Royalty stream investing generates income from intellectual property rights, such as patents, music, or natural resources, providing ongoing cash flow without property management challenges. Real estate investing creates value through owning physical properties, offering potential appreciation and rental income but requires active oversight and maintenance. Explore the benefits and risks of these investment strategies to determine which aligns best with your financial goals.

Why it is important

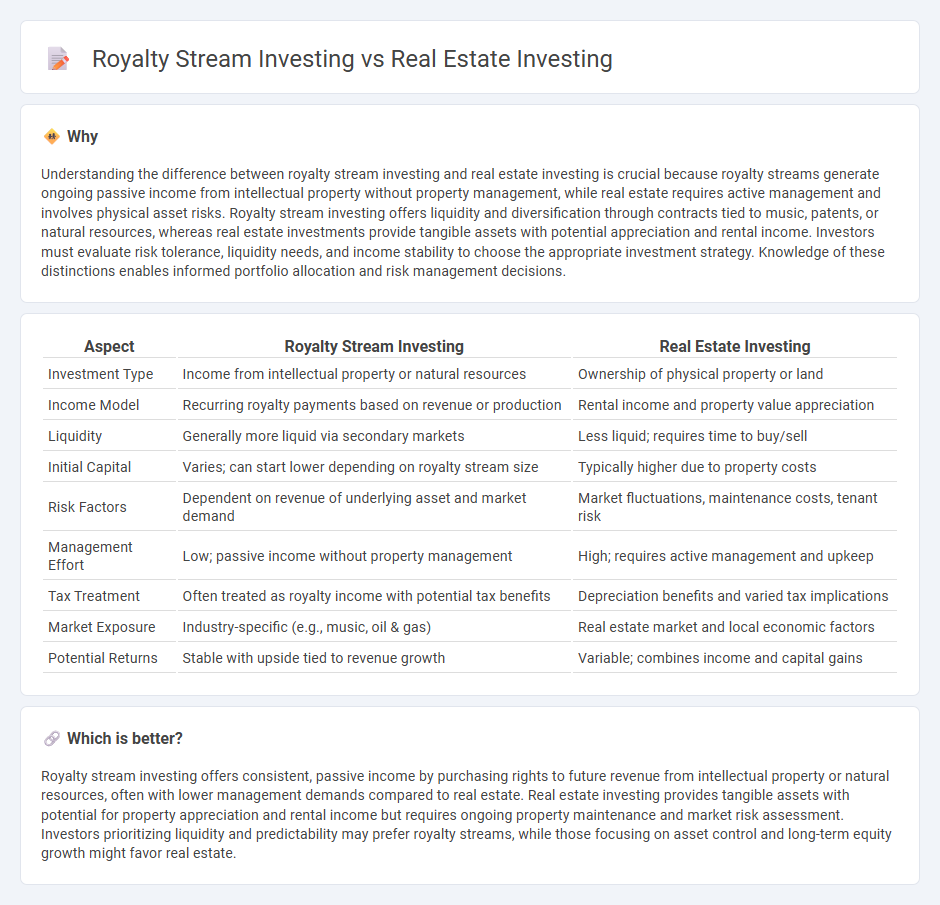

Understanding the difference between royalty stream investing and real estate investing is crucial because royalty streams generate ongoing passive income from intellectual property without property management, while real estate requires active management and involves physical asset risks. Royalty stream investing offers liquidity and diversification through contracts tied to music, patents, or natural resources, whereas real estate investments provide tangible assets with potential appreciation and rental income. Investors must evaluate risk tolerance, liquidity needs, and income stability to choose the appropriate investment strategy. Knowledge of these distinctions enables informed portfolio allocation and risk management decisions.

Comparison Table

| Aspect | Royalty Stream Investing | Real Estate Investing |

|---|---|---|

| Investment Type | Income from intellectual property or natural resources | Ownership of physical property or land |

| Income Model | Recurring royalty payments based on revenue or production | Rental income and property value appreciation |

| Liquidity | Generally more liquid via secondary markets | Less liquid; requires time to buy/sell |

| Initial Capital | Varies; can start lower depending on royalty stream size | Typically higher due to property costs |

| Risk Factors | Dependent on revenue of underlying asset and market demand | Market fluctuations, maintenance costs, tenant risk |

| Management Effort | Low; passive income without property management | High; requires active management and upkeep |

| Tax Treatment | Often treated as royalty income with potential tax benefits | Depreciation benefits and varied tax implications |

| Market Exposure | Industry-specific (e.g., music, oil & gas) | Real estate market and local economic factors |

| Potential Returns | Stable with upside tied to revenue growth | Variable; combines income and capital gains |

Which is better?

Royalty stream investing offers consistent, passive income by purchasing rights to future revenue from intellectual property or natural resources, often with lower management demands compared to real estate. Real estate investing provides tangible assets with potential for property appreciation and rental income but requires ongoing property maintenance and market risk assessment. Investors prioritizing liquidity and predictability may prefer royalty streams, while those focusing on asset control and long-term equity growth might favor real estate.

Connection

Royalty stream investing and real estate investing both generate passive income through asset ownership, where royalties derive from intellectual property or natural resources, and real estate yields rental income or property appreciation. Investors in both sectors benefit from predictable cash flows and portfolio diversification, minimizing risk by spreading investments across different asset classes. The underlying value in each approach depends on the consistent performance and market demand for the revenue-generating asset, making them complementary strategies for income-focused portfolios.

Key Terms

Property Appreciation (Real Estate)

Property appreciation in real estate investing occurs as market demand drives up the value of land and buildings, creating potential for substantial capital gains over time. Unlike royalty stream investing, which provides income based on revenue from intellectual property or natural resources, real estate appreciation ties directly to physical asset growth influenced by location, infrastructure development, and economic trends. Discover more about how property appreciation impacts investment portfolios and long-term wealth creation.

Passive Income (Royalty Stream)

Royalty stream investing offers a unique passive income opportunity by generating consistent cash flow from intellectual property or natural resource rights, contrasting with real estate investing which requires property management and market risk consideration. Royalty streams typically provide more liquidity and lower entry costs compared to real estate, appealing to investors seeking diversification and predictable returns without asset maintenance. Explore the advantages of royalty stream investing to enhance your passive income strategy.

Liquidity

Real estate investing typically involves lower liquidity due to the time required to buy, sell, or lease properties, whereas royalty stream investing offers higher liquidity through the ease of buying and selling income-producing rights. Investors often prefer royalty streams for quick access to cash flow without the complexities of property management or market timing. Explore the benefits and risks of each investment type to determine the best fit for your financial goals.

Source and External Links

5 Ways to Invest in Real Estate - This article provides five methods for investing in real estate, including REITs and rental properties.

Arrived - Arrived allows individuals to invest in rental properties with as little as $100, offering passive income and property appreciation.

Yieldstreet - Yieldstreet offers diversified exposure to private real estate opportunities, with investment minimums starting at $10,000.

Real Estate Investing for Beginners - This guide outlines the skills needed for successful real estate investing, highlighting the diverse nature of real estate investments.

dowidth.com

dowidth.com