital ownership tracked via accounts |

| Income Potential | Capital gains from resale in collectibles market | Revenue potential via in-game assets and esports |

| Technology Dependency | Minimal; physical cartridges/discs | High; dependent on digital platforms and updates |

Which is better?

Vintage video game investing often yields higher returns due to rarity, historical significance, and nostalgic demand driving prices up over time. Modern video game investing benefits from greater accessibility, fast market turnover, and dynamic trends influenced by new releases, esports, and digital platforms. Both have unique risk profiles: vintage games appreciate slowly but steadily, while modern games can be volatile but offer opportunities for quick gains.

Connection

Vintage video game investing and modern video game investing are connected through the shared appeal of rarity, nostalgia, and market demand, driving value appreciation over time. Both markets rely on the provenance and condition of games, with vintage titles gaining historical significance while modern games benefit from digital scarcity and collector editions. Investors leverage trends in pop culture and technological advancements to identify promising assets in these evolving entertainment sectors.

Key Terms

**Modern video game investing:**

Modern video game investing centers on digital assets such as limited edition NFTs, in-game items, and early access titles that can appreciate rapidly due to technological advances and growing gamer communities. Platforms like Steam, Epic Games, and blockchain-based marketplaces facilitate dynamic trading environments, with value driven by player demand, game popularity, and rarity of digital goods. Explore the latest trends and strategies in modern video game investing to capitalize on the evolving gaming economy.

Sealed Grading

Sealed grading significantly impacts the valuation of both modern and vintage video games, with modern titles often graded by entities like Wata Games, ensuring authenticity and condition for collectors and investors. Vintage games benefit from standardized grading approaches such as those by the Video Game Authority (VGA), which emphasize preservation of original packaging and rarity. Explore the nuances of sealed grading to optimize your investment strategy in the video game market.

Limited Editions

Investing in modern video game limited editions offers high liquidity and access to digital platforms with consistent market demand, while vintage video game limited editions provide rarity and historical significance that often command premium prices among collectors. Modern editions benefit from contemporary production runs with guaranteed authenticity, whereas vintage editions' scarcity and condition heavily influence their investment value. Discover more about how limited edition video games can diversify and enhance your investment portfolio.

Source and External Links

Innovation in Gaming and the Role of Startups - Venture capital investment in gaming startups has surged, growing 3.7 times from 2014 to 2024, with 2024 on track for nearly $5.5 billion in funding, primarily focusing on content creation.

How to Start Investing in Gaming: The Best Ways - Investors can engage in modern video game investing by buying shares in large public gaming companies, investing in gaming-focused ETFs, or funding early-stage gaming startups through venture capital.

The 10+ Best Gaming VCs Investing in 2025 - The gaming investment landscape is driven by trends such as mobile gaming's rapid growth and AI integration, attracting venture capital interested in dynamic, technology-driven game development.

dowidth.com

dowidth.com