Carbon credit arbitrage involves exploiting price differences in carbon credits across markets to generate profit, focusing primarily on financial returns with minimal direct environmental impact. Impact investing prioritizes funding projects and companies that deliver measurable social and environmental benefits alongside financial gains, targeting long-term sustainability. Explore how these investment strategies differ in balancing profitability and positive change.

Why it is important

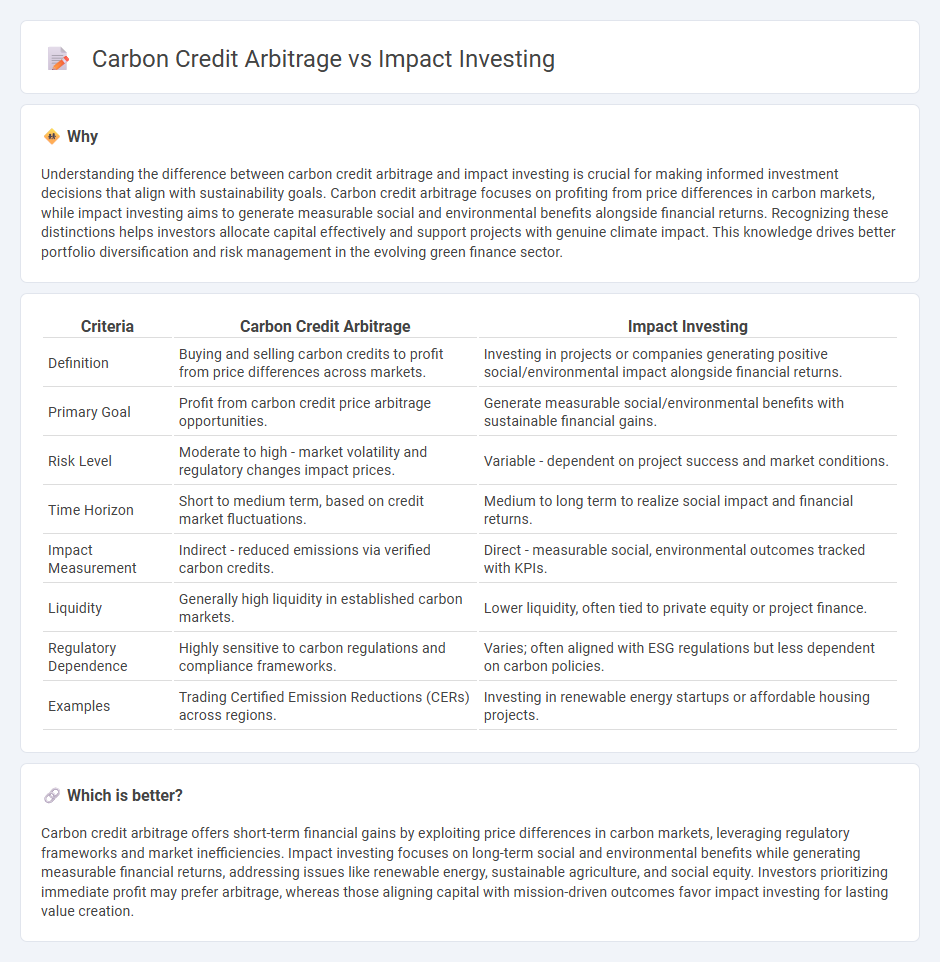

Understanding the difference between carbon credit arbitrage and impact investing is crucial for making informed investment decisions that align with sustainability goals. Carbon credit arbitrage focuses on profiting from price differences in carbon markets, while impact investing aims to generate measurable social and environmental benefits alongside financial returns. Recognizing these distinctions helps investors allocate capital effectively and support projects with genuine climate impact. This knowledge drives better portfolio diversification and risk management in the evolving green finance sector.

Comparison Table

| Criteria | Carbon Credit Arbitrage | Impact Investing |

|---|---|---|

| Definition | Buying and selling carbon credits to profit from price differences across markets. | Investing in projects or companies generating positive social/environmental impact alongside financial returns. |

| Primary Goal | Profit from carbon credit price arbitrage opportunities. | Generate measurable social/environmental benefits with sustainable financial gains. |

| Risk Level | Moderate to high - market volatility and regulatory changes impact prices. | Variable - dependent on project success and market conditions. |

| Time Horizon | Short to medium term, based on credit market fluctuations. | Medium to long term to realize social impact and financial returns. |

| Impact Measurement | Indirect - reduced emissions via verified carbon credits. | Direct - measurable social, environmental outcomes tracked with KPIs. |

| Liquidity | Generally high liquidity in established carbon markets. | Lower liquidity, often tied to private equity or project finance. |

| Regulatory Dependence | Highly sensitive to carbon regulations and compliance frameworks. | Varies; often aligned with ESG regulations but less dependent on carbon policies. |

| Examples | Trading Certified Emission Reductions (CERs) across regions. | Investing in renewable energy startups or affordable housing projects. |

Which is better?

Carbon credit arbitrage offers short-term financial gains by exploiting price differences in carbon markets, leveraging regulatory frameworks and market inefficiencies. Impact investing focuses on long-term social and environmental benefits while generating measurable financial returns, addressing issues like renewable energy, sustainable agriculture, and social equity. Investors prioritizing immediate profit may prefer arbitrage, whereas those aligning capital with mission-driven outcomes favor impact investing for lasting value creation.

Connection

Carbon credit arbitrage exploits price differences in carbon markets to generate profit while promoting emission reductions, aligning financial incentives with environmental goals. Impact investing directs capital towards projects that deliver measurable social and environmental benefits, often including carbon offset initiatives. Both strategies leverage market mechanisms to drive sustainable investments, bridging financial returns with climate impact.

Key Terms

Impact Investing:

Impact investing channels capital into companies and projects that generate measurable social and environmental benefits alongside financial returns, emphasizing sustainable development and positive change. This approach targets sectors like renewable energy, affordable housing, and social enterprises, contrasting with carbon credit arbitrage which exploits price differences in carbon markets for profit without necessarily ensuring real-world environmental impact. Explore further to understand how impact investing aligns financial goals with global sustainability ambitions.

Social Return

Impact investing channels capital into projects generating measurable social and environmental benefits alongside financial returns, emphasizing long-term positive change in communities and ecosystems. Carbon credit arbitrage exploits price differentials in carbon markets for profit, often prioritizing short-term financial gain over sustained social impact. Explore how these strategies differ in delivering social returns and shaping sustainable development outcomes.

ESG (Environmental, Social, Governance)

Impact investing channels capital into companies and projects that generate measurable social and environmental benefits alongside financial returns, enhancing ESG performance by fostering sustainable practices and social responsibility. Carbon credit arbitrage exploits price differentials in carbon markets to maximize financial gains, but its contribution to ESG goals depends on the integrity and verification of emission reductions. Explore how these strategies shape sustainable finance and influence corporate ESG outcomes for deeper insights.

Source and External Links

What you need to know about impact investing - The GIIN - Impact investing involves making investments with the intention to generate positive, measurable social or environmental impact alongside a financial return, applicable across various stages of market growth and sectors such as energy and healthcare.

What Is Impact Investing? | NPTrust - Impact investing is a strategy leveraging capital to achieve positive social or environmental change while also generating financial returns, with a growing global market projected to reach $6 trillion by 2031, driven significantly by Millennial investors.

What is Impact Investing? | Fidelity Charitable - Impact investing purposefully makes investments that align with social and environmental benefits and generate financial returns, with notable growth driven by wealthy individuals, women, and younger investors such as Millennials.

dowidth.com

dowidth.com