Sports memorabilia funds focus on acquiring valuable collectibles tied to athletes and historic events, capitalizing on market trends and rarity to generate financial returns. Impact investment funds prioritize investments that deliver measurable social and environmental benefits alongside financial gains, targeting sectors like renewable energy, education, and healthcare. Explore more to understand the unique strategies and potential benefits of these distinct investment approaches.

Why it is important

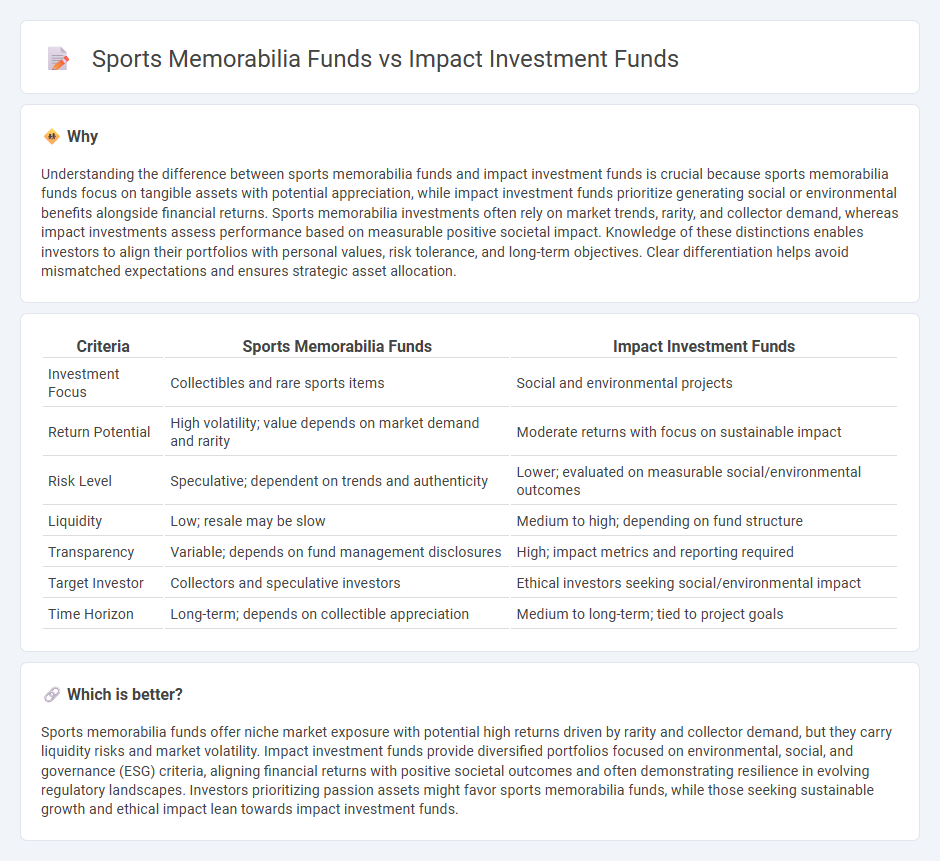

Understanding the difference between sports memorabilia funds and impact investment funds is crucial because sports memorabilia funds focus on tangible assets with potential appreciation, while impact investment funds prioritize generating social or environmental benefits alongside financial returns. Sports memorabilia investments often rely on market trends, rarity, and collector demand, whereas impact investments assess performance based on measurable positive societal impact. Knowledge of these distinctions enables investors to align their portfolios with personal values, risk tolerance, and long-term objectives. Clear differentiation helps avoid mismatched expectations and ensures strategic asset allocation.

Comparison Table

| Criteria | Sports Memorabilia Funds | Impact Investment Funds |

|---|---|---|

| Investment Focus | Collectibles and rare sports items | Social and environmental projects |

| Return Potential | High volatility; value depends on market demand and rarity | Moderate returns with focus on sustainable impact |

| Risk Level | Speculative; dependent on trends and authenticity | Lower; evaluated on measurable social/environmental outcomes |

| Liquidity | Low; resale may be slow | Medium to high; depending on fund structure |

| Transparency | Variable; depends on fund management disclosures | High; impact metrics and reporting required |

| Target Investor | Collectors and speculative investors | Ethical investors seeking social/environmental impact |

| Time Horizon | Long-term; depends on collectible appreciation | Medium to long-term; tied to project goals |

Which is better?

Sports memorabilia funds offer niche market exposure with potential high returns driven by rarity and collector demand, but they carry liquidity risks and market volatility. Impact investment funds provide diversified portfolios focused on environmental, social, and governance (ESG) criteria, aligning financial returns with positive societal outcomes and often demonstrating resilience in evolving regulatory landscapes. Investors prioritizing passion assets might favor sports memorabilia funds, while those seeking sustainable growth and ethical impact lean towards impact investment funds.

Connection

Sports memorabilia funds and impact investment funds share a strategic focus on alternative asset classes that combine financial returns with social or cultural value. Both fund types attract investors seeking diversification beyond traditional markets, leveraging the emotional and historical significance of sports collectibles alongside the sustainable and social goals championed by impact investments. Their convergence lies in the growing demand for investments that generate measurable impact while preserving or enhancing asset value, appealing to values-driven investors.

Key Terms

**Impact Investment Funds:**

Impact investment funds prioritize generating measurable social and environmental benefits alongside financial returns, targeting sectors such as renewable energy, affordable housing, and sustainable agriculture. These funds attract investors seeking to align their capital with positive global change, often backed by rigorous impact measurement frameworks. Explore how impact investment funds can drive both profit and purpose for a sustainable future.

Social Return on Investment (SROI)

Impact investment funds prioritize Social Return on Investment (SROI) by channeling capital into projects that generate measurable social and environmental benefits alongside financial returns. Sports memorabilia funds, in contrast, primarily target financial appreciation through the acquisition and sale of valuable collectibles, with limited direct social impact. Explore how these distinct fund types align with your values and investment goals to better understand their potential contributions to social and financial outcomes.

Environmental, Social, and Governance (ESG)

Impact investment funds prioritize Environmental, Social, and Governance (ESG) criteria by actively supporting projects with measurable positive outcomes in sustainability, social equity, and ethical management. In contrast, sports memorabilia funds concentrate on financial returns through the acquisition and sale of collectible items, with limited direct influence on ESG factors. Explore detailed comparisons of ESG performance and risk profiles across these investment types to make informed decisions.

Source and External Links

Impact Investments - Social Finance - Impact investment funds channel philanthropic capital toward measurable social and environmental impact by complementing philanthropy and government spending, mobilizing substantial capital to scale solutions for complex global problems.

What you need to know about impact investing - The GIIN - Impact investment funds intentionally generate positive, measurable social or environmental impact alongside financial returns, playing a critical role in sectors like energy, healthcare, and sustainable agriculture worldwide.

Impact Investments Program Strategy - MacArthur Foundation - Impact investment funds prioritize additionality, capital mobilization, and systemic impact by supporting innovative enterprises and funds that address social/environmental challenges and serve underserved communities globally.

dowidth.com

dowidth.com