Litigation funding provides financial support to plaintiffs involved in legal disputes, offering capital without requiring equity in the business, whereas venture capital involves investing in startups and early-stage companies in exchange for ownership stakes. Litigation funding mitigates legal risks by financing costly court cases, while venture capital drives innovation and business growth through strategic investments. Explore the differences between these investment types to determine the best opportunity for your financial goals.

Why it is important

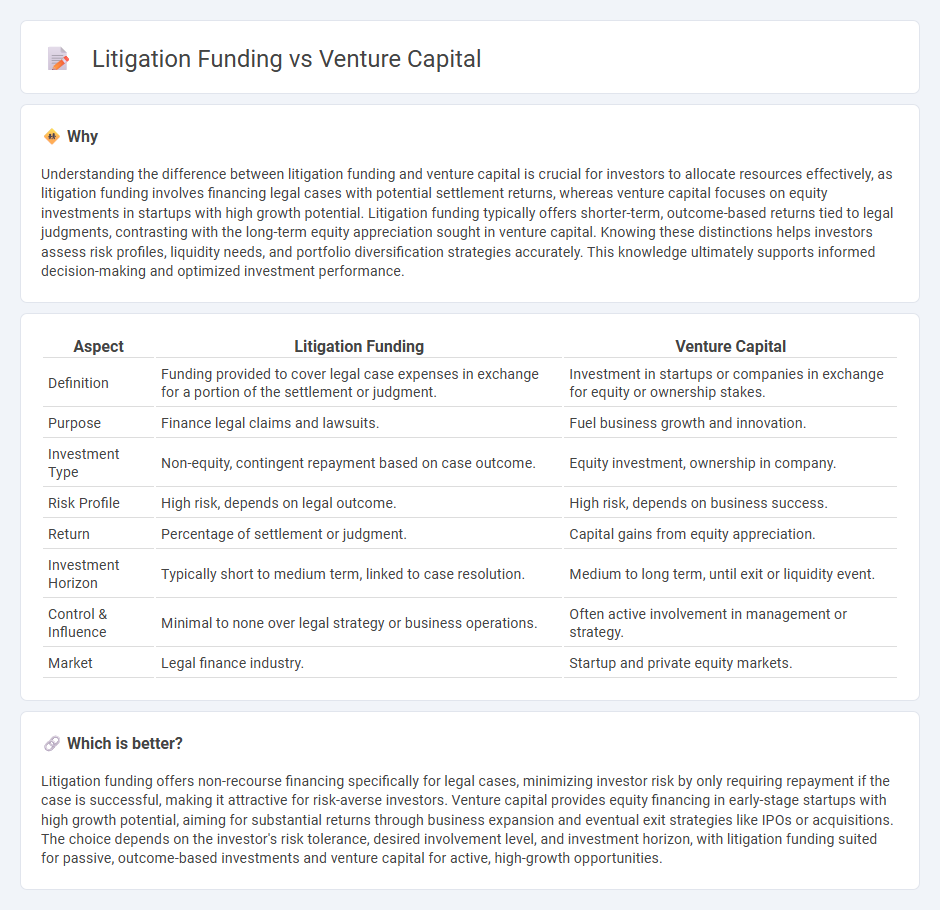

Understanding the difference between litigation funding and venture capital is crucial for investors to allocate resources effectively, as litigation funding involves financing legal cases with potential settlement returns, whereas venture capital focuses on equity investments in startups with high growth potential. Litigation funding typically offers shorter-term, outcome-based returns tied to legal judgments, contrasting with the long-term equity appreciation sought in venture capital. Knowing these distinctions helps investors assess risk profiles, liquidity needs, and portfolio diversification strategies accurately. This knowledge ultimately supports informed decision-making and optimized investment performance.

Comparison Table

| Aspect | Litigation Funding | Venture Capital |

|---|---|---|

| Definition | Funding provided to cover legal case expenses in exchange for a portion of the settlement or judgment. | Investment in startups or companies in exchange for equity or ownership stakes. |

| Purpose | Finance legal claims and lawsuits. | Fuel business growth and innovation. |

| Investment Type | Non-equity, contingent repayment based on case outcome. | Equity investment, ownership in company. |

| Risk Profile | High risk, depends on legal outcome. | High risk, depends on business success. |

| Return | Percentage of settlement or judgment. | Capital gains from equity appreciation. |

| Investment Horizon | Typically short to medium term, linked to case resolution. | Medium to long term, until exit or liquidity event. |

| Control & Influence | Minimal to none over legal strategy or business operations. | Often active involvement in management or strategy. |

| Market | Legal finance industry. | Startup and private equity markets. |

Which is better?

Litigation funding offers non-recourse financing specifically for legal cases, minimizing investor risk by only requiring repayment if the case is successful, making it attractive for risk-averse investors. Venture capital provides equity financing in early-stage startups with high growth potential, aiming for substantial returns through business expansion and eventual exit strategies like IPOs or acquisitions. The choice depends on the investor's risk tolerance, desired involvement level, and investment horizon, with litigation funding suited for passive, outcome-based investments and venture capital for active, high-growth opportunities.

Connection

Litigation funding and venture capital share a common investment approach by allocating capital into high-risk, high-reward opportunities, often driven by comprehensive due diligence and anticipated financial returns. Both sectors emphasize portfolio diversification and align their interests with innovation-driven enterprises or legal cases that promise substantial monetary outcomes. This connection creates a unique intersection where capital deployment strategies focus on unlocking value from unconventional assets and emerging markets.

Key Terms

Equity

Venture capital involves investing equity in startups and high-growth companies in exchange for ownership stakes, aiming for significant returns through company valuation increases. Litigation funding provides capital to plaintiffs or law firms in exchange for a portion of the settlement or judgment, focusing on financial recovery rather than company control. Explore how equity considerations differ between venture capital and litigation funding to understand strategic investment impacts.

Due Diligence

Venture capital due diligence emphasizes market potential, financial health, and management team capabilities to ensure high returns on investment, while litigation funding due diligence scrutinizes case merits, legal risks, and enforceability of judgments to mitigate financial exposure. Both require comprehensive analysis, but litigation funding demands specialized legal expertise to assess litigation viability and recovery prospects. Explore detailed strategies and best practices for due diligence in both sectors to enhance investment decisions.

Return on Investment

Venture capital typically offers high return on investment through equity stakes in high-growth startups, with potential returns ranging from 20% to over 30% annually depending on the success of the company. Litigation funding provides returns linked to the outcome of legal cases, often yielding 15% to 25% IRR, but carries risks related to case duration and verdict uncertainty. Explore detailed comparisons of risk profiles and expected ROI to make informed investment decisions.

Source and External Links

What is Venture Capital? - Venture capital is funding that turns innovative ideas into high-growth companies by investing equity in startups, providing strategic support, and fueling economic impact with long-term, high-risk investments.

Fund your business | U.S. Small Business Administration - Venture capital involves investors providing capital in exchange for equity and often board seats, focusing on startups with high growth potential and taking higher risks than traditional financing.

What is Venture Capital? - Venture capital finances startups with novel technologies through equity investments, with investors expecting long-term success through events like IPOs or acquisitions while managing high risks by diversifying across many companies.

dowidth.com

dowidth.com