Sports memorabilia investment offers unique opportunities for portfolio diversification and potential high returns through rare collectible items, while real estate investment provides tangible assets with steady cash flow and long-term appreciation. Both asset classes carry distinct risks and benefits, with sports memorabilia being more volatile and real estate generally more stable. Explore detailed comparisons to understand which investment aligns best with your financial goals.

Why it is important

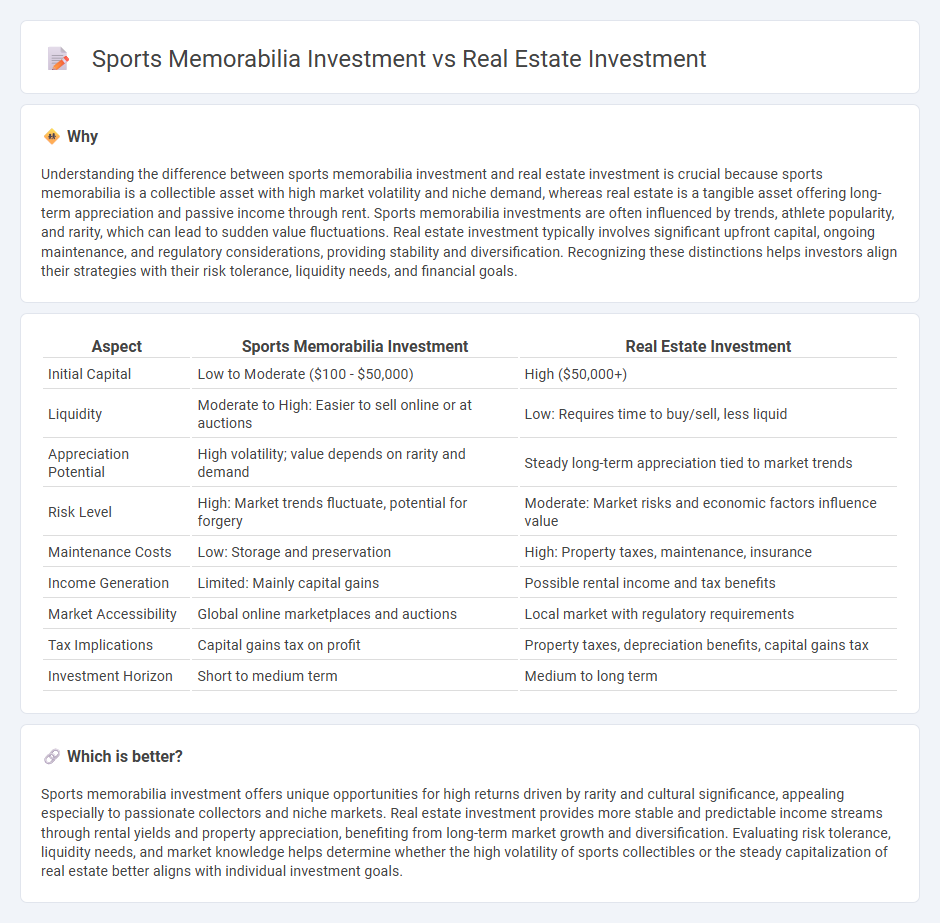

Understanding the difference between sports memorabilia investment and real estate investment is crucial because sports memorabilia is a collectible asset with high market volatility and niche demand, whereas real estate is a tangible asset offering long-term appreciation and passive income through rent. Sports memorabilia investments are often influenced by trends, athlete popularity, and rarity, which can lead to sudden value fluctuations. Real estate investment typically involves significant upfront capital, ongoing maintenance, and regulatory considerations, providing stability and diversification. Recognizing these distinctions helps investors align their strategies with their risk tolerance, liquidity needs, and financial goals.

Comparison Table

| Aspect | Sports Memorabilia Investment | Real Estate Investment |

|---|---|---|

| Initial Capital | Low to Moderate ($100 - $50,000) | High ($50,000+) |

| Liquidity | Moderate to High: Easier to sell online or at auctions | Low: Requires time to buy/sell, less liquid |

| Appreciation Potential | High volatility; value depends on rarity and demand | Steady long-term appreciation tied to market trends |

| Risk Level | High: Market trends fluctuate, potential for forgery | Moderate: Market risks and economic factors influence value |

| Maintenance Costs | Low: Storage and preservation | High: Property taxes, maintenance, insurance |

| Income Generation | Limited: Mainly capital gains | Possible rental income and tax benefits |

| Market Accessibility | Global online marketplaces and auctions | Local market with regulatory requirements |

| Tax Implications | Capital gains tax on profit | Property taxes, depreciation benefits, capital gains tax |

| Investment Horizon | Short to medium term | Medium to long term |

Which is better?

Sports memorabilia investment offers unique opportunities for high returns driven by rarity and cultural significance, appealing especially to passionate collectors and niche markets. Real estate investment provides more stable and predictable income streams through rental yields and property appreciation, benefiting from long-term market growth and diversification. Evaluating risk tolerance, liquidity needs, and market knowledge helps determine whether the high volatility of sports collectibles or the steady capitalization of real estate better aligns with individual investment goals.

Connection

Sports memorabilia investment and real estate investment both leverage asset appreciation driven by market demand and scarcity, creating opportunities for significant financial returns over time. Collectors and investors in sports memorabilia capitalize on limited-edition items and historical significance, while real estate investors focus on location, property improvements, and economic growth to enhance value. Both markets require thorough research, timing, and strategic acquisition to maximize profitability and diversify investment portfolios.

Key Terms

Real Estate Investment:

Real estate investment offers tangible assets with consistent cash flow through rental income and potential for property appreciation, making it a stable long-term wealth-building strategy. Properties can be leveraged for financing, providing tax advantages and diversification within an investment portfolio. Explore in-depth insights and strategies to optimize your real estate investment returns.

Property Valuation

Real estate investment offers tangible asset appreciation driven by factors like location, market trends, and economic growth, providing relatively stable property valuation over time. Sports memorabilia investments exhibit value fluctuations influenced by rarity, athlete popularity, and market demand, often resulting in higher volatility compared to real estate. Explore detailed comparisons to understand which investment aligns better with your portfolio goals.

Rental Yield

Real estate investment typically offers a rental yield ranging from 4% to 8%, providing a steady income stream through property rentals, making it a reliable choice for long-term investors. Sports memorabilia investment, while potentially lucrative with high appreciation in value, generates little to no rental income, relying primarily on capital gains from resale. Explore the comparative benefits and risks of these asset classes to determine the best fit for your investment portfolio.

Source and External Links

Real estate investing - Real estate investing involves purchasing, owning, managing, renting, or selling real estate to generate profit or long-term wealth through strategic decisions, financing, and market analysis.

Real Estate Investing: 5 Ways to Get Started - NerdWallet - Common real estate investment methods include buying REITs, investing through platforms, owning rental properties, and flipping investment properties.

Real Estate Investment Trusts (REITs) | Investor.gov - REITs allow individuals to invest in income-producing real estate without owning the properties directly, offering exposure to commercial real estate through publicly traded or non-traded shares.

dowidth.com

dowidth.com