Tax lien certificates offer investors a secured way to earn interest by purchasing liens on delinquent property taxes, providing a potentially high return with lower initial capital. Land banking involves buying undeveloped land in strategic locations for long-term appreciation, appealing to those seeking substantial growth over time but with higher risk and capital commitment. Explore detailed comparisons to determine which investment aligns best with your financial goals.

Why it is important

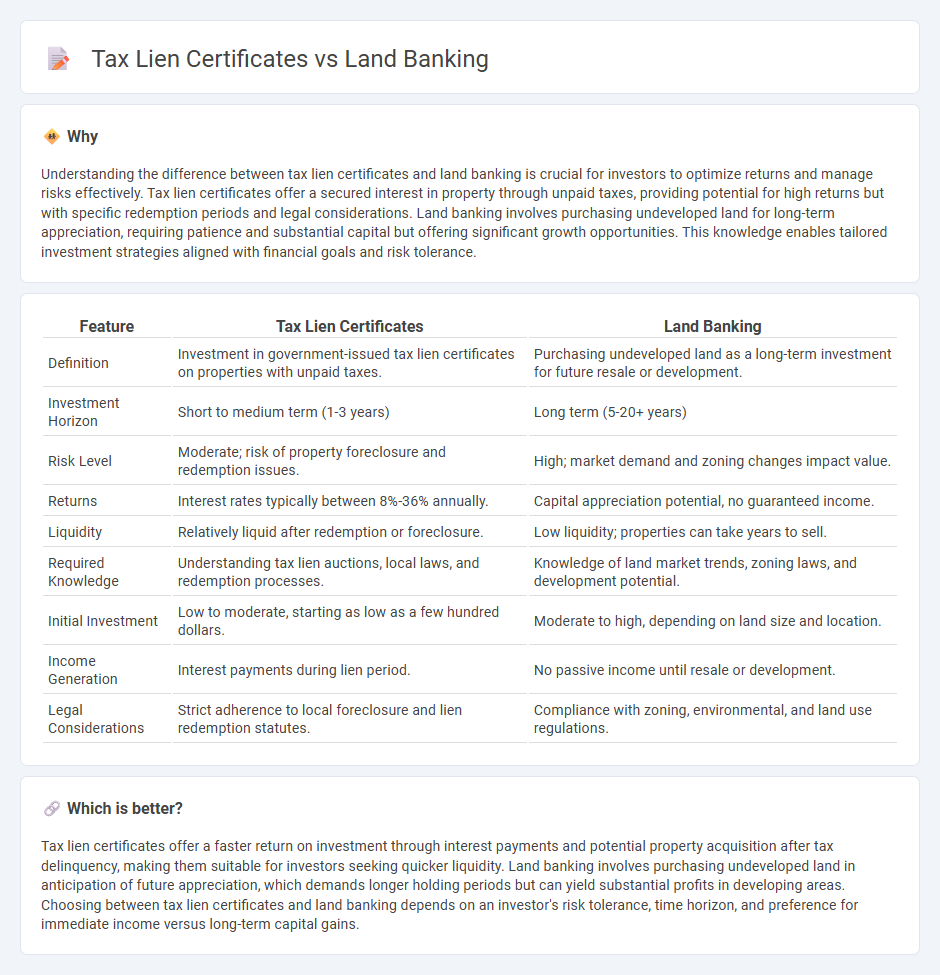

Understanding the difference between tax lien certificates and land banking is crucial for investors to optimize returns and manage risks effectively. Tax lien certificates offer a secured interest in property through unpaid taxes, providing potential for high returns but with specific redemption periods and legal considerations. Land banking involves purchasing undeveloped land for long-term appreciation, requiring patience and substantial capital but offering significant growth opportunities. This knowledge enables tailored investment strategies aligned with financial goals and risk tolerance.

Comparison Table

| Feature | Tax Lien Certificates | Land Banking |

|---|---|---|

| Definition | Investment in government-issued tax lien certificates on properties with unpaid taxes. | Purchasing undeveloped land as a long-term investment for future resale or development. |

| Investment Horizon | Short to medium term (1-3 years) | Long term (5-20+ years) |

| Risk Level | Moderate; risk of property foreclosure and redemption issues. | High; market demand and zoning changes impact value. |

| Returns | Interest rates typically between 8%-36% annually. | Capital appreciation potential, no guaranteed income. |

| Liquidity | Relatively liquid after redemption or foreclosure. | Low liquidity; properties can take years to sell. |

| Required Knowledge | Understanding tax lien auctions, local laws, and redemption processes. | Knowledge of land market trends, zoning laws, and development potential. |

| Initial Investment | Low to moderate, starting as low as a few hundred dollars. | Moderate to high, depending on land size and location. |

| Income Generation | Interest payments during lien period. | No passive income until resale or development. |

| Legal Considerations | Strict adherence to local foreclosure and lien redemption statutes. | Compliance with zoning, environmental, and land use regulations. |

Which is better?

Tax lien certificates offer a faster return on investment through interest payments and potential property acquisition after tax delinquency, making them suitable for investors seeking quicker liquidity. Land banking involves purchasing undeveloped land in anticipation of future appreciation, which demands longer holding periods but can yield substantial profits in developing areas. Choosing between tax lien certificates and land banking depends on an investor's risk tolerance, time horizon, and preference for immediate income versus long-term capital gains.

Connection

Tax lien certificates create opportunities for investors to acquire property rights by purchasing government-issued liens on delinquent taxes, potentially leading to ownership through foreclosure. Land banking complements this by allowing investors to hold undervalued or strategically located parcels of land for long-term appreciation and development. Together, these investment strategies leverage tax-related holdings to build diversified real estate portfolios focused on future capital gains.

Key Terms

**Land Banking:**

Land banking involves purchasing undeveloped or underdeveloped real estate properties with the expectation of long-term appreciation, often in growth corridors or emerging markets. This strategy requires a thorough understanding of zoning laws, market trends, and holding costs, as properties may remain non-productive for years before yielding significant returns. Explore more about land banking to discover how strategic property acquisition can build substantial wealth over time.

Appreciation

Land banking primarily benefits from property appreciation as investors hold undervalued land parcels expecting their value to increase over time, especially in developing or expanding areas. Tax lien certificates generate fixed interest income from delinquent property taxes, with appreciation being secondary or indirect if the lien results in foreclosure and property acquisition. Explore deeper insights into how appreciation impacts these real estate investment strategies.

Zoning

Land banking involves acquiring undeveloped or underdeveloped properties, where zoning regulations play a crucial role in determining future land use and potential value appreciation. Tax lien certificates, on the other hand, represent a claim against properties with unpaid taxes but do not provide ownership or control over zoning; investors must understand zoning laws indirectly through property specifics before bidding. Explore how zoning impacts both investment types to maximize returns and mitigate risks.

Source and External Links

Land Banking: A Sound Approach to Residential Real ... - Land banking in real estate allows capital providers to purchase and hold undeveloped residential land, then sell or reconvey it to developers under structured options, transferring land market risks to the banker and leaving development risks with the developer.

Land banking - Land banking is the practice of assembling parcels of land for future sale or development, often by private investors or, in the U.S., by local public authorities managing abandoned properties to spur revitalization.

Land Banks - Land banks are public entities with special legal powers to acquire, manage, and repurpose vacant, abandoned, or deteriorated properties according to community objectives, often to encourage productive reuse aligned with local goals.

dowidth.com

dowidth.com