Sports card fractionalization offers collectors the opportunity to own shares of valuable memorabilia, enabling diversified investment in rare trading cards with potential for significant appreciation. Music royalties fractional investment allows investors to earn passive income by purchasing rights to future royalty streams from popular songs and artists, providing steady cash flow linked to music consumption. Discover how these unique fractional investment avenues can diversify your portfolio and enhance financial growth strategies.

Why it is important

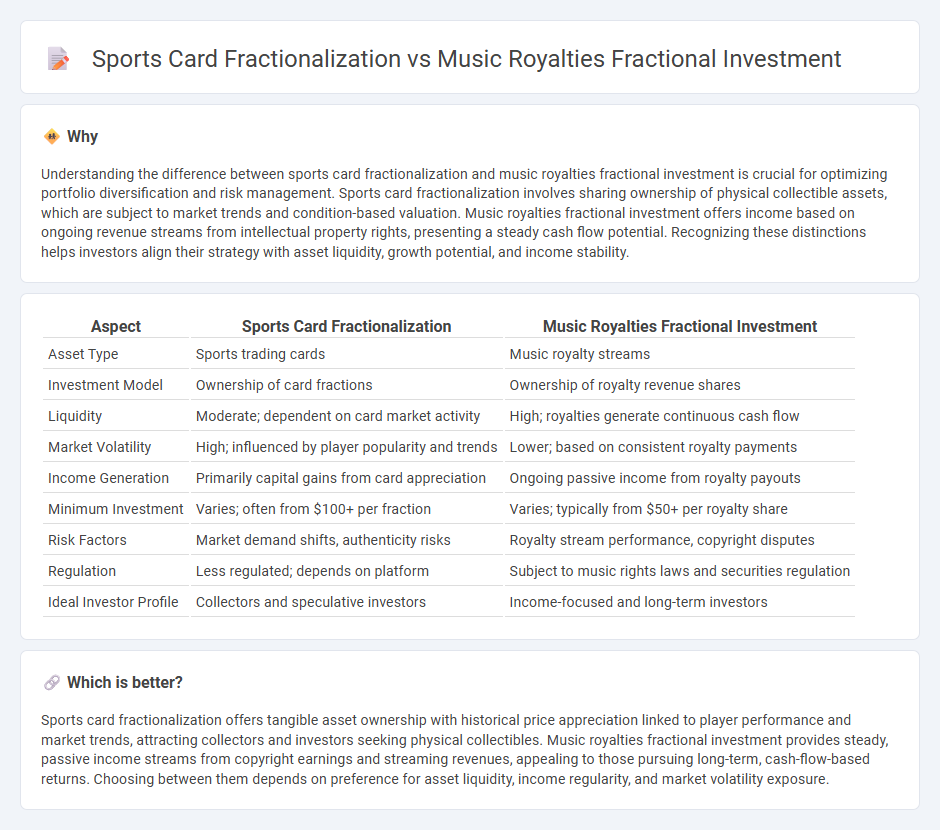

Understanding the difference between sports card fractionalization and music royalties fractional investment is crucial for optimizing portfolio diversification and risk management. Sports card fractionalization involves sharing ownership of physical collectible assets, which are subject to market trends and condition-based valuation. Music royalties fractional investment offers income based on ongoing revenue streams from intellectual property rights, presenting a steady cash flow potential. Recognizing these distinctions helps investors align their strategy with asset liquidity, growth potential, and income stability.

Comparison Table

| Aspect | Sports Card Fractionalization | Music Royalties Fractional Investment |

|---|---|---|

| Asset Type | Sports trading cards | Music royalty streams |

| Investment Model | Ownership of card fractions | Ownership of royalty revenue shares |

| Liquidity | Moderate; dependent on card market activity | High; royalties generate continuous cash flow |

| Market Volatility | High; influenced by player popularity and trends | Lower; based on consistent royalty payments |

| Income Generation | Primarily capital gains from card appreciation | Ongoing passive income from royalty payouts |

| Minimum Investment | Varies; often from $100+ per fraction | Varies; typically from $50+ per royalty share |

| Risk Factors | Market demand shifts, authenticity risks | Royalty stream performance, copyright disputes |

| Regulation | Less regulated; depends on platform | Subject to music rights laws and securities regulation |

| Ideal Investor Profile | Collectors and speculative investors | Income-focused and long-term investors |

Which is better?

Sports card fractionalization offers tangible asset ownership with historical price appreciation linked to player performance and market trends, attracting collectors and investors seeking physical collectibles. Music royalties fractional investment provides steady, passive income streams from copyright earnings and streaming revenues, appealing to those pursuing long-term, cash-flow-based returns. Choosing between them depends on preference for asset liquidity, income regularity, and market volatility exposure.

Connection

Sports card fractionalization and music royalties fractional investment both leverage blockchain technology to democratize access to traditionally exclusive asset classes. By dividing high-value sports cards and royalty rights into fractional shares, investors can buy and trade smaller portions, increasing liquidity and market participation. This fractional ownership model enhances portfolio diversification and enables retail investors to benefit from alternative investments that were previously limited to high-net-worth individuals.

Key Terms

**Music royalties fractional investment:**

Music royalties fractional investment allows multiple investors to own shares in future earnings from songs, providing a unique revenue stream backed by intellectual property rights. This model leverages blockchain technology and smart contracts for transparent distribution and secure ownership tracking, attracting diverse investors seeking passive income. Explore how fractional investment in music royalties can diversify your portfolio and generate consistent returns.

Royalty streams

Music royalties fractional investment allows investors to purchase a portion of future revenue generated from song plays, licensing, and performances, granting steady cash flow linked to popular tracks. Sports card fractionalization involves dividing ownership of valuable collectible cards into shares, providing access to asset appreciation without direct revenue streams like royalties. Explore deeper insights into how royalty streams uniquely position music investments compared to sports card fractional ownership.

Copyright ownership

Music royalties fractional investment often involves acquiring a percentage of copyright ownership, entitling investors to a share of future royalty payments and licensing revenues. Sports card fractionalization, however, typically entails shared physical asset ownership without direct copyright rights, focusing instead on collectible value appreciation. Explore the nuances of copyright ownership differences and investment opportunities in both domains.

Source and External Links

Royalty Shares - Unchained Music - Fractionalized royalties let artists divide ownership of songs or catalogs into tradable shares, allowing fans and investors to earn money from the music's success while providing artists upfront revenue and reinvestment opportunities through transparent, vetted partnerships.

Royalty Shares: A Guide for Independent Artists - Xposure Music - Fractional ownership enables artists to sell a percentage of future royalties for immediate cash while retaining creative control, facilitated by platforms connecting artists to investors and fans with flexible agreements on royalty share terms.

Top 6 Music Royalty Investment Strategies for 2025 - Royalty Exchange - Investors can buy partial music rights via platforms like Royalty Exchange for affordable entry, benefiting from diversification and liquidity options with reported returns averaging over 10%, making fractional royalty investments an accessible, transparent asset class.

dowidth.com

dowidth.com