Tangible asset tokenization transforms physical assets like real estate or art into digital tokens, enabling fractional ownership and increasing liquidity in traditionally illiquid markets. Crowdfunding pools small investments from numerous contributors to finance projects or startups, often providing equity or rewards but lacking the direct asset backing seen in tokenization. Explore the nuances of both investment strategies to determine which aligns best with your financial goals.

Why it is important

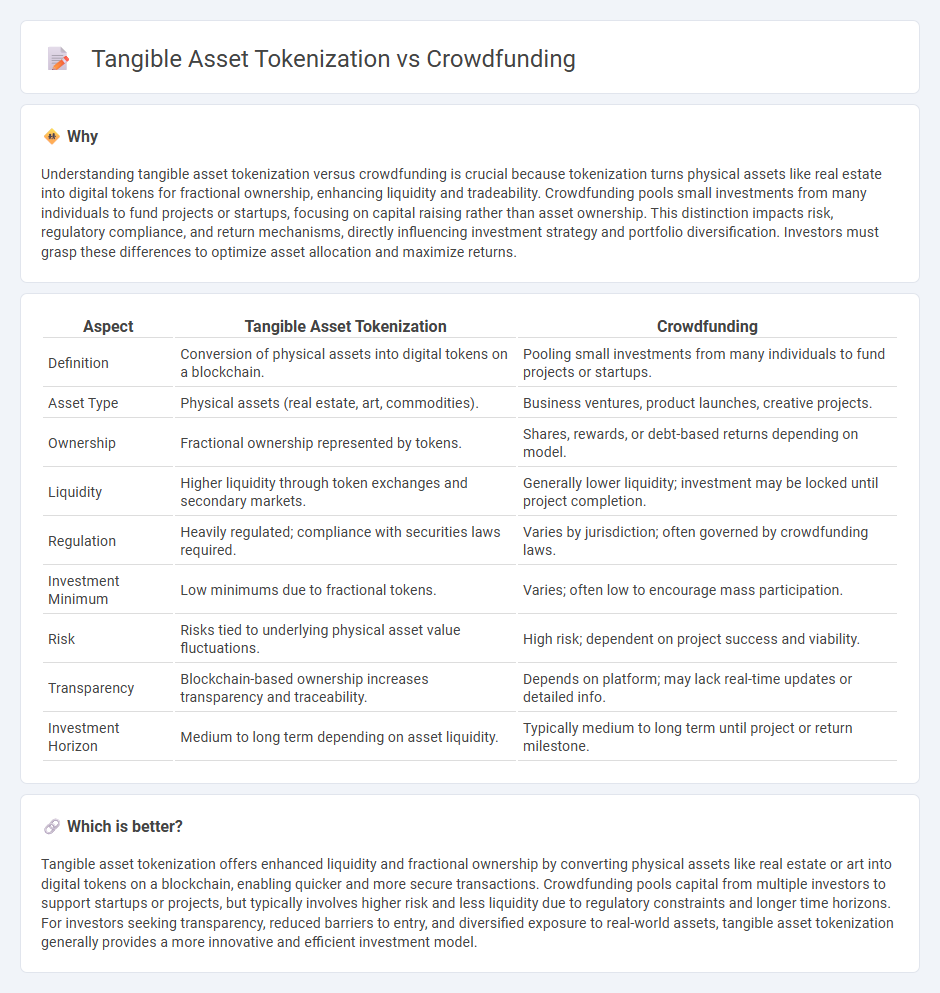

Understanding tangible asset tokenization versus crowdfunding is crucial because tokenization turns physical assets like real estate into digital tokens for fractional ownership, enhancing liquidity and tradeability. Crowdfunding pools small investments from many individuals to fund projects or startups, focusing on capital raising rather than asset ownership. This distinction impacts risk, regulatory compliance, and return mechanisms, directly influencing investment strategy and portfolio diversification. Investors must grasp these differences to optimize asset allocation and maximize returns.

