Fractional farmland ownership offers direct equity in agricultural land, providing tangible asset control and potential for crop revenue, while REITs (Real Estate Investment Trusts) deliver diversified exposure to real estate through traded shares with liquidity and passive income benefits. Investors seeking concrete agricultural asset involvement might prefer fractional ownership, whereas those valuing ease of trading and broader real estate access often choose REITs. Explore more to understand which investment aligns best with your financial goals.

Why it is important

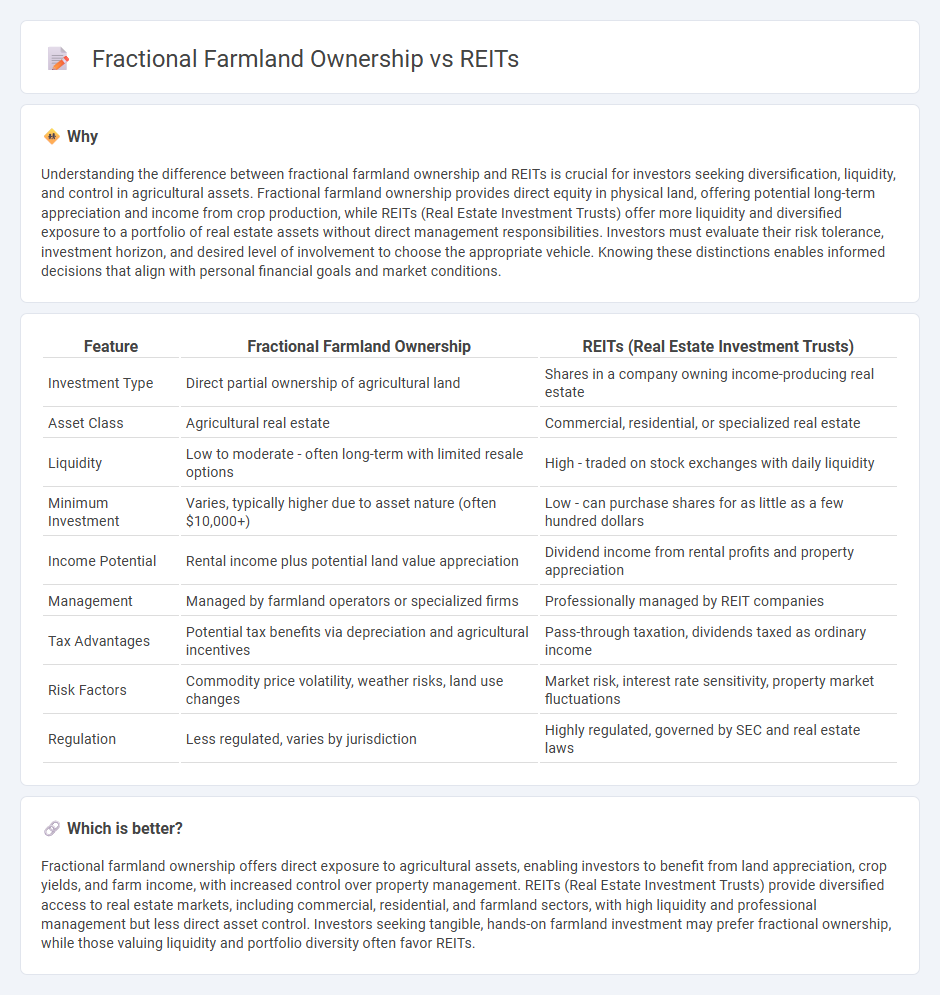

Understanding the difference between fractional farmland ownership and REITs is crucial for investors seeking diversification, liquidity, and control in agricultural assets. Fractional farmland ownership provides direct equity in physical land, offering potential long-term appreciation and income from crop production, while REITs (Real Estate Investment Trusts) offer more liquidity and diversified exposure to a portfolio of real estate assets without direct management responsibilities. Investors must evaluate their risk tolerance, investment horizon, and desired level of involvement to choose the appropriate vehicle. Knowing these distinctions enables informed decisions that align with personal financial goals and market conditions.

