Luxury handbag investment offers high liquidity and strong brand appreciation, with iconic brands like Hermes and Chanel often outperforming traditional assets. Classic car investment requires significant maintenance and storage but can yield substantial returns through rarity and historical significance, especially models from Ferrari and Porsche. Explore the unique benefits and risks of these luxury asset classes to make an informed investment choice.

Why it is important

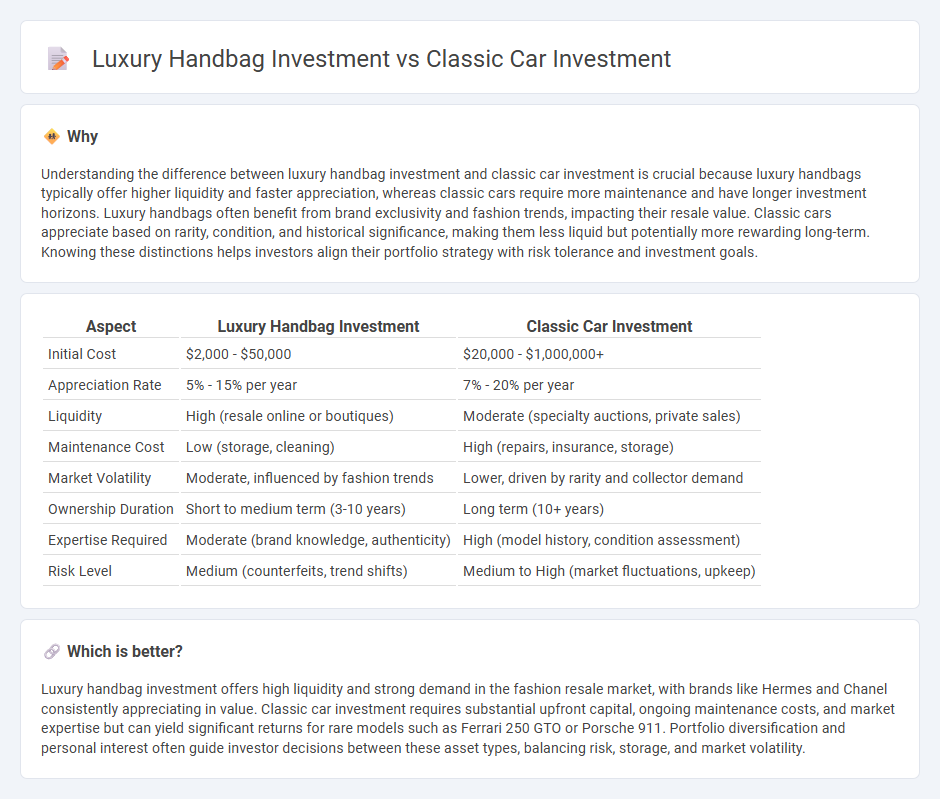

Understanding the difference between luxury handbag investment and classic car investment is crucial because luxury handbags typically offer higher liquidity and faster appreciation, whereas classic cars require more maintenance and have longer investment horizons. Luxury handbags often benefit from brand exclusivity and fashion trends, impacting their resale value. Classic cars appreciate based on rarity, condition, and historical significance, making them less liquid but potentially more rewarding long-term. Knowing these distinctions helps investors align their portfolio strategy with risk tolerance and investment goals.

Comparison Table

| Aspect | Luxury Handbag Investment | Classic Car Investment |

|---|---|---|

| Initial Cost | $2,000 - $50,000 | $20,000 - $1,000,000+ |

| Appreciation Rate | 5% - 15% per year | 7% - 20% per year |

| Liquidity | High (resale online or boutiques) | Moderate (specialty auctions, private sales) |

| Maintenance Cost | Low (storage, cleaning) | High (repairs, insurance, storage) |

| Market Volatility | Moderate, influenced by fashion trends | Lower, driven by rarity and collector demand |

| Ownership Duration | Short to medium term (3-10 years) | Long term (10+ years) |

| Expertise Required | Moderate (brand knowledge, authenticity) | High (model history, condition assessment) |

| Risk Level | Medium (counterfeits, trend shifts) | Medium to High (market fluctuations, upkeep) |

Which is better?

Luxury handbag investment offers high liquidity and strong demand in the fashion resale market, with brands like Hermes and Chanel consistently appreciating in value. Classic car investment requires substantial upfront capital, ongoing maintenance costs, and market expertise but can yield significant returns for rare models such as Ferrari 250 GTO or Porsche 911. Portfolio diversification and personal interest often guide investor decisions between these asset types, balancing risk, storage, and market volatility.

Connection

Luxury handbag investment and classic car investment both capitalize on the principles of rarity, brand prestige, and historical value appreciation, making them alternative asset classes sought by affluent investors. Limited edition luxury handbags from brands like Hermes and Chanel appreciate over time due to scarcity and craftsmanship, similar to how classic cars from manufacturers such as Ferrari and Porsche gain value through vintage status and collector demand. These investments offer portfolio diversification by providing tangible assets that hedge against market volatility and inflation, driven by a niche yet global collector community.

Key Terms

Appreciation

Classic cars often appreciate due to rarity, historical significance, and restoration quality, making them highly sought after by collectors worldwide. Luxury handbags, particularly limited editions from brands like Hermes and Chanel, maintain strong value growth driven by brand prestige and exclusivity. Explore detailed comparisons to understand which investment aligns best with your financial goals.

Authenticity

Authenticity plays a critical role in both classic car investment and luxury handbag investment, determining the value and future appreciation potential of each asset. Classic cars require verified provenance, matching numbers, and original parts to maintain their market worth, while luxury handbags demand authenticated craftsmanship, serial numbers, and proof of purchase from reputable sources. Explore how authenticity impacts your investment strategies and portfolio diversification in the luxury market.

Provenance

Provenance plays a crucial role in both classic car and luxury handbag investments, as it directly affects authenticity, value, and desirability. Classic cars with a well-documented history, including previous owners, meticulous maintenance, and participation in prestigious events, often command higher prices at auctions. Explore detailed provenance strategies and their impact on investment returns to make informed decisions.

Source and External Links

Top 10 Most Investable Classic Cars | MyArtBroker | Article - Classic cars are a good investment because they are finite assets with rarity, cultural significance, and unique design that drive demand and value over time, offering strong returns and versatility for collectors and investors.

Cars | Rally | Alternative Asset Investment - The global classic car market, valued over $30 billion in 2020, delivers stable returns and low volatility, with examples like the 1955 Porsche 356 Speedster gaining over 568% in value since 2002, making classic car investment attractive for diversification.

Investing in Classic Cars - Nationwide - Classic car investing is increasingly popular beyond the wealthy, with vehicles in the $20,000-$30,000 range offering potential strong resale value and historical growth of 500% in a decade according to the Knight Frank index.

dowidth.com

dowidth.com