Designer sneaker portfolios deliver rapid appreciation driven by limited releases and strong resale markets, capturing younger, trend-focused investors seeking high liquidity and cultural relevance. Classic car portfolios offer long-term value growth rooted in historical significance, rarity, and mechanical craftsmanship, appealing to collectors prioritizing tangible assets and heritage preservation. Explore the unique advantages and investment potential of designer sneakers versus classic cars to determine which alternative asset best suits your financial goals.

Why it is important

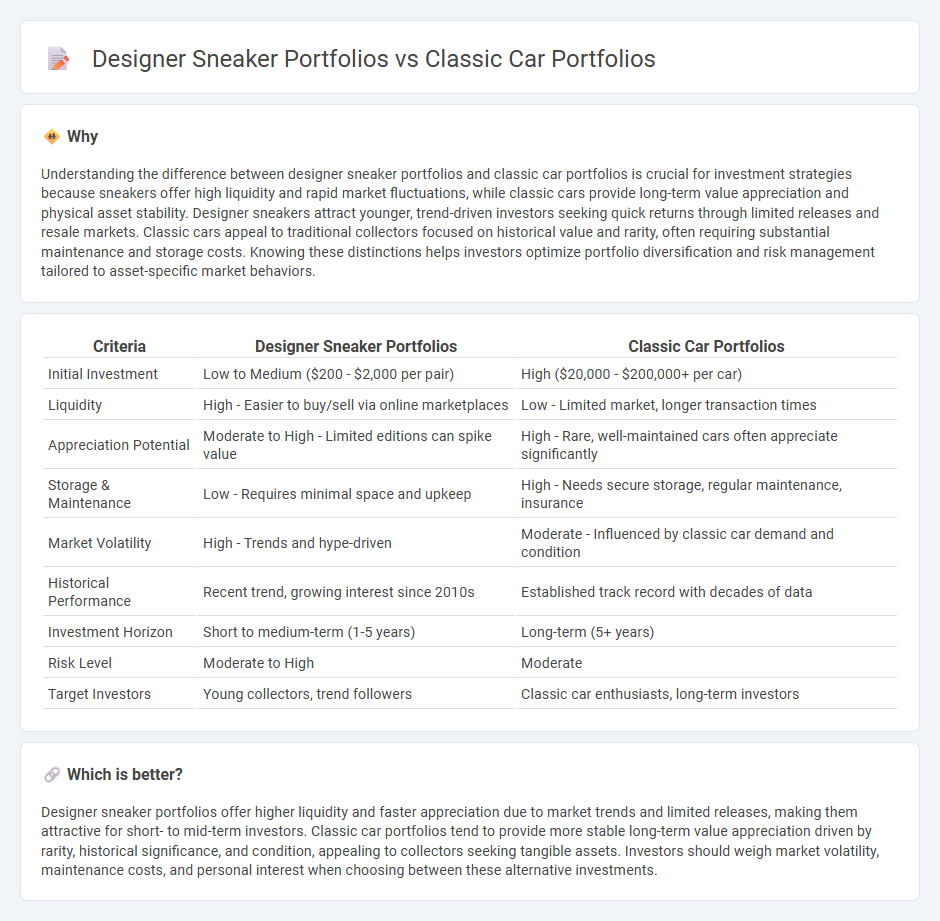

Understanding the difference between designer sneaker portfolios and classic car portfolios is crucial for investment strategies because sneakers offer high liquidity and rapid market fluctuations, while classic cars provide long-term value appreciation and physical asset stability. Designer sneakers attract younger, trend-driven investors seeking quick returns through limited releases and resale markets. Classic cars appeal to traditional collectors focused on historical value and rarity, often requiring substantial maintenance and storage costs. Knowing these distinctions helps investors optimize portfolio diversification and risk management tailored to asset-specific market behaviors.

Comparison Table

| Criteria | Designer Sneaker Portfolios | Classic Car Portfolios |

|---|---|---|

| Initial Investment | Low to Medium ($200 - $2,000 per pair) | High ($20,000 - $200,000+ per car) |

| Liquidity | High - Easier to buy/sell via online marketplaces | Low - Limited market, longer transaction times |

| Appreciation Potential | Moderate to High - Limited editions can spike value | High - Rare, well-maintained cars often appreciate significantly |

| Storage & Maintenance | Low - Requires minimal space and upkeep | High - Needs secure storage, regular maintenance, insurance |

| Market Volatility | High - Trends and hype-driven | Moderate - Influenced by classic car demand and condition |

| Historical Performance | Recent trend, growing interest since 2010s | Established track record with decades of data |

| Investment Horizon | Short to medium-term (1-5 years) | Long-term (5+ years) |

| Risk Level | Moderate to High | Moderate |

| Target Investors | Young collectors, trend followers | Classic car enthusiasts, long-term investors |

Which is better?

Designer sneaker portfolios offer higher liquidity and faster appreciation due to market trends and limited releases, making them attractive for short- to mid-term investors. Classic car portfolios tend to provide more stable long-term value appreciation driven by rarity, historical significance, and condition, appealing to collectors seeking tangible assets. Investors should weigh market volatility, maintenance costs, and personal interest when choosing between these alternative investments.

Connection

Designer sneaker portfolios and classic car portfolios both capitalize on the appreciation of rare, high-demand assets influenced by cultural trends and limited availability. These investment vehicles rely on market scarcity, brand prestige, and historical value to drive long-term asset appreciation and portfolio diversification. Understanding market dynamics and consumer behavior in luxury goods is essential for maximizing returns in both sectors.

Key Terms

Asset Appreciation

Classic car portfolios often demonstrate substantial asset appreciation due to limited production models, historical significance, and robust collector demand, leading to high-value auction results and consistent market growth. Designer sneaker portfolios leverage limited edition releases, brand collaborations, and cultural trends to fuel rapid short-term value increases, supported by sneaker resale platforms and influencer-driven hype. Explore the dynamics of these distinct asset classes to determine which portfolio best aligns with your investment goals.

Market Liquidity

Market liquidity in classic car portfolios often exceeds that of designer sneaker collections due to established auction houses and broader collector networks facilitating quicker sales. Designer sneaker portfolios, while rapidly growing in popularity, face challenges from limited resale platforms and fluctuating demand, impacting liquidity. Explore deeper insights into optimizing portfolio choices based on market liquidity dynamics.

Authentication

Classic car portfolios rely heavily on detailed provenance and historical documentation to ensure authentication, leveraging expert appraisals and original factory records. Designer sneaker portfolios utilize blockchain verification and limited-edition release tracking to combat counterfeiting and confirm authenticity. Explore how advanced technologies are transforming authentication processes in these emerging investment markets.

Source and External Links

Classic Cars as a Portfolio Diversification Strategy | Woodside Credit - Classic cars, such as the 1956 Mercedes-Benz 300SL Gullwing Coupe, can serve as high-return alternative investments that may outperform traditional equities like the S&P 500, making them an appealing option for portfolio diversification when approached strategically.

Classic Car Investment Funds: Do These Portfolios Pay Off? - Private investment funds focused on classic and high-performance cars offer individuals access to prestigious vehicles as alternative assets, blending enjoyment with potential appreciation, and sometimes allowing investors to experience the cars firsthand.

Investing in Collectible Cars | Wealthspire - Successful collectible car investing requires understanding factors like historical significance, brand legacy, rarity, condition, and evolving market trends, with vehicles from iconic brands and limited production runs generally holding the strongest investment appeal.

dowidth.com

dowidth.com