Comparison Table

| Feature | Fractional Farmland Ownership | REITs (Real Estate Investment Trusts) |

|---|---|---|

| Investment Type | Direct partial ownership of agricultural land | Shares in a company owning income-producing real estate |

| Asset Class | Agricultural real estate | Commercial, residential, or specialized real estate |

| Liquidity | Low to moderate - often long-term with limited resale options | High - traded on stock exchanges with daily liquidity |

| Minimum Investment | Varies, typically higher due to asset nature (often $10,000+) | Low - can purchase shares for as little as a few hundred dollars |

| Income Potential | Rental income plus potential land value appreciation | Dividend income from rental profits and property appreciation |

| Management | Managed by farmland operators or specialized firms | Professionally managed by REIT companies |

| Tax Advantages | Potential tax benefits via depreciation and agricultural incentives | Pass-through taxation, dividends taxed as ordinary income |

| Risk Factors | Commodity price volatility, weather risks, land use changes | Market risk, interest rate sensitivity, property market fluctuations |

| Regulation | Less regulated, varies by jurisdiction | Highly regulated, governed by SEC and real estate laws |

Which is better?

Fractional farmland ownership offers direct exposure to agricultural assets, enabling investors to benefit from land appreciation, crop yields, and farm income, with increased control over property management. REITs (Real Estate Investment Trusts) provide diversified access to real estate markets, including commercial, residential, and farmland sectors, with high liquidity and professional management but less direct asset control. Investors seeking tangible, hands-on farmland investment may prefer fractional ownership, while those valuing liquidity and portfolio diversity often favor REITs.

Connection

Fractional farmland ownership and Real Estate Investment Trusts (REITs) both offer investors accessible entry points into the agricultural real estate market by enabling partial ownership of high-value land assets. These investment vehicles allow diversification, income generation through rental yields or crop profits, and exposure to farmland appreciation without the need for full property management responsibilities. By pooling capital, investors benefit from professional asset management and risk mitigation within the agricultural sector.

Key Terms

Liquidity

REITs offer significantly higher liquidity compared to fractional farmland ownership, as shares can be bought and sold quickly on public exchanges. Fractional farmland ownership often involves longer holding periods with limited secondary market options, making it less accessible for investors seeking quick exit strategies. Explore detailed liquidity comparisons to determine the best fit for your investment portfolio.

Diversification

REITs offer diversification by providing access to a broad portfolio of income-generating commercial real estate assets, reducing risk through asset variety and geographic spread. Fractional farmland ownership diversifies investment by allowing participation in agricultural land, which traditionally shows low correlation with stock markets and real estate sectors. Explore detailed comparisons to understand how these options align with your diversification goals.

Minimum investment

REITs typically require a minimum investment ranging from $500 to $1,000, making them accessible for many investors seeking exposure to real estate markets. Fractional farmland ownership often demands higher minimums, generally starting around $10,000 to $25,000, reflecting the asset's tangible, agricultural nature and operational costs. Explore further to understand which investment aligns best with your portfolio goals and financial capacity.

Source and External Links

Real estate investment trust - Wikipedia - A REIT (real estate investment trust) is a company that owns and often operates income-producing real estate, such as office buildings, apartments, shopping centers, and warehouses, providing a way for investors to participate in large-scale real estate ownership and has special tax advantages in many countries.

Real Estate Investment Trusts (REITs) | Investor.gov - REITs enable individuals to invest in large-scale, income-producing real estate without buying property directly, and they come in publicly traded and non-traded forms with variations in liquidity and risk.

What's a REIT (Real Estate Investment Trust)? - Nareit - REITs are companies owning, operating, or financing income-producing real estate, offering investors steady dividend income, diversification, and long-term capital appreciation, often traded on major stock exchanges.

dowidth.com

dowidth.com