Secondaries in venture capital involve purchasing existing equity stakes from current investors, offering liquidity and portfolio diversification without dilution, while primaries refer to direct investments in new venture funding rounds that inject fresh capital into startups. The secondary market provides opportunities to acquire mature assets with clearer valuation metrics, contrasting with primaries where investment risk is higher due to early-stage uncertainties. Explore the nuances of secondaries versus primaries to optimize your venture capital investment strategy.

Why it is important

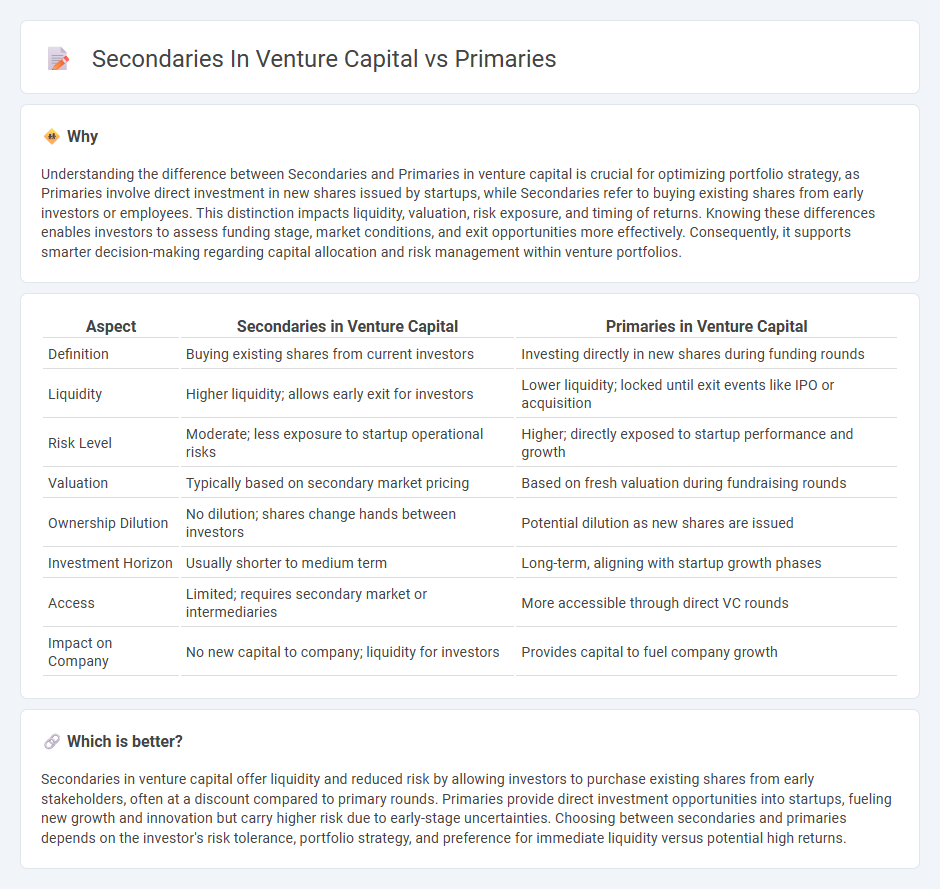

Understanding the difference between Secondaries and Primaries in venture capital is crucial for optimizing portfolio strategy, as Primaries involve direct investment in new shares issued by startups, while Secondaries refer to buying existing shares from early investors or employees. This distinction impacts liquidity, valuation, risk exposure, and timing of returns. Knowing these differences enables investors to assess funding stage, market conditions, and exit opportunities more effectively. Consequently, it supports smarter decision-making regarding capital allocation and risk management within venture portfolios.

Comparison Table

| Aspect | Secondaries in Venture Capital | Primaries in Venture Capital |

|---|---|---|

| Definition | Buying existing shares from current investors | Investing directly in new shares during funding rounds |

| Liquidity | Higher liquidity; allows early exit for investors | Lower liquidity; locked until exit events like IPO or acquisition |

| Risk Level | Moderate; less exposure to startup operational risks | Higher; directly exposed to startup performance and growth |

| Valuation | Typically based on secondary market pricing | Based on fresh valuation during fundraising rounds |

| Ownership Dilution | No dilution; shares change hands between investors | Potential dilution as new shares are issued |

| Investment Horizon | Usually shorter to medium term | Long-term, aligning with startup growth phases |

| Access | Limited; requires secondary market or intermediaries | More accessible through direct VC rounds |

| Impact on Company | No new capital to company; liquidity for investors | Provides capital to fuel company growth |

Which is better?

Secondaries in venture capital offer liquidity and reduced risk by allowing investors to purchase existing shares from early stakeholders, often at a discount compared to primary rounds. Primaries provide direct investment opportunities into startups, fueling new growth and innovation but carry higher risk due to early-stage uncertainties. Choosing between secondaries and primaries depends on the investor's risk tolerance, portfolio strategy, and preference for immediate liquidity versus potential high returns.

Connection

Secondaries in venture capital involve the buying and selling of existing shares, providing liquidity to early investors and employees, while primaries refer to new shares issued during fundraising rounds to fuel company growth. The connection between secondaries and primaries lies in their complementary role in capital markets, where primaries inject fresh capital to scale startups, and secondaries facilitate portfolio rebalancing and investor exit strategies without diluting ownership. Both mechanisms enhance market efficiency by balancing new investments and liquidity options within the venture capital ecosystem.

Key Terms

New Issuance

Primary investments in venture capital refer to the acquisition of newly issued shares directly from a startup during fundraising rounds, fueling company growth and innovation. Secondary investments involve purchasing existing shares from early investors or employees, providing liquidity without diluting ownership. Explore the differences between primary and secondary market opportunities to optimize your venture capital strategy.

Secondary Purchase

Secondary purchases in venture capital involve acquiring existing equity stakes from current shareholders, rather than investing directly in new funding rounds as seen in primary transactions. This method provides liquidity to early investors or employees while allowing buyers to access mature assets with established valuations and potentially reduced risk. Explore the advantages and strategies behind secondary purchases to enhance your venture capital portfolio.

Liquidity

Primary investments in venture capital involve direct capital infusion into startups during funding rounds, facilitating growth and product development. Secondary transactions provide liquidity by enabling investors to buy and sell pre-existing shares, offering an exit strategy without waiting for IPOs or acquisitions. Explore how liquidity differs between primaries and secondaries to optimize your venture capital portfolio strategy.

Source and External Links

Primaries and Caucuses - U.S. Embassy & Consulate in Thailand - Primaries are elections where party members vote for the best candidate to represent their party in the general election, whereas caucuses involve party members selecting candidates through discussions and votes, both leading to delegate selection at conventions.

Types of Primary Systems, Explained | Unite America - There are various primary systems including semi-open primaries, where independents can choose a party primary to vote in, and all-candidate primaries like California's top-two system, where all candidates appear on one ballot and the top finishers advance to the general election.

United States presidential primary - Wikipedia - Primaries and caucuses are held by states and territories to nominate candidates for president, with voting rules varying by state and includes binding and winner-take-all processes, culminating often on "Super Tuesday" when many states hold primaries simultaneously.

dowidth.com

dowidth.com