Sports memorabilia funds and collectibles funds both offer unique investment opportunities by leveraging the growing market for rare and valuable items. Sports memorabilia funds focus on items like autographed jerseys, game-used equipment, and limited-edition trading cards, which have shown consistent appreciation due to increasing fan engagement and celebrity cachet. Explore the differences in risk, liquidity, and potential returns to determine which fund aligns best with your investment portfolio.

Why it is important

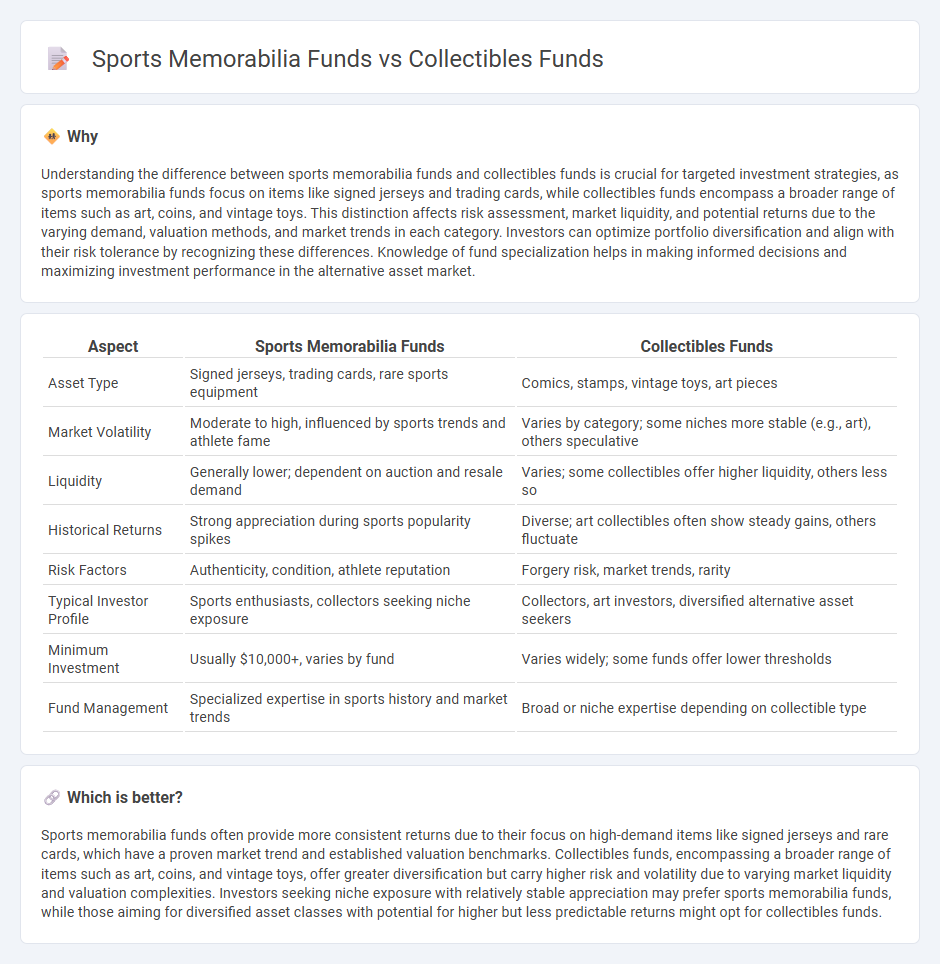

Understanding the difference between sports memorabilia funds and collectibles funds is crucial for targeted investment strategies, as sports memorabilia funds focus on items like signed jerseys and trading cards, while collectibles funds encompass a broader range of items such as art, coins, and vintage toys. This distinction affects risk assessment, market liquidity, and potential returns due to the varying demand, valuation methods, and market trends in each category. Investors can optimize portfolio diversification and align with their risk tolerance by recognizing these differences. Knowledge of fund specialization helps in making informed decisions and maximizing investment performance in the alternative asset market.

Comparison Table

| Aspect | Sports Memorabilia Funds | Collectibles Funds |

|---|---|---|

| Asset Type | Signed jerseys, trading cards, rare sports equipment | Comics, stamps, vintage toys, art pieces |

| Market Volatility | Moderate to high, influenced by sports trends and athlete fame | Varies by category; some niches more stable (e.g., art), others speculative |

| Liquidity | Generally lower; dependent on auction and resale demand | Varies; some collectibles offer higher liquidity, others less so |

| Historical Returns | Strong appreciation during sports popularity spikes | Diverse; art collectibles often show steady gains, others fluctuate |

| Risk Factors | Authenticity, condition, athlete reputation | Forgery risk, market trends, rarity |

| Typical Investor Profile | Sports enthusiasts, collectors seeking niche exposure | Collectors, art investors, diversified alternative asset seekers |

| Minimum Investment | Usually $10,000+, varies by fund | Varies widely; some funds offer lower thresholds |

| Fund Management | Specialized expertise in sports history and market trends | Broad or niche expertise depending on collectible type |

Which is better?

Sports memorabilia funds often provide more consistent returns due to their focus on high-demand items like signed jerseys and rare cards, which have a proven market trend and established valuation benchmarks. Collectibles funds, encompassing a broader range of items such as art, coins, and vintage toys, offer greater diversification but carry higher risk and volatility due to varying market liquidity and valuation complexities. Investors seeking niche exposure with relatively stable appreciation may prefer sports memorabilia funds, while those aiming for diversified asset classes with potential for higher but less predictable returns might opt for collectibles funds.

Connection

Sports memorabilia funds and collectibles funds are connected through their shared focus on investing in tangible assets that appreciate in value over time, such as rare trading cards, autographed items, and historic sports artifacts. Both fund types leverage market trends, rarity, and provenance to maximize returns, appealing to collectors and investors seeking diversification outside traditional financial instruments. The growth of online marketplaces and increasing cultural interest in sports and collectibles further enhance liquidity and valuation potential for these alternative investment vehicles.

Key Terms

Asset Diversification

Collectibles funds primarily invest in a broad range of tangible assets such as rare coins, stamps, art, and vintage toys, offering diversified exposure to various niche markets. Sports memorabilia funds concentrate on autographed items, game-worn gear, and historic sports cards, providing specialized investment within the sports collectibles sector. Explore the advantages and unique risks of both fund types to optimize your asset diversification strategy.

Valuation Methods

Collectibles funds primarily rely on expert appraisals, past auction results, and market demand trends to determine the valuation of items like art, coins, and rare stamps, while sports memorabilia funds emphasize authenticity verification, player significance, and historical context when assessing items such as game-worn jerseys or autographed balls. Market liquidity and provenance play crucial roles in both funds, but sports memorabilia often involves higher volatility due to fluctuating athlete popularity and event significance. Explore deeper insights on valuation methodologies to optimize investment strategies in both collectibles and sports memorabilia funds.

Liquidity

Collectibles funds typically offer higher liquidity compared to sports memorabilia funds due to broader market demand and established secondary markets for assets like art, rare coins, and vintage toys. Sports memorabilia funds often face limited buyer pools and slower transaction processes, resulting in longer hold periods and reduced liquidity. Explore more insights on how liquidity impacts investment strategies in alternative asset classes.

Source and External Links

Types of Collectible Investments To Consider - Offers guidance on various collectible investments, including classic cars, fine art, and sports memorabilia.

Investing In The $500 Billion Collectibles Market: How To Get Started - Provides insights into the collectibles market, highlighting trends and potential risks.

How to Invest in Collectibles - Discusses the strategy of investing in collectibles, including rare coins and vintage wines.

dowidth.com

dowidth.com