Eco-friendly cryptocurrencies leverage blockchain technology to reduce carbon footprints by utilizing energy-efficient consensus mechanisms like Proof of Stake. Cleantech ETFs invest in companies focused on renewable energy, energy efficiency, and sustainable technologies, providing diversified exposure to the green economy. Explore the benefits and risks of both investment options to make informed decisions in sustainable finance.

Why it is important

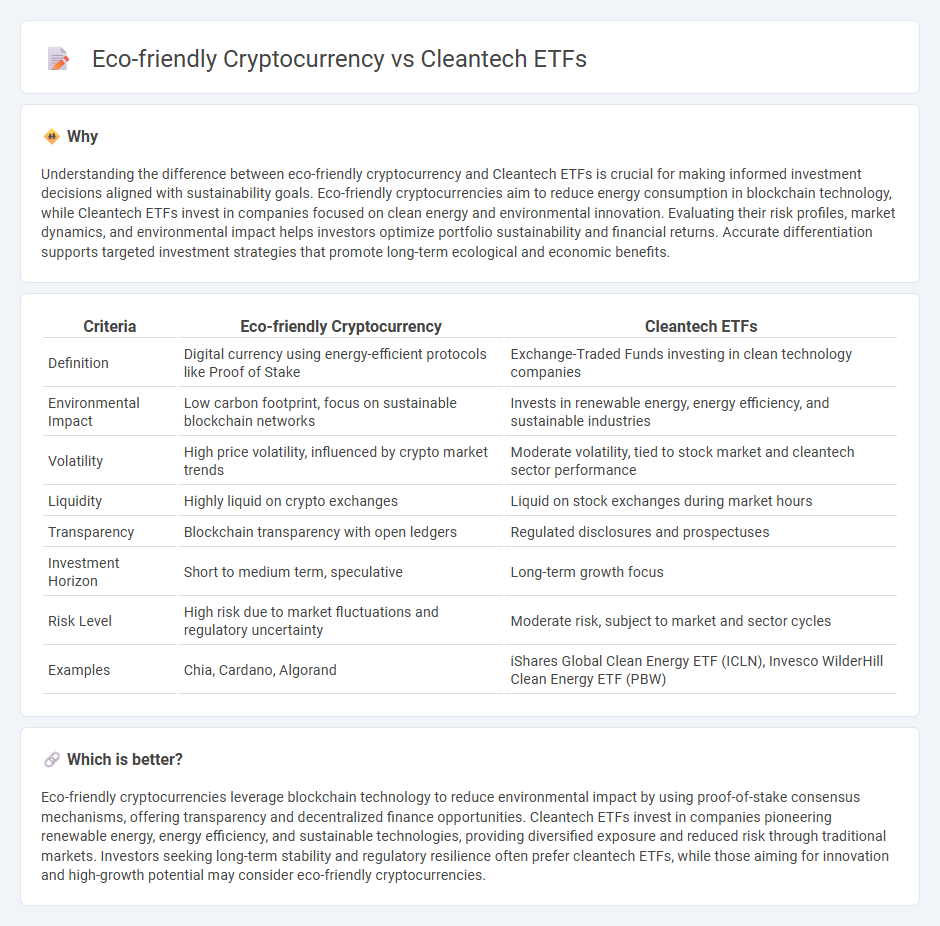

Understanding the difference between eco-friendly cryptocurrency and Cleantech ETFs is crucial for making informed investment decisions aligned with sustainability goals. Eco-friendly cryptocurrencies aim to reduce energy consumption in blockchain technology, while Cleantech ETFs invest in companies focused on clean energy and environmental innovation. Evaluating their risk profiles, market dynamics, and environmental impact helps investors optimize portfolio sustainability and financial returns. Accurate differentiation supports targeted investment strategies that promote long-term ecological and economic benefits.

