Litigation finance provides capital to plaintiffs involved in legal disputes in exchange for a portion of the settlement or judgment, while crowdfunding pools small contributions from a large group of investors to fund projects or ventures. Investors in litigation finance benefit from potentially high returns tied to case outcomes, whereas crowdfunding offers diverse opportunities with varying levels of risk and liquidity. Explore the advantages and considerations of both funding strategies to determine which aligns best with your investment goals.

Why it is important

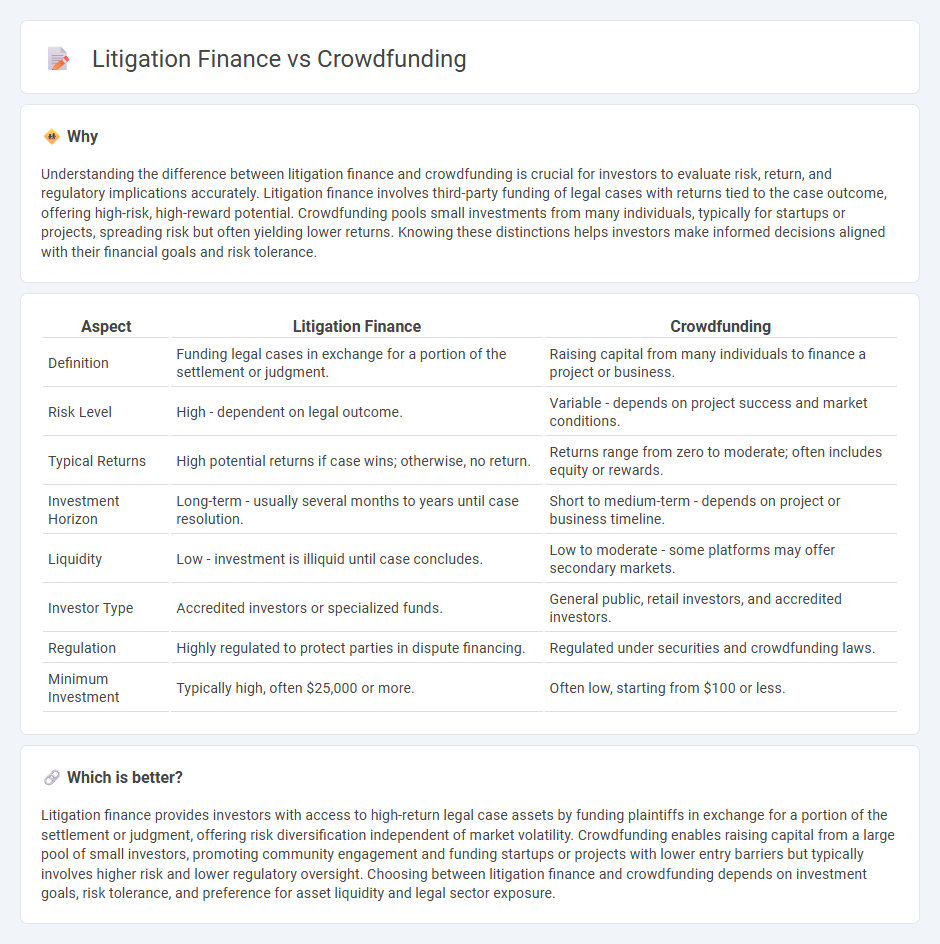

Understanding the difference between litigation finance and crowdfunding is crucial for investors to evaluate risk, return, and regulatory implications accurately. Litigation finance involves third-party funding of legal cases with returns tied to the case outcome, offering high-risk, high-reward potential. Crowdfunding pools small investments from many individuals, typically for startups or projects, spreading risk but often yielding lower returns. Knowing these distinctions helps investors make informed decisions aligned with their financial goals and risk tolerance.

Comparison Table

| Aspect | Litigation Finance | Crowdfunding |

|---|---|---|

| Definition | Funding legal cases in exchange for a portion of the settlement or judgment. | Raising capital from many individuals to finance a project or business. |

| Risk Level | High - dependent on legal outcome. | Variable - depends on project success and market conditions. |

| Typical Returns | High potential returns if case wins; otherwise, no return. | Returns range from zero to moderate; often includes equity or rewards. |

| Investment Horizon | Long-term - usually several months to years until case resolution. | Short to medium-term - depends on project or business timeline. |

| Liquidity | Low - investment is illiquid until case concludes. | Low to moderate - some platforms may offer secondary markets. |

| Investor Type | Accredited investors or specialized funds. | General public, retail investors, and accredited investors. |

| Regulation | Highly regulated to protect parties in dispute financing. | Regulated under securities and crowdfunding laws. |

| Minimum Investment | Typically high, often $25,000 or more. | Often low, starting from $100 or less. |

Which is better?

Litigation finance provides investors with access to high-return legal case assets by funding plaintiffs in exchange for a portion of the settlement or judgment, offering risk diversification independent of market volatility. Crowdfunding enables raising capital from a large pool of small investors, promoting community engagement and funding startups or projects with lower entry barriers but typically involves higher risk and lower regulatory oversight. Choosing between litigation finance and crowdfunding depends on investment goals, risk tolerance, and preference for asset liquidity and legal sector exposure.

Connection

Litigation finance and crowdfunding intersect through their ability to democratize access to capital by enabling multiple investors to collectively fund legal cases or business ventures. Both leverage technology platforms to pool resources from a broad base of contributors, reducing financial barriers and distributing risk among participants. This connection enhances liquidity in traditionally illiquid markets while providing new investment opportunities driven by community involvement and diversified portfolios.

Key Terms

Capital Raising

Crowdfunding enables capital raising by pooling small investments from a large number of individuals, providing access to diverse funding sources for startups and projects. Litigation finance offers targeted capital for legal cases through third-party funding, reducing financial risk for plaintiffs and law firms. Explore the key differences and benefits of crowdfunding and litigation finance to optimize your capital raising strategy.

Legal Claims

Crowdfunding for legal claims leverages a broad base of small contributions from individuals to fund lawsuits, democratizing access to justice while engaging community support. Litigation finance involves specialized third-party investors providing capital to plaintiffs in exchange for a portion of the judgment or settlement, offering substantial resources but often with higher costs and complex agreements. Explore more about how each funding method can impact legal strategies and case outcomes.

Risk Assessment

Crowdfunding distributes financial risk among numerous backers, minimizing individual exposure through small contributions, while litigation finance entails concentrated risk borne by specialized investors who underwrite legal expenses in exchange for a portion of potential settlements or awards. Risk assessment in crowdfunding emphasizes project credibility, market demand, and backer trust, whereas litigation finance requires rigorous legal case evaluation, probability of success, and potential recovery magnitude. Explore the detailed risk metrics and strategies used in each financing model to understand their unique risk landscapes.

Source and External Links

Crowdfunding - Wikipedia - Crowdfunding is the practice of funding a project or venture by raising money from a large number of people, typically via the internet, acting as an alternative finance method without traditional intermediaries, and has raised over US$34 billion globally in 2015.

What is crowdfunding? Here are four types for startups to know - Stripe - Crowdfunding allows startups to raise money through the collective effort of individuals primarily online, leveraging social media and crowdfunding platforms to get funding without traditional investors.

Crowdfunding - Small Business Financing: A Resource Guide - Crowdfunding uses online platforms to collect small amounts of money from many individuals and can take the forms of donation, reward, or equity-based models, with platforms like GoFundMe and Kickstarter being notable examples.

dowidth.com

dowidth.com