Livestock investment platforms offer opportunities to invest in tangible assets like cattle, poultry, and other farm animals, providing steady returns through agricultural growth and product sales. Collectibles investment platforms focus on unique items such as rare coins, vintage toys, and art pieces, where value appreciation is driven by rarity and market demand. Explore the differences between these platforms to determine which aligns best with your investment goals.

Why it is important

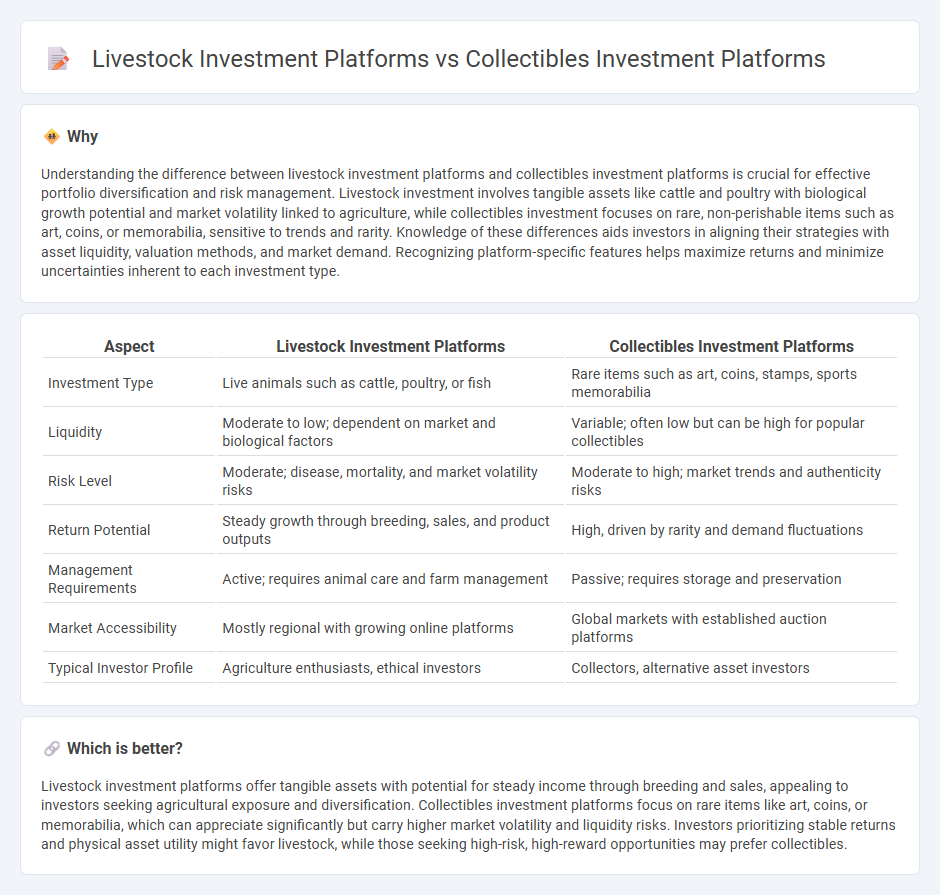

Understanding the difference between livestock investment platforms and collectibles investment platforms is crucial for effective portfolio diversification and risk management. Livestock investment involves tangible assets like cattle and poultry with biological growth potential and market volatility linked to agriculture, while collectibles investment focuses on rare, non-perishable items such as art, coins, or memorabilia, sensitive to trends and rarity. Knowledge of these differences aids investors in aligning their strategies with asset liquidity, valuation methods, and market demand. Recognizing platform-specific features helps maximize returns and minimize uncertainties inherent to each investment type.

Comparison Table

| Aspect | Livestock Investment Platforms | Collectibles Investment Platforms |

|---|---|---|

| Investment Type | Live animals such as cattle, poultry, or fish | Rare items such as art, coins, stamps, sports memorabilia |

| Liquidity | Moderate to low; dependent on market and biological factors | Variable; often low but can be high for popular collectibles |

| Risk Level | Moderate; disease, mortality, and market volatility risks | Moderate to high; market trends and authenticity risks |

| Return Potential | Steady growth through breeding, sales, and product outputs | High, driven by rarity and demand fluctuations |

| Management Requirements | Active; requires animal care and farm management | Passive; requires storage and preservation |

| Market Accessibility | Mostly regional with growing online platforms | Global markets with established auction platforms |

| Typical Investor Profile | Agriculture enthusiasts, ethical investors | Collectors, alternative asset investors |

Which is better?

Livestock investment platforms offer tangible assets with potential for steady income through breeding and sales, appealing to investors seeking agricultural exposure and diversification. Collectibles investment platforms focus on rare items like art, coins, or memorabilia, which can appreciate significantly but carry higher market volatility and liquidity risks. Investors prioritizing stable returns and physical asset utility might favor livestock, while those seeking high-risk, high-reward opportunities may prefer collectibles.

Connection

Livestock investment platforms and collectibles investment platforms both leverage digital technology to provide fractional ownership opportunities, allowing investors to diversify portfolios beyond traditional assets. These platforms utilize blockchain and secure transaction systems to ensure transparency, traceability, and liquidity in unique asset classes. By tapping into niche markets, they attract investors interested in alternative investments with growth potential linked to tangible assets.

Key Terms

Collectibles investment platforms:

Collectibles investment platforms offer unique opportunities to invest in rare items such as art, vintage toys, and rare coins, leveraging the growing market demand for tangible assets with appreciating value. These platforms provide access to fractional ownership, secure storage, and expert authentication, minimizing risks associated with counterfeit products while maximizing potential returns. Explore our detailed insights to understand how collectibles investment platforms can diversify and enhance your investment portfolio.

Authentication

Collectibles investment platforms prioritize rigorous authentication processes using expert appraisals, blockchain technology, and provenance verification to ensure the genuineness of rare items like art, coins, and memorabilia. Livestock investment platforms authenticate assets through veterinary health certifications, breed verification documents, and real-time tracking technologies such as RFID to guarantee the quality and pedigree of animals. Explore the critical authentication methods that distinguish these investment sectors to make informed decisions.

Fractional ownership

Fractional ownership in collectibles investment platforms enables investors to buy shares in rare assets like art, vintage cars, or sports memorabilia, allowing access to high-value markets with lower capital. Livestock investment platforms leverage fractional ownership by offering stakes in cattle, dairy cows, or other farm animals, providing diversification with tangible, income-generating assets linked to agriculture. Explore how fractional ownership transforms asset accessibility and portfolio diversification by learning more about each platform's unique features.

Source and External Links

Collectable - A platform offering investments in sports memorabilia and trading cards, with options for fractional share ownership and a secondary market for trading.

Rally - Allows investors to buy and sell equity shares in diverse collectibles such as classic cars, luxury watches, and comic books.

Timeless - Offers fractional ownership of unique collectibles, with a focus on exclusive assets and a trading platform for investors.

dowidth.com

dowidth.com