Whiskey cask investment offers tangible asset growth through aging spirits that increase in value over time, benefiting from limited supply and rising global demand. Art investment provides portfolio diversification with unique cultural pieces that can appreciate based on artist reputation, rarity, and market trends. Explore the nuances of these alternative investments to determine which aligns best with your financial goals.

Why it is important

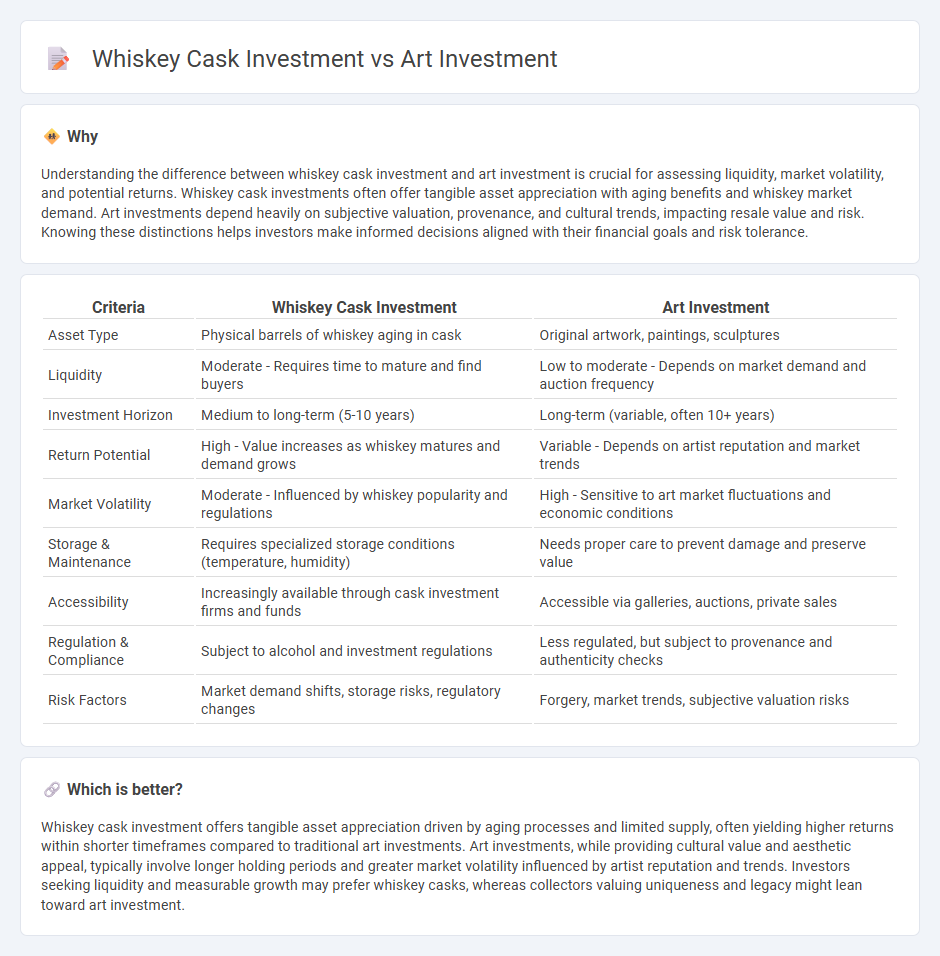

Understanding the difference between whiskey cask investment and art investment is crucial for assessing liquidity, market volatility, and potential returns. Whiskey cask investments often offer tangible asset appreciation with aging benefits and whiskey market demand. Art investments depend heavily on subjective valuation, provenance, and cultural trends, impacting resale value and risk. Knowing these distinctions helps investors make informed decisions aligned with their financial goals and risk tolerance.

Comparison Table

| Criteria | Whiskey Cask Investment | Art Investment |

|---|---|---|

| Asset Type | Physical barrels of whiskey aging in cask | Original artwork, paintings, sculptures |

| Liquidity | Moderate - Requires time to mature and find buyers | Low to moderate - Depends on market demand and auction frequency |

| Investment Horizon | Medium to long-term (5-10 years) | Long-term (variable, often 10+ years) |

| Return Potential | High - Value increases as whiskey matures and demand grows | Variable - Depends on artist reputation and market trends |

| Market Volatility | Moderate - Influenced by whiskey popularity and regulations | High - Sensitive to art market fluctuations and economic conditions |

| Storage & Maintenance | Requires specialized storage conditions (temperature, humidity) | Needs proper care to prevent damage and preserve value |

| Accessibility | Increasingly available through cask investment firms and funds | Accessible via galleries, auctions, private sales |

| Regulation & Compliance | Subject to alcohol and investment regulations | Less regulated, but subject to provenance and authenticity checks |

| Risk Factors | Market demand shifts, storage risks, regulatory changes | Forgery, market trends, subjective valuation risks |

Which is better?

Whiskey cask investment offers tangible asset appreciation driven by aging processes and limited supply, often yielding higher returns within shorter timeframes compared to traditional art investments. Art investments, while providing cultural value and aesthetic appeal, typically involve longer holding periods and greater market volatility influenced by artist reputation and trends. Investors seeking liquidity and measurable growth may prefer whiskey casks, whereas collectors valuing uniqueness and legacy might lean toward art investment.

Connection

Whiskey cask investment and art investment are connected through their shared appeal as alternative assets offering portfolio diversification and potential value appreciation. Both markets rely heavily on rarity, provenance, and expert valuation to drive demand and price performance. Investors seek tangible assets like aged whiskey casks and unique artworks to hedge against traditional market volatility and inflation.

Key Terms

Art Investment:

Art investment offers tangible appreciation potential through rare masterpieces and emerging artists, often outperforming traditional markets with its low correlation to stocks or bonds. The global art market surpassed $65 billion in 2023, highlighting strong demand and liquidity for high-quality pieces. Explore how art can diversify your portfolio and uncover unique value opportunities today.

Provenance

Provenance plays a crucial role in both art investment and whiskey cask investment, serving as a key factor in validating authenticity and increasing value. Art investors rely on documented ownership history, expert appraisals, and exhibition records to verify the origin and significance of pieces, while whiskey cask investors focus on distillery records, cask age, and previous ownership for credibility. Explore detailed strategies to maximize asset security and returns by understanding provenance in these unique investment markets.

Authenticity

Authenticity plays a crucial role in art investment, where provenance, artist signature, and condition directly impact value and market demand, while whiskey cask investment emphasizes the authenticity of distillery origin, cask type, and maturation period to ensure quality and appreciation potential. Both markets rely heavily on verified documentation and expert evaluation to mitigate risks and enhance investor confidence. Explore detailed strategies on verifying authenticity to maximize returns in these distinctive investment avenues.

Source and External Links

Basics of Art Funds and their Managers , The Art Fund Association - Art investment funds use various strategies like buy and hold, geographic arbitrage, and focus on emerging artists, offering potential for diversification, inflation hedging, and returns uncorrelated to traditional stocks and bonds.

Investing in art: What to know about turning a passion into a ... - Art as an investment carries risks including illiquidity, dependence on provenance and trends, but can provide portfolio diversification, inflation protection, potential high returns, and cultural value.

How to Invest in Art: A Seven-Point Guide to Help You Understand ... - Compared to other passion investments like cars or wine, art has delivered superior and sustainable returns, requires minimal upkeep, and appeals to many ultra-high-net-worth investors for its cultural significance and rarity.

dowidth.com

dowidth.com