Tax lien certificates offer investors a secured position by paying delinquent property taxes and earning interest or potential ownership if liens are not redeemed. Foreclosure investing involves purchasing properties at auction, often below market value, but requires careful due diligence to avoid legal and financial risks. Explore the differences and benefits of each method to enhance your investment strategy.

Why it is important

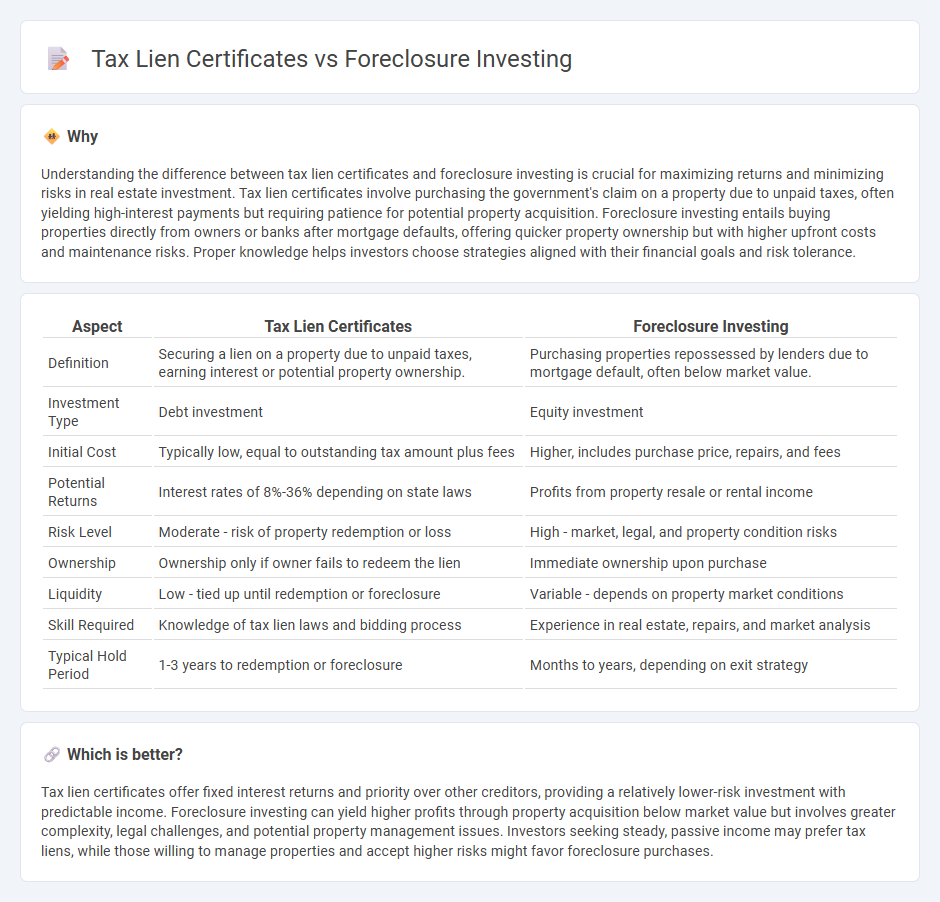

Understanding the difference between tax lien certificates and foreclosure investing is crucial for maximizing returns and minimizing risks in real estate investment. Tax lien certificates involve purchasing the government's claim on a property due to unpaid taxes, often yielding high-interest payments but requiring patience for potential property acquisition. Foreclosure investing entails buying properties directly from owners or banks after mortgage defaults, offering quicker property ownership but with higher upfront costs and maintenance risks. Proper knowledge helps investors choose strategies aligned with their financial goals and risk tolerance.

Comparison Table

| Aspect | Tax Lien Certificates | Foreclosure Investing |

|---|---|---|

| Definition | Securing a lien on a property due to unpaid taxes, earning interest or potential property ownership. | Purchasing properties repossessed by lenders due to mortgage default, often below market value. |

| Investment Type | Debt investment | Equity investment |

| Initial Cost | Typically low, equal to outstanding tax amount plus fees | Higher, includes purchase price, repairs, and fees |

| Potential Returns | Interest rates of 8%-36% depending on state laws | Profits from property resale or rental income |

| Risk Level | Moderate - risk of property redemption or loss | High - market, legal, and property condition risks |

| Ownership | Ownership only if owner fails to redeem the lien | Immediate ownership upon purchase |

| Liquidity | Low - tied up until redemption or foreclosure | Variable - depends on property market conditions |

| Skill Required | Knowledge of tax lien laws and bidding process | Experience in real estate, repairs, and market analysis |

| Typical Hold Period | 1-3 years to redemption or foreclosure | Months to years, depending on exit strategy |

Which is better?

Tax lien certificates offer fixed interest returns and priority over other creditors, providing a relatively lower-risk investment with predictable income. Foreclosure investing can yield higher profits through property acquisition below market value but involves greater complexity, legal challenges, and potential property management issues. Investors seeking steady, passive income may prefer tax liens, while those willing to manage properties and accept higher risks might favor foreclosure purchases.

Connection

Tax lien certificates and foreclosure investing both involve acquiring properties through unresolved debts, where tax lien certificates represent claims on properties with unpaid taxes, allowing investors to earn interest or initiate foreclosure if debts remain unpaid. In foreclosure investing, properties are acquired after legal proceedings due to mortgage defaults, often following tax liens or other liens. Understanding the lien priority system is crucial, as tax liens typically take precedence, influencing investment strategies and potential returns.

Key Terms

**Foreclosure Investing:**

Foreclosure investing involves purchasing properties after borrowers fail to repay their mortgages, often through public auctions or direct bank sales, allowing investors to acquire real estate below market value. This strategy requires in-depth knowledge of local foreclosure laws, property conditions, and potential liens that may affect ownership. Explore this comprehensive guide to understand how foreclosure investing can diversify your portfolio and generate substantial returns.

Auction

Foreclosure investing involves purchasing properties through auctions when owners default on mortgage payments, offering potential real estate acquisition at below-market prices. Tax lien certificate auctions allow investors to bid on liens placed by governments for unpaid property taxes, earning interest or acquiring the property if liens remain unpaid. Explore detailed strategies and risks of both auction types to optimize your investment approach.

Title Search

Title searches are critical in foreclosure investing to uncover any existing liens, judgments, or claims that could affect property ownership and marketability. In tax lien certificate investing, title searches help verify property ownership and ensure there are no competing taxes or encumbrances before purchasing the lien. Explore detailed strategies and legal considerations in title searches to enhance your investment success.

Source and External Links

Foreclosure investment - Wikipedia - Foreclosure investment involves buying mortgaged properties sold at public foreclosure sales, typically offering opportunities to acquire properties below market value due to loan defaults and rising interest rates, with sales conducted by courts or trustees.

Steps for Beginners for Investing in Foreclosures - Foreclosure investing includes pre-foreclosure and auction phases, where investors can bid on properties listed publicly, requiring registration and cash deposits, but is highly competitive due to many investors targeting the same homeowners.

Foreclosure Investing For Dummies Cheat Sheet - Key tips for foreclosure investing include setting a maximum bid to ensure returns above costs, attending auctions prepared with cashier's checks, promptly paying balances and taxes if successful, and understanding redemption rights for former owners.

dowidth.com

dowidth.com