Whiskey barrel investment offers unique advantages such as tangible asset appreciation and limited supply, often yielding higher returns compared to volatile precious metals like gold and silver. Unlike precious metals, whiskey barrels mature over time, increasing in value while also benefiting from the growing global demand for rare spirits. Explore the distinct benefits and risks of whiskey barrel versus precious metals investment to make informed financial decisions.

Why it is important

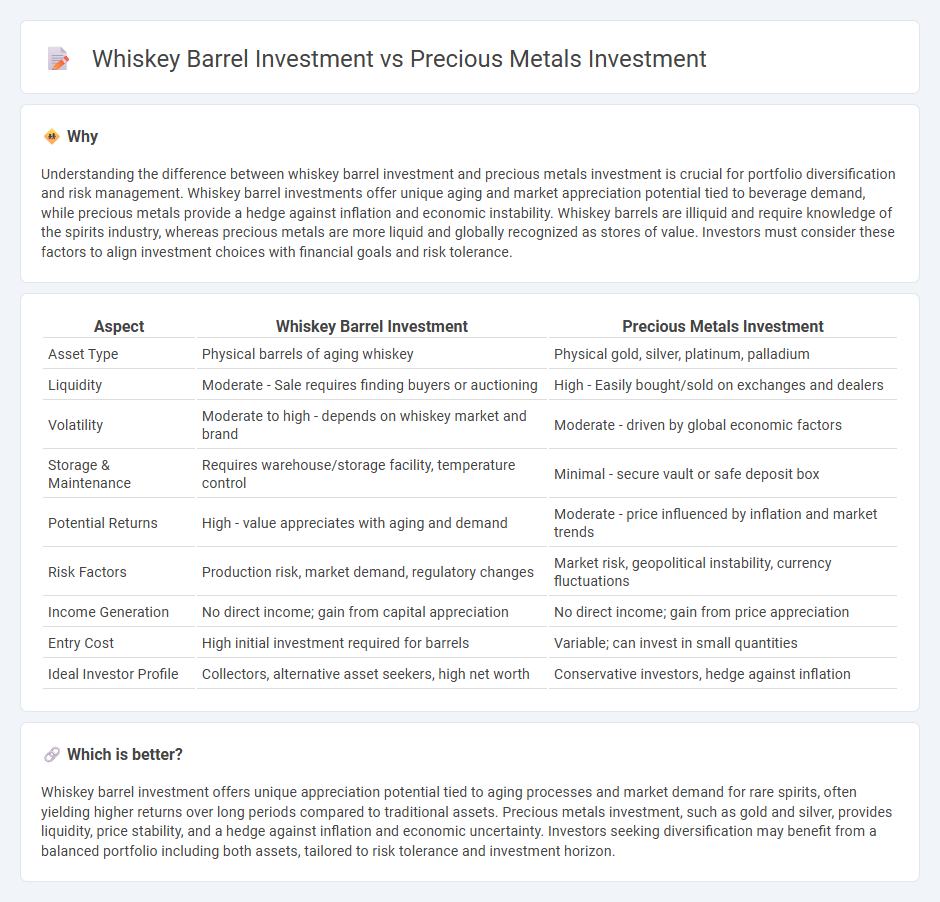

Understanding the difference between whiskey barrel investment and precious metals investment is crucial for portfolio diversification and risk management. Whiskey barrel investments offer unique aging and market appreciation potential tied to beverage demand, while precious metals provide a hedge against inflation and economic instability. Whiskey barrels are illiquid and require knowledge of the spirits industry, whereas precious metals are more liquid and globally recognized as stores of value. Investors must consider these factors to align investment choices with financial goals and risk tolerance.

Comparison Table

| Aspect | Whiskey Barrel Investment | Precious Metals Investment |

|---|---|---|

| Asset Type | Physical barrels of aging whiskey | Physical gold, silver, platinum, palladium |

| Liquidity | Moderate - Sale requires finding buyers or auctioning | High - Easily bought/sold on exchanges and dealers |

| Volatility | Moderate to high - depends on whiskey market and brand | Moderate - driven by global economic factors |

| Storage & Maintenance | Requires warehouse/storage facility, temperature control | Minimal - secure vault or safe deposit box |

| Potential Returns | High - value appreciates with aging and demand | Moderate - price influenced by inflation and market trends |

| Risk Factors | Production risk, market demand, regulatory changes | Market risk, geopolitical instability, currency fluctuations |

| Income Generation | No direct income; gain from capital appreciation | No direct income; gain from price appreciation |

| Entry Cost | High initial investment required for barrels | Variable; can invest in small quantities |

| Ideal Investor Profile | Collectors, alternative asset seekers, high net worth | Conservative investors, hedge against inflation |

Which is better?

Whiskey barrel investment offers unique appreciation potential tied to aging processes and market demand for rare spirits, often yielding higher returns over long periods compared to traditional assets. Precious metals investment, such as gold and silver, provides liquidity, price stability, and a hedge against inflation and economic uncertainty. Investors seeking diversification may benefit from a balanced portfolio including both assets, tailored to risk tolerance and investment horizon.

Connection

Whiskey barrel investment and precious metals investment share a common strategy of asset diversification, offering protection against inflation and economic instability. Both types of investments involve tangible assets with intrinsic value that can appreciate over time due to rarity, demand, and limited supply. Investors leverage the resilience of whiskey casks and precious metals like gold and silver to balance portfolio risk and preserve wealth during market volatility.

Key Terms

**Precious Metals Investment:**

Precious metals investment offers a tangible hedge against inflation and economic uncertainty by holding assets such as gold, silver, platinum, and palladium, which have intrinsic value recognized globally. These metals provide liquidity, portfolio diversification, and a long-term store of value with established markets and regulatory frameworks. Explore the benefits and strategies of precious metals investment to secure your financial future.

Spot Price

Precious metals investment, particularly in gold and silver, is directly influenced by spot prices, which reflect current market values and ensure liquidity and transparency. Whiskey barrel investment, however, is driven more by factors such as brand reputation, aging quality, and rarity, leading to price appreciation that doesn't correlate with spot market prices. Explore the nuances between these asset classes to optimize your diversified investment portfolio.

Purity

Precious metals investment emphasizes purity, with gold and silver typically ranked by their fineness, such as 99.99% pure gold (24 karats) offering reliability, liquidity, and long-term value retention. Whiskey barrel investments focus on the quality and age of the spirit, where purity relates to the craftsmanship, aging process, and absence of contaminants, impacting flavor and market price. Explore how purity differentiates these asset classes and influences investment returns for more detailed insights.

Source and External Links

Investing in Precious Metals: A Guide for Beginners - Money - Precious metals such as gold, silver, palladium, and platinum can be invested in physically as bullion (coins, bars, ingots) or through mining stocks and mutual funds, with each method offering different levels of exposure and risks.

Seven things to consider when investing in precious metals - TD Bank - Investing in gold, silver, and platinum diversifies portfolios with assets uncorrelated to stocks and bonds, through physical purchases, futures contracts, or secure storage solutions to manage risks like theft and liquidity.

Investor Advisory: Precious Metals and Coin Investments - Mutual funds and exchange-traded products (ETPs) provide a lower-risk means to gain precious metals exposure, investing in physical metals, mining companies, or commodity futures with varying fees and tax consequences.

dowidth.com

dowidth.com