Farmland crowdfunding offers investors tangible asset-backed opportunities with potential steady returns tied to agricultural productivity, contrasting sharply with the high volatility and speculative nature of cryptocurrency investing. While farmland investments provide long-term value through land appreciation and crop yields, cryptocurrencies deliver rapid market fluctuations driven by digital asset demand and blockchain innovation. Explore the distinct benefits and risks of each investment to determine the best fit for your portfolio.

Why it is important

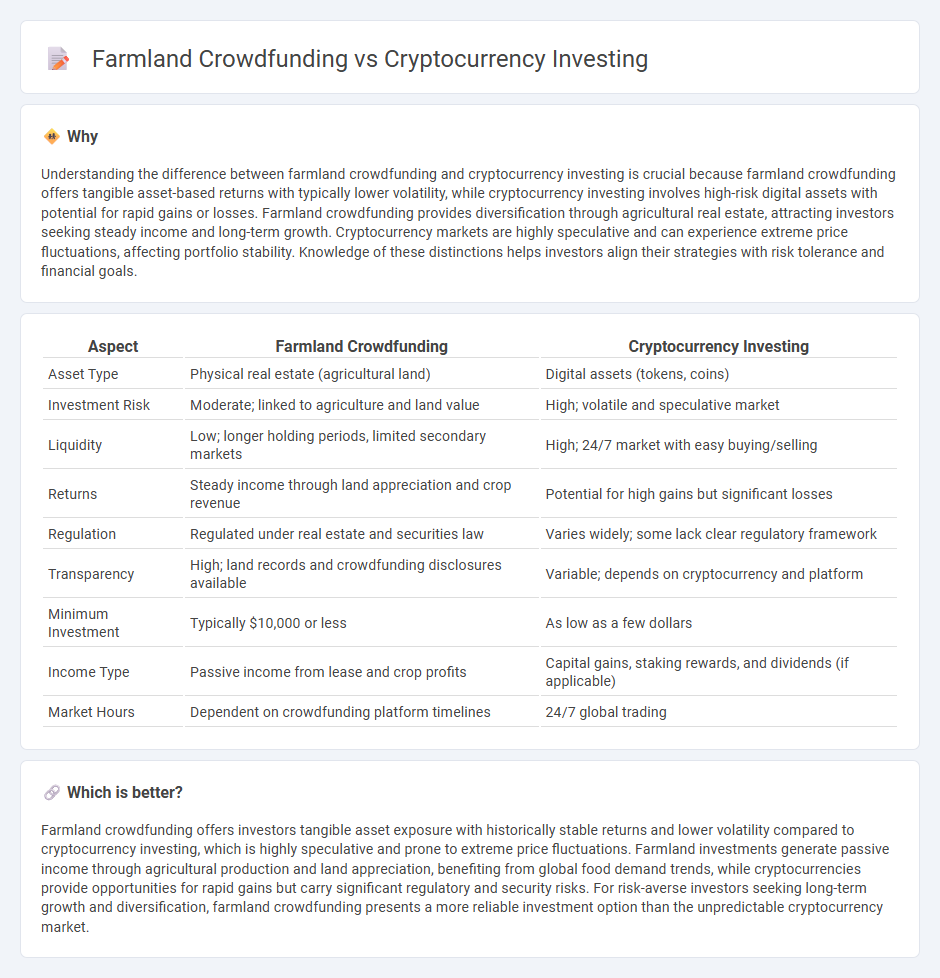

Understanding the difference between farmland crowdfunding and cryptocurrency investing is crucial because farmland crowdfunding offers tangible asset-based returns with typically lower volatility, while cryptocurrency investing involves high-risk digital assets with potential for rapid gains or losses. Farmland crowdfunding provides diversification through agricultural real estate, attracting investors seeking steady income and long-term growth. Cryptocurrency markets are highly speculative and can experience extreme price fluctuations, affecting portfolio stability. Knowledge of these distinctions helps investors align their strategies with risk tolerance and financial goals.

Comparison Table

| Aspect | Farmland Crowdfunding | Cryptocurrency Investing |

|---|---|---|

| Asset Type | Physical real estate (agricultural land) | Digital assets (tokens, coins) |

| Investment Risk | Moderate; linked to agriculture and land value | High; volatile and speculative market |

| Liquidity | Low; longer holding periods, limited secondary markets | High; 24/7 market with easy buying/selling |

| Returns | Steady income through land appreciation and crop revenue | Potential for high gains but significant losses |

| Regulation | Regulated under real estate and securities law | Varies widely; some lack clear regulatory framework |

| Transparency | High; land records and crowdfunding disclosures available | Variable; depends on cryptocurrency and platform |

| Minimum Investment | Typically $10,000 or less | As low as a few dollars |

| Income Type | Passive income from lease and crop profits | Capital gains, staking rewards, and dividends (if applicable) |

| Market Hours | Dependent on crowdfunding platform timelines | 24/7 global trading |

Which is better?

Farmland crowdfunding offers investors tangible asset exposure with historically stable returns and lower volatility compared to cryptocurrency investing, which is highly speculative and prone to extreme price fluctuations. Farmland investments generate passive income through agricultural production and land appreciation, benefiting from global food demand trends, while cryptocurrencies provide opportunities for rapid gains but carry significant regulatory and security risks. For risk-averse investors seeking long-term growth and diversification, farmland crowdfunding presents a more reliable investment option than the unpredictable cryptocurrency market.

Connection

Farmland crowdfunding and cryptocurrency investing intersect through blockchain technology, which enhances transparency and security in both sectors. Blockchain enables fractional ownership and real-time trading of farmland shares, similar to how cryptocurrencies are traded, attracting a broader range of investors. This convergence creates innovative investment opportunities by combining tangible assets with decentralized digital finance.

Key Terms

Volatility

Cryptocurrency investing exhibits high volatility with price swings often exceeding 10% daily, driven by market speculation and regulatory news. Farmland crowdfunding offers lower volatility, typically providing steady returns through agricultural land value appreciation and crop yield stability. Discover how these contrasting volatility profiles impact your investment strategy.

Liquidity

Cryptocurrency investing offers high liquidity with the ability to buy or sell assets on global exchanges 24/7, enabling near-instant access to funds. Farmland crowdfunding typically involves longer lock-in periods and limited secondary market options, resulting in lower liquidity and less flexibility for investors. Explore the nuances of liquidity in these investment models to make informed decisions tailored to your financial goals.

Tangible Assets

Cryptocurrency investing involves digital assets with high volatility and speculative potential, whereas farmland crowdfunding offers tangible asset ownership in agricultural land, providing steady income through crop yields and land appreciation. Farmland investments benefit from physical asset security and a hedge against inflation, contrasting with the digital nature and regulatory uncertainties of cryptocurrencies. Explore the advantages and risks of both asset classes to make informed investment decisions.

Source and External Links

How Does Cryptocurrency Work? A Beginner's Guide - Coursera - Cryptocurrency investing can involve short-term trading, where you buy and sell based on market trends, or long-term holding, where you benefit from potential long-term appreciation despite volatility.

What is Cryptocurrency and How Does it Work? - Kaspersky - Cryptocurrency investing is highly speculative and volatile, so it's crucial to research exchanges, diversify your holdings, choose secure storage, and prepare for significant price swings.

Cryptocurrency Investments: ETFs, Stocks & Futures | E*TRADE - You can invest in cryptocurrencies indirectly through ETFs, coin trusts, futures, and stocks tied to the crypto industry, gaining exposure without directly owning or storing digital currency.

dowidth.com

dowidth.com