Designer sneaker portfolios deliver high returns by capitalizing on limited edition releases and strong resale markets, with some rare pairs appreciating over 100% annually. Fine wine investment offers long-term value growth driven by scarcity, provenance, and aging potential, often outperforming traditional stocks over decades. Explore the unique benefits and risks of both asset classes to optimize your investment strategy.

Why it is important

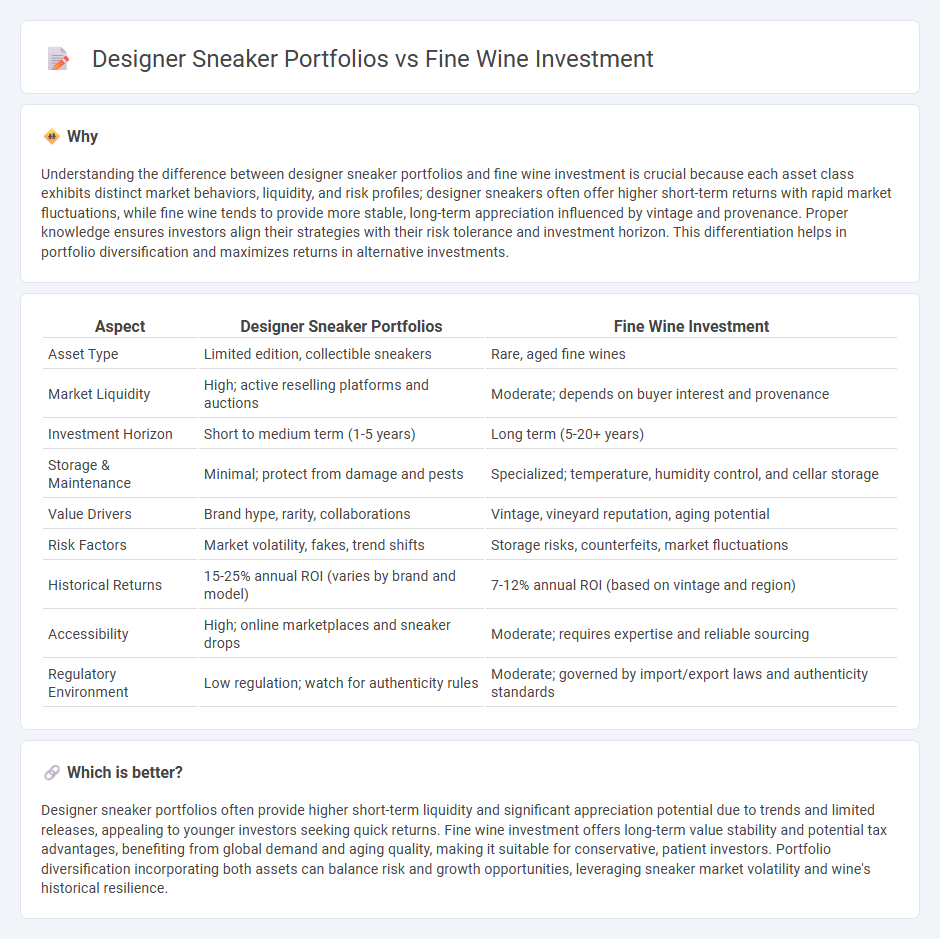

Understanding the difference between designer sneaker portfolios and fine wine investment is crucial because each asset class exhibits distinct market behaviors, liquidity, and risk profiles; designer sneakers often offer higher short-term returns with rapid market fluctuations, while fine wine tends to provide more stable, long-term appreciation influenced by vintage and provenance. Proper knowledge ensures investors align their strategies with their risk tolerance and investment horizon. This differentiation helps in portfolio diversification and maximizes returns in alternative investments.

Comparison Table

| Aspect | Designer Sneaker Portfolios | Fine Wine Investment |

|---|---|---|

| Asset Type | Limited edition, collectible sneakers | Rare, aged fine wines |

| Market Liquidity | High; active reselling platforms and auctions | Moderate; depends on buyer interest and provenance |

| Investment Horizon | Short to medium term (1-5 years) | Long term (5-20+ years) |

| Storage & Maintenance | Minimal; protect from damage and pests | Specialized; temperature, humidity control, and cellar storage |

| Value Drivers | Brand hype, rarity, collaborations | Vintage, vineyard reputation, aging potential |

| Risk Factors | Market volatility, fakes, trend shifts | Storage risks, counterfeits, market fluctuations |

| Historical Returns | 15-25% annual ROI (varies by brand and model) | 7-12% annual ROI (based on vintage and region) |

| Accessibility | High; online marketplaces and sneaker drops | Moderate; requires expertise and reliable sourcing |

| Regulatory Environment | Low regulation; watch for authenticity rules | Moderate; governed by import/export laws and authenticity standards |

Which is better?

Designer sneaker portfolios often provide higher short-term liquidity and significant appreciation potential due to trends and limited releases, appealing to younger investors seeking quick returns. Fine wine investment offers long-term value stability and potential tax advantages, benefiting from global demand and aging quality, making it suitable for conservative, patient investors. Portfolio diversification incorporating both assets can balance risk and growth opportunities, leveraging sneaker market volatility and wine's historical resilience.

Connection

Designer sneaker portfolios and fine wine investment both leverage scarcity and cultural trends to drive value appreciation, making them alternative asset classes in the investment landscape. Their markets are influenced by limited editions, brand reputation, and aging potential, with sneaker collaborations and vintage wines often commanding premium prices at auctions or private sales. Investors benefit from diversification by combining these tangible assets, which exhibit low correlation with traditional stocks and bonds.

Key Terms

Fine wine investment:

Fine wine investment offers a unique asset class characterized by historical price appreciation, scarcity, and global demand, with wines such as Bordeaux and Burgundy consistently outperforming traditional markets. Investment-grade bottles are stored under optimal conditions to preserve quality and value, while market dynamics are influenced by vintage ratings, critic scores, and provenance. Explore detailed strategies and market insights to enhance your fine wine investment portfolio.

Provenance

Provenance plays a crucial role in fine wine investment, as documented origin and storage history significantly affect the wine's value and authenticity. Designer sneaker portfolios rely heavily on verified provenance to ensure rarity and prevent counterfeiting, impacting market demand and resale prices. Explore how provenance standards differentiate these asset classes and influence investor confidence.

Vintage

Vintage fine wine investments offer stable appreciation driven by scarcity, provenance, and aging potential, making them a resilient asset class compared to the often volatile designer sneaker market. Iconic labels like Bordeaux, Burgundy, and Napa Valley vintages demonstrate consistent demand among collectors and connoisseurs, enhancing portfolio diversification with tangible assets. Explore how integrating vintage fine wines can optimize your investment strategy and enhance long-term returns.

Source and External Links

Investing in fine wine: How to put a price on passion assets - Fine wine acts as a Veblen good, with value driven by exclusivity, rarity, and aging potential, making early acquisition and proper storage key to maximizing returns.

Getting Started with Wine Investments - Top investment wines include Bordeaux, Grand Cru Burgundy, Napa Cabernet, and tete de cuvee Champagne, with provenance and proper storage being critical to maintaining value.

Evaluating the Investment Performance of Fine Wine - Fine wine has delivered average annual returns of 10% since 1988, offering uncorrelated, consistent performance attractive to investors seeking diversification beyond traditional assets.

dowidth.com

dowidth.com