Blue economy funds focus on investing in sustainable marine and ocean-based industries, promoting environmental preservation and responsible resource management. Infrastructure funds target large-scale physical projects such as transportation, energy, and utilities, driving economic development and long-term asset growth. Explore the unique benefits and opportunities of both fund types to enhance your investment strategy.

Why it is important

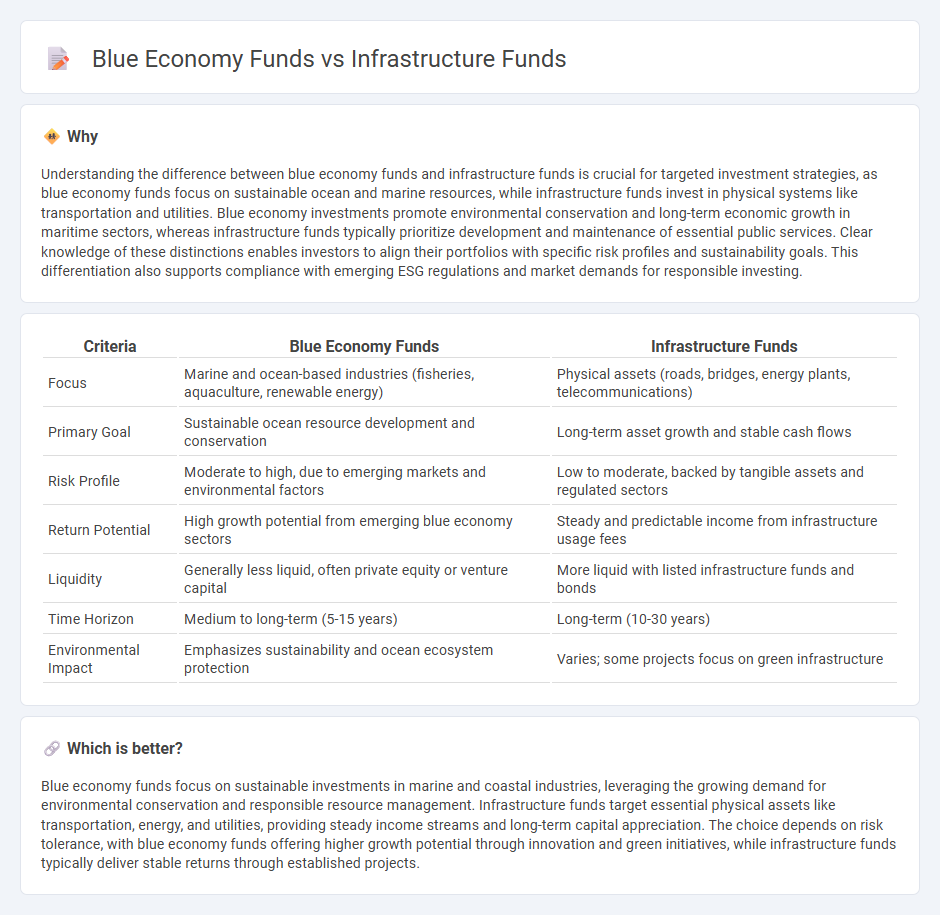

Understanding the difference between blue economy funds and infrastructure funds is crucial for targeted investment strategies, as blue economy funds focus on sustainable ocean and marine resources, while infrastructure funds invest in physical systems like transportation and utilities. Blue economy investments promote environmental conservation and long-term economic growth in maritime sectors, whereas infrastructure funds typically prioritize development and maintenance of essential public services. Clear knowledge of these distinctions enables investors to align their portfolios with specific risk profiles and sustainability goals. This differentiation also supports compliance with emerging ESG regulations and market demands for responsible investing.

Comparison Table

| Criteria | Blue Economy Funds | Infrastructure Funds |

|---|---|---|

| Focus | Marine and ocean-based industries (fisheries, aquaculture, renewable energy) | Physical assets (roads, bridges, energy plants, telecommunications) |

| Primary Goal | Sustainable ocean resource development and conservation | Long-term asset growth and stable cash flows |

| Risk Profile | Moderate to high, due to emerging markets and environmental factors | Low to moderate, backed by tangible assets and regulated sectors |

| Return Potential | High growth potential from emerging blue economy sectors | Steady and predictable income from infrastructure usage fees |

| Liquidity | Generally less liquid, often private equity or venture capital | More liquid with listed infrastructure funds and bonds |

| Time Horizon | Medium to long-term (5-15 years) | Long-term (10-30 years) |

| Environmental Impact | Emphasizes sustainability and ocean ecosystem protection | Varies; some projects focus on green infrastructure |

Which is better?

Blue economy funds focus on sustainable investments in marine and coastal industries, leveraging the growing demand for environmental conservation and responsible resource management. Infrastructure funds target essential physical assets like transportation, energy, and utilities, providing steady income streams and long-term capital appreciation. The choice depends on risk tolerance, with blue economy funds offering higher growth potential through innovation and green initiatives, while infrastructure funds typically deliver stable returns through established projects.

Connection

Blue economy funds invest in sustainable marine and water-based industries such as fisheries, renewable energy, and coastal tourism, providing capital for projects that promote ocean health and economic growth. Infrastructure funds focus on financing physical assets like ports, desalination plants, and offshore wind farms, which are critical components supporting the blue economy's operational capabilities. Together, these funds drive the development of resilient maritime infrastructure and sustainable resource management, enhancing both environmental and economic outcomes.

Key Terms

**Infrastructure Funds:**

Infrastructure funds primarily invest in physical assets such as transportation, energy, and utilities that provide stable, long-term cash flows and lower risk profiles. These funds support the development and maintenance of essential services, often generating predictable income through government contracts and regulated returns. Explore how infrastructure funds can diversify portfolios and contribute to sustainable economic growth.

Public-Private Partnership (PPP)

Infrastructure funds primarily invest in large-scale physical assets like roads, bridges, and utilities by leveraging Public-Private Partnerships (PPP) to enhance project financing and risk-sharing between government and private sectors. Blue economy funds target sustainable marine and ocean resources, supporting PPPs that promote environmental conservation alongside economic growth in fisheries, renewable energy, and coastal infrastructure. Explore how PPP frameworks uniquely drive investment efficiency and sustainability in infrastructure and blue economy sectors by learning more about their strategic roles.

Asset-backed Securities

Infrastructure funds primarily invest in physical assets like roads, bridges, and energy facilities, providing steady cash flows through asset-backed securities (ABS) tied to these tangible projects. Blue economy funds focus on sustainable ocean-related ventures such as fisheries, marine transport, and renewable ocean energy, with ABS linked to marine assets and environmental impact. Explore how asset-backed securities differentiate investment risks and returns between these dynamic sectors.

Source and External Links

Infrastructure fund - Wikipedia - An infrastructure fund is a privately offered or publicly listed fund investing directly or indirectly in infrastructure such as power plants, transportation, communications, and sometimes healthcare or education, with a large global investment market predicted to reach $1.87 trillion by 2026.

Infrastructure Fund - Cohen & Steers - This fund focuses on total return with an emphasis on income by investing in securities issued by infrastructure companies, offering portfolio diversification and potentially higher returns with lower volatility than global equities.

Largest Infrastructure Fund Managers | Infrastructure Investor 100 - The top global infrastructure fund managers ranked by capital raised include Brookfield Asset Management as the largest with over $103 billion raised, followed by Global Infrastructure Partners, KKR, and Macquarie Asset Management.

dowidth.com

dowidth.com