Collectibles investment involves assets like art, rare coins, and vintage items that often appreciate based on rarity and demand, while precious metals investment focuses on tangible commodities like gold and silver known for their intrinsic value and market liquidity. Both strategies offer portfolio diversification and act as hedges against inflation, yet collectibles can carry higher volatility compared to the historically stable precious metals market. Explore the unique benefits and risks of each investment type to determine the best fit for your financial goals.

Why it is important

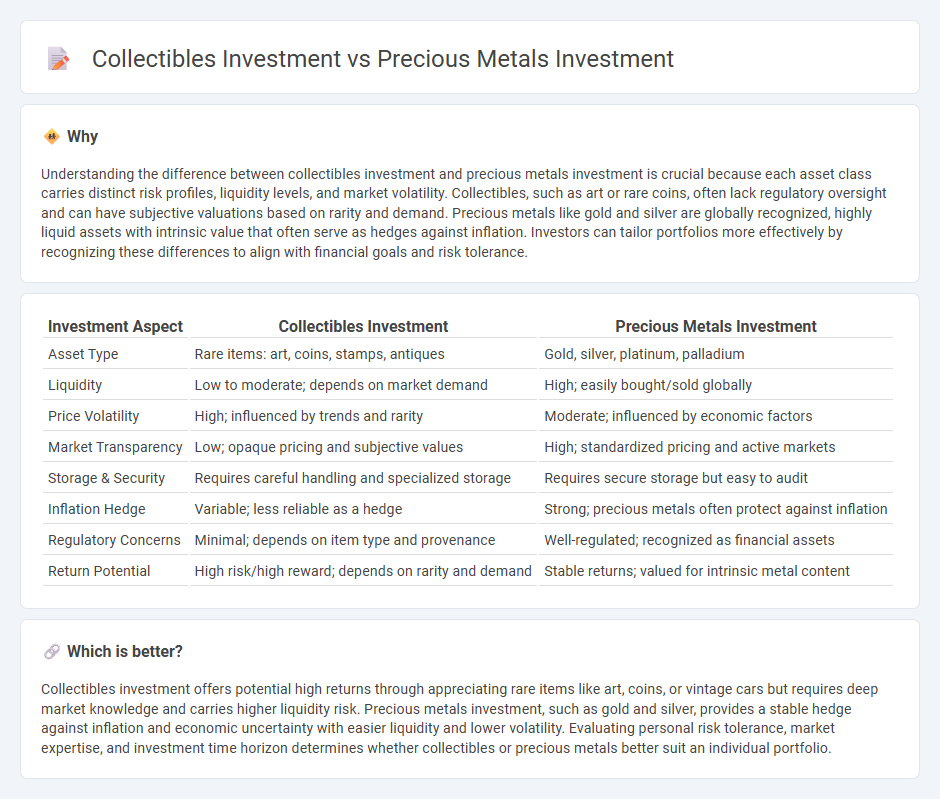

Understanding the difference between collectibles investment and precious metals investment is crucial because each asset class carries distinct risk profiles, liquidity levels, and market volatility. Collectibles, such as art or rare coins, often lack regulatory oversight and can have subjective valuations based on rarity and demand. Precious metals like gold and silver are globally recognized, highly liquid assets with intrinsic value that often serve as hedges against inflation. Investors can tailor portfolios more effectively by recognizing these differences to align with financial goals and risk tolerance.

Comparison Table

| Investment Aspect | Collectibles Investment | Precious Metals Investment |

|---|---|---|

| Asset Type | Rare items: art, coins, stamps, antiques | Gold, silver, platinum, palladium |

| Liquidity | Low to moderate; depends on market demand | High; easily bought/sold globally |

| Price Volatility | High; influenced by trends and rarity | Moderate; influenced by economic factors |

| Market Transparency | Low; opaque pricing and subjective values | High; standardized pricing and active markets |

| Storage & Security | Requires careful handling and specialized storage | Requires secure storage but easy to audit |

| Inflation Hedge | Variable; less reliable as a hedge | Strong; precious metals often protect against inflation |

| Regulatory Concerns | Minimal; depends on item type and provenance | Well-regulated; recognized as financial assets |

| Return Potential | High risk/high reward; depends on rarity and demand | Stable returns; valued for intrinsic metal content |

Which is better?

Collectibles investment offers potential high returns through appreciating rare items like art, coins, or vintage cars but requires deep market knowledge and carries higher liquidity risk. Precious metals investment, such as gold and silver, provides a stable hedge against inflation and economic uncertainty with easier liquidity and lower volatility. Evaluating personal risk tolerance, market expertise, and investment time horizon determines whether collectibles or precious metals better suit an individual portfolio.

Connection

Collectibles investment and precious metals investment both serve as alternative assets that diversify portfolios and hedge against inflation and economic uncertainty. Both asset classes hold intrinsic value and can appreciate over time based on rarity, demand, and market conditions. Investors often combine these investments to balance risk and capitalize on the tangible nature of physical assets.

Key Terms

**Precious Metals Investment:**

Precious metals investment primarily involves acquiring assets such as gold, silver, platinum, and palladium, which serve as hedges against inflation and currency fluctuations. These metals are traded on global markets with prices influenced by factors like industrial demand, geopolitical stability, and central bank reserves. Explore the advantages and strategies of investing in precious metals to safeguard and diversify your portfolio.

Spot Price

Spot price is a critical factor in precious metals investment, directly reflecting current market value for gold, silver, platinum, and palladium, enabling investors to buy and sell based on real-time fluctuations. Collectibles investment relies less on spot price and more on rarity, provenance, and demand, which can cause valuations to deviate significantly from metal content value. Explore detailed strategies to understand how spot price impacts precious metals investments versus collectibles for optimized portfolio management.

Bullion

Bullion investment involves purchasing precious metals like gold, silver, platinum, or palladium in the form of bars or coins, valued primarily by weight and purity. Unlike collectibles, bullion offers high liquidity, standardized pricing, and intrinsic metal content, making it a preferred choice for wealth preservation during market volatility. Explore more to understand how bullion can diversify and safeguard your investment portfolio.

Source and External Links

Investing in Precious Metals: A Guide for Beginners - Money - Common precious metals to invest in include gold, silver, palladium, and platinum, and investment options range from physical bullion (coins, bars) to stocks of mining companies and mutual funds.

Seven things to consider when investing in precious metals - TD Bank - Precious metals help diversify portfolios by being less correlated to stocks and bonds, with investment methods including physical metals, futures contracts, and storage considerations.

Investor Advisory: Precious Metals and Coin Investments - Mutual funds and exchange-traded products (ETPs) offer lower-risk exposure to precious metals and mining companies, though they come with fees and tax considerations.

dowidth.com

dowidth.com