Collectibles investment involves acquiring physical items such as art, antiques, or rare coins, which can appreciate based on rarity and demand, while exchange-traded funds (ETFs) offer diversified exposure to stocks, bonds, or commodities through a single, liquid investment vehicle. ETFs provide greater liquidity and ease of trading on stock exchanges, whereas collectibles require specialized knowledge and may involve higher transaction costs and illiquidity. Explore more to understand which investment aligns best with your financial goals and risk tolerance.

Why it is important

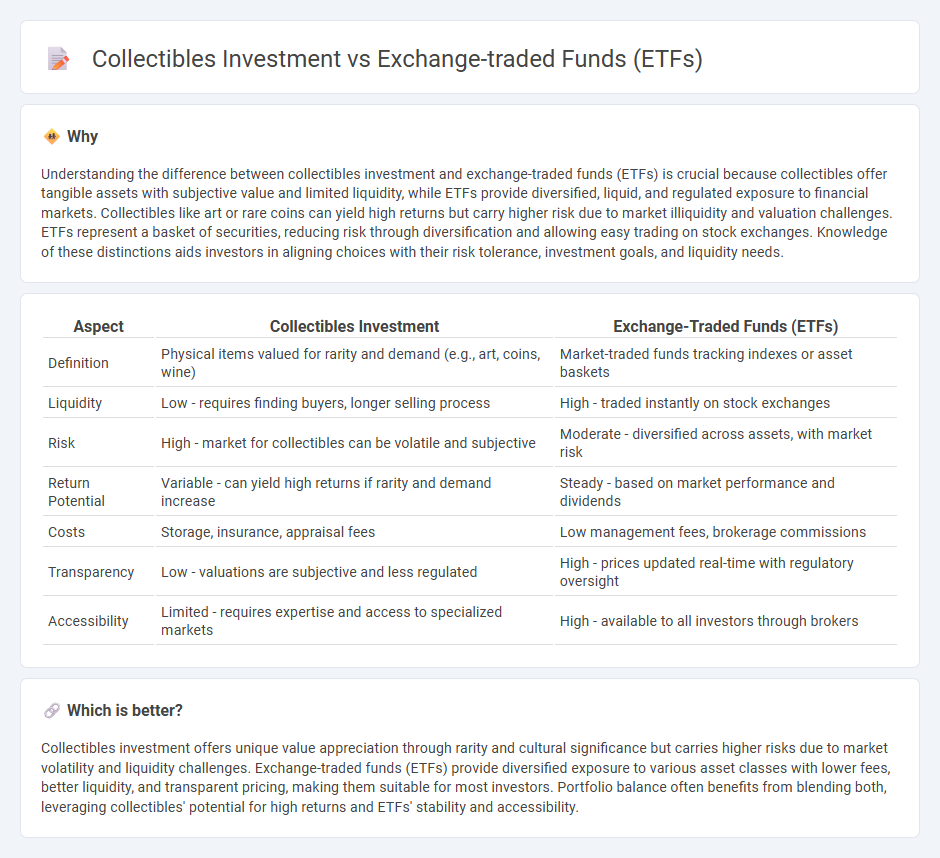

Understanding the difference between collectibles investment and exchange-traded funds (ETFs) is crucial because collectibles offer tangible assets with subjective value and limited liquidity, while ETFs provide diversified, liquid, and regulated exposure to financial markets. Collectibles like art or rare coins can yield high returns but carry higher risk due to market illiquidity and valuation challenges. ETFs represent a basket of securities, reducing risk through diversification and allowing easy trading on stock exchanges. Knowledge of these distinctions aids investors in aligning choices with their risk tolerance, investment goals, and liquidity needs.

Comparison Table

| Aspect | Collectibles Investment | Exchange-Traded Funds (ETFs) |

|---|---|---|

| Definition | Physical items valued for rarity and demand (e.g., art, coins, wine) | Market-traded funds tracking indexes or asset baskets |

| Liquidity | Low - requires finding buyers, longer selling process | High - traded instantly on stock exchanges |

| Risk | High - market for collectibles can be volatile and subjective | Moderate - diversified across assets, with market risk |

| Return Potential | Variable - can yield high returns if rarity and demand increase | Steady - based on market performance and dividends |

| Costs | Storage, insurance, appraisal fees | Low management fees, brokerage commissions |

| Transparency | Low - valuations are subjective and less regulated | High - prices updated real-time with regulatory oversight |

| Accessibility | Limited - requires expertise and access to specialized markets | High - available to all investors through brokers |

Which is better?

Collectibles investment offers unique value appreciation through rarity and cultural significance but carries higher risks due to market volatility and liquidity challenges. Exchange-traded funds (ETFs) provide diversified exposure to various asset classes with lower fees, better liquidity, and transparent pricing, making them suitable for most investors. Portfolio balance often benefits from blending both, leveraging collectibles' potential for high returns and ETFs' stability and accessibility.

Connection

Collectibles investment and exchange-traded funds (ETFs) intersect through specialized ETFs that offer exposure to tangible assets like art, coins, and rare collectibles, providing investors diversification beyond traditional stocks and bonds. These ETFs aggregate fractional ownership of high-value collectibles, enabling liquidity and easier market access compared to direct collectible purchases. The evolving market for collectible-focused ETFs highlights growing investor interest in alternative assets as part of a balanced investment portfolio.

Key Terms

Liquidity

Exchange-traded funds (ETFs) offer high liquidity as they can be bought and sold on stock exchanges throughout the trading day, allowing investors to quickly convert holdings into cash. Collectibles, such as art, antiques, or rare coins, generally have low liquidity due to limited marketplaces, longer transaction times, and the need for specialized knowledge to determine value and find buyers. Explore more about the liquidity differences and investment implications between ETFs and collectibles to make informed portfolio choices.

Diversification

Exchange-traded funds (ETFs) offer broad diversification by holding a variety of assets such as stocks, bonds, or commodities within a single portfolio, reducing specific risk. Collectibles investment, including art, coins, and rare items, typically provides limited diversification as these assets are often illiquid and influenced by niche market factors. Explore comprehensive strategies to enhance portfolio resilience through diversified investment choices.

Valuation

Exchange-traded funds (ETFs) offer transparent and real-time valuation based on market prices, facilitating easy portfolio tracking and liquidity. Collectibles investment, such as art or rare coins, involves subjective valuation influenced by rarity, condition, and market demand, often lacking standardized pricing and liquidity. Explore detailed insights to understand which investment suits your financial goals better.

Source and External Links

Exchange-Traded Fund (ETF) - Investor.gov - An ETF is an investment product registered with the SEC, pooling money to invest in various securities, but unlike mutual funds, ETF shares trade on stock exchanges at market prices and can be more tax efficient.

What is an ETF (Exchange-Traded Fund)? - Charles Schwab - ETFs combine the diversification of mutual funds with the flexibility of stocks, offering affordable access to a broad range of assets and trading like a stock on exchanges during market hours.

Exchange-Traded Funds and Products | FINRA.org - ETFs are pooled investment funds traded on exchanges that either passively track an index or are actively managed, with shares created and redeemed primarily by authorized participants, offering liquidity and transparency to investors.

dowidth.com

dowidth.com