Comparison Table

| Aspect | Tangible Asset Tokenization | Crowdfunding |

|---|---|---|

| Definition | Conversion of physical assets into digital tokens on a blockchain. | Pooling small investments from many individuals to fund projects or startups. |

| Asset Type | Physical assets (real estate, art, commodities). | Business ventures, product launches, creative projects. |

| Ownership | Fractional ownership represented by tokens. | Shares, rewards, or debt-based returns depending on model. |

| Liquidity | Higher liquidity through token exchanges and secondary markets. | Generally lower liquidity; investment may be locked until project completion. |

| Regulation | Heavily regulated; compliance with securities laws required. | Varies by jurisdiction; often governed by crowdfunding laws. |

| Investment Minimum | Low minimums due to fractional tokens. | Varies; often low to encourage mass participation. |

| Risk | Risks tied to underlying physical asset value fluctuations. | High risk; dependent on project success and viability. |

| Transparency | Blockchain-based ownership increases transparency and traceability. | Depends on platform; may lack real-time updates or detailed info. |

| Investment Horizon | Medium to long term depending on asset liquidity. | Typically medium to long term until project or return milestone. |

Which is better?

Tangible asset tokenization offers enhanced liquidity and fractional ownership by converting physical assets like real estate or art into digital tokens on a blockchain, enabling quicker and more secure transactions. Crowdfunding pools capital from multiple investors to support startups or projects, but typically involves higher risk and less liquidity due to regulatory constraints and longer time horizons. For investors seeking transparency, reduced barriers to entry, and diversified exposure to real-world assets, tangible asset tokenization generally provides a more innovative and efficient investment model.

Connection

Tangible asset tokenization transforms physical assets into digital tokens, enabling fractional ownership and enhancing liquidity in investment markets. Crowdfunding platforms leverage this tokenization to attract smaller investors by offering accessible entry points into traditionally illiquid asset classes like real estate or art. This connection democratizes investment opportunities and fosters a more inclusive financial ecosystem by combining blockchain technology with collective funding mechanisms.

Key Terms

Investor Participation

Investor participation in crowdfunding typically involves pooling small sums of money from numerous individuals to fund projects or startups, offering equity or rewards without direct ownership of physical assets. Tangible asset tokenization enables investors to purchase digital tokens representing fractional ownership in real-world assets like real estate, art, or commodities, providing liquidity and easier transferability. Explore the benefits and mechanics of these innovative investment methods to enhance your portfolio diversification strategy.

Asset Liquidity

Crowdfunding typically limits investor liquidity due to fixed fundraising periods and secondary market restrictions, whereas tangible asset tokenization enhances asset liquidity by enabling fractional ownership and real-time trading on blockchain platforms. The tokenization of assets like real estate, art, or commodities allows investors to buy, sell, or trade tokens seamlessly, providing increased market access and better liquidity compared to traditional crowdfunding methods. Discover how these evolving financial technologies are reshaping investment liquidity and opportunities.

Regulatory Compliance

Crowdfunding platforms must navigate securities regulations such as the JOBS Act in the U.S. and the European Union's Prospectus Regulation to ensure investor protection and legal compliance. Tangible asset tokenization involves stricter oversight under anti-money laundering (AML) and know-your-customer (KYC) frameworks, often requiring alignment with financial authorities like the SEC or FCA. Explore further to understand how evolving legal landscapes shape the future of fundraising and digital asset ownership.

Source and External Links

Crowdfunding - Wikipedia - Crowdfunding is the practice of funding a project or venture by raising money from a large number of people, typically via the internet, involving three main actors: the project initiator, supporters, and a platform connecting them.

What is crowdfunding? Here are four types to know - Crowdfunding is a popular way for startups to finance projects and businesses by mobilizing contributions from a wide network of individuals primarily online, contrasting with traditional financing from a few investors.

Small Business Financing: A Resource Guide: Crowdfunding - Crowdfunding uses online platforms to collect small contributions from many people, and includes donation-based, rewards-based, and equity-based models, allowing funders to support charities, receive rewards, or gain ownership stakes.

dowidth.com

dowidth.com