Farmland funds offer investors access to agricultural land assets with professional management and steady income through lease payments, providing a relatively stable and inflation-hedged investment. Crowdfunding platforms enable direct participation in diverse projects or startups with lower entry barriers but higher risk and potential volatility. Explore detailed comparisons to determine which investment aligns best with your financial goals.

Why it is important

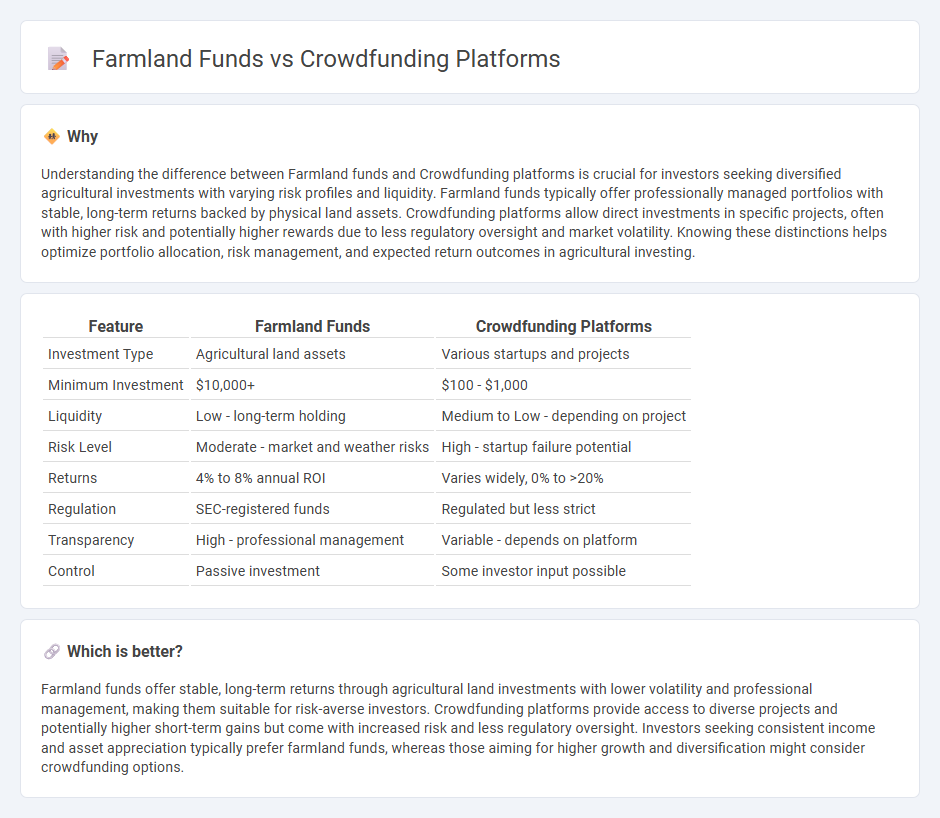

Understanding the difference between Farmland funds and Crowdfunding platforms is crucial for investors seeking diversified agricultural investments with varying risk profiles and liquidity. Farmland funds typically offer professionally managed portfolios with stable, long-term returns backed by physical land assets. Crowdfunding platforms allow direct investments in specific projects, often with higher risk and potentially higher rewards due to less regulatory oversight and market volatility. Knowing these distinctions helps optimize portfolio allocation, risk management, and expected return outcomes in agricultural investing.

Comparison Table

| Feature | Farmland Funds | Crowdfunding Platforms |

|---|---|---|

| Investment Type | Agricultural land assets | Various startups and projects |

| Minimum Investment | $10,000+ | $100 - $1,000 |

| Liquidity | Low - long-term holding | Medium to Low - depending on project |

| Risk Level | Moderate - market and weather risks | High - startup failure potential |

| Returns | 4% to 8% annual ROI | Varies widely, 0% to >20% |

| Regulation | SEC-registered funds | Regulated but less strict |

| Transparency | High - professional management | Variable - depends on platform |

| Control | Passive investment | Some investor input possible |

Which is better?

Farmland funds offer stable, long-term returns through agricultural land investments with lower volatility and professional management, making them suitable for risk-averse investors. Crowdfunding platforms provide access to diverse projects and potentially higher short-term gains but come with increased risk and less regulatory oversight. Investors seeking consistent income and asset appreciation typically prefer farmland funds, whereas those aiming for higher growth and diversification might consider crowdfunding options.

Connection

Farmland funds pool capital from investors to purchase and manage agricultural land, generating returns through crop sales and land appreciation. Crowdfunding platforms facilitate access to these farmland investments by enabling individual investors to participate with smaller amounts of capital. This connection democratizes farmland investment, increasing liquidity and expanding opportunities beyond traditional institutional investors.

Key Terms

Equity Ownership

Crowdfunding platforms offer individual investors the opportunity to gain equity ownership in farmland projects with relatively low capital requirements, enabling diversified portfolio options and direct participation in agricultural ventures. Farmland funds, managed by professional asset managers, typically require higher minimum investments and provide institutional-grade stewardship, targeting long-term appreciation and income through leased agricultural land. Explore the distinct advantages of each investment type to identify the best fit for your financial goals and risk tolerance.

Asset Diversification

Crowdfunding platforms offer retail investors access to diverse agricultural projects with smaller capital commitments, enabling portfolio customization across multiple farm types and geographic regions. In contrast, farmland funds pool substantial investor capital to acquire large-scale, professionally managed farmland assets, providing broader exposure but often less flexibility in asset selection. Explore strategic benefits and risk profiles of both options to optimize your agricultural investment portfolio.

Liquidity

Crowdfunding platforms offer higher liquidity by enabling investors to buy and sell shares in real-time, whereas farmland funds typically have longer lock-in periods and limited secondary market options. Farmland funds provide stability through professional management and diversified agricultural assets but often at the cost of reduced liquidity. Explore more about which investment aligns best with your liquidity preferences and financial goals.

Source and External Links

How to Choose the Best Crowdfunding Website for Your Next ... - Lists popular crowdfunding platforms like Fundly, FundRazr, and DonorsChoose, detailing their fee structures and types of supported fundraisers including causes, nonprofits, and education projects.

Top 10 US Crowdfunding Platforms (Reward and Equity) - Provides a comparison of leading US platforms such as Kickstarter (largest reward crowdfunding), Indiegogo, and Patreon, highlighting features like fees, project success rates, and niche focuses like supporting artists.

GoFundMe | The #1 Crowdfunding and Fundraising Platform - Describes GoFundMe as the global leader in personal and charity crowdfunding with no fee to start, raising $50 million weekly, and offering tools to create, share, and manage fundraisers easily.

dowidth.com

dowidth.com