Comparison Table

| Criteria | Eco-friendly Cryptocurrency | Cleantech ETFs |

|---|---|---|

| Definition | Digital currency using energy-efficient protocols like Proof of Stake | Exchange-Traded Funds investing in clean technology companies |

| Environmental Impact | Low carbon footprint, focus on sustainable blockchain networks | Invests in renewable energy, energy efficiency, and sustainable industries |

| Volatility | High price volatility, influenced by crypto market trends | Moderate volatility, tied to stock market and cleantech sector performance |

| Liquidity | Highly liquid on crypto exchanges | Liquid on stock exchanges during market hours |

| Transparency | Blockchain transparency with open ledgers | Regulated disclosures and prospectuses |

| Investment Horizon | Short to medium term, speculative | Long-term growth focus |

| Risk Level | High risk due to market fluctuations and regulatory uncertainty | Moderate risk, subject to market and sector cycles |

| Examples | Chia, Cardano, Algorand | iShares Global Clean Energy ETF (ICLN), Invesco WilderHill Clean Energy ETF (PBW) |

Which is better?

Eco-friendly cryptocurrencies leverage blockchain technology to reduce environmental impact by using proof-of-stake consensus mechanisms, offering transparency and decentralized finance opportunities. Cleantech ETFs invest in companies pioneering renewable energy, energy efficiency, and sustainable technologies, providing diversified exposure and reduced risk through traditional markets. Investors seeking long-term stability and regulatory resilience often prefer cleantech ETFs, while those aiming for innovation and high-growth potential may consider eco-friendly cryptocurrencies.

Connection

Eco-friendly cryptocurrency utilizes blockchain technology with low energy consumption, aligning with the sustainability goals promoted by Cleantech ETFs that invest in companies developing renewable energy and green technologies. Both investment forms attract environmentally conscious investors seeking to reduce carbon footprints while capitalizing on the growth of clean energy innovations. Their connection lies in advancing a green economy through innovative financial instruments that prioritize ecological impact alongside profitability.

Key Terms

ESG Criteria

Cleantech ETFs invest in companies developing renewable energy, energy efficiency, and sustainable technologies, ensuring compliance with rigorous Environmental, Social, and Governance (ESG) criteria. Eco-friendly cryptocurrencies utilize energy-efficient consensus mechanisms like Proof of Stake, aiming to reduce carbon emissions and promote transparency in environmental impact. Explore the evolving landscape of sustainable investments to understand their potential in advancing global ESG goals.

Carbon Footprint

Cleantech ETFs typically invest in companies advancing renewable energy and energy efficiency, presenting a lower carbon footprint compared to traditional sectors. Eco-friendly cryptocurrencies utilize proof-of-stake or other energy-efficient consensus mechanisms to significantly reduce carbon emissions compared to proof-of-work coins like Bitcoin. Explore how these investment options align with your sustainability goals by learning more about their environmental impact metrics.

Blockchain Sustainability

Cleantech ETFs invest directly in companies developing renewable energy technologies, energy efficiency solutions, and sustainable infrastructure, offering a diversified and regulated approach to green investing with strong historical performance metrics. Eco-friendly cryptocurrencies emphasize blockchain sustainability through low-energy consensus mechanisms like Proof of Stake, carbon offset initiatives, and eco-conscious tokenomics aimed at reducing environmental impact. Explore further to understand the evolving landscape of sustainable investing through blockchain innovation and renewable technologies.

Source and External Links

Cleantech ETF List - This webpage provides a comprehensive list of cleantech ETFs traded in the USA, covering various sub-sectors such as alternative energy and clean manufacturing.

6 Best-Performing Clean Energy ETFs for July 2025 - Lists the top-performing clean energy ETFs, which often overlap with cleantech due to their focus on alternative energy sectors.

Global X CleanTech UCITS ETF - Invests in companies benefiting from the adoption of clean technologies, offering a Europe-focused cleantech investment option.

dowidth.com

dowidth.com