Carbon credits trading enables investors to purchase and sell carbon emission allowances, creating a market-driven approach to environmental impact reduction. Community Development Financial Institutions (CDFIs) focus on providing financial services to underserved communities, fostering local economic growth and social equity. Explore how these investment strategies differ in risk, return, and social impact to make informed decisions.

Why it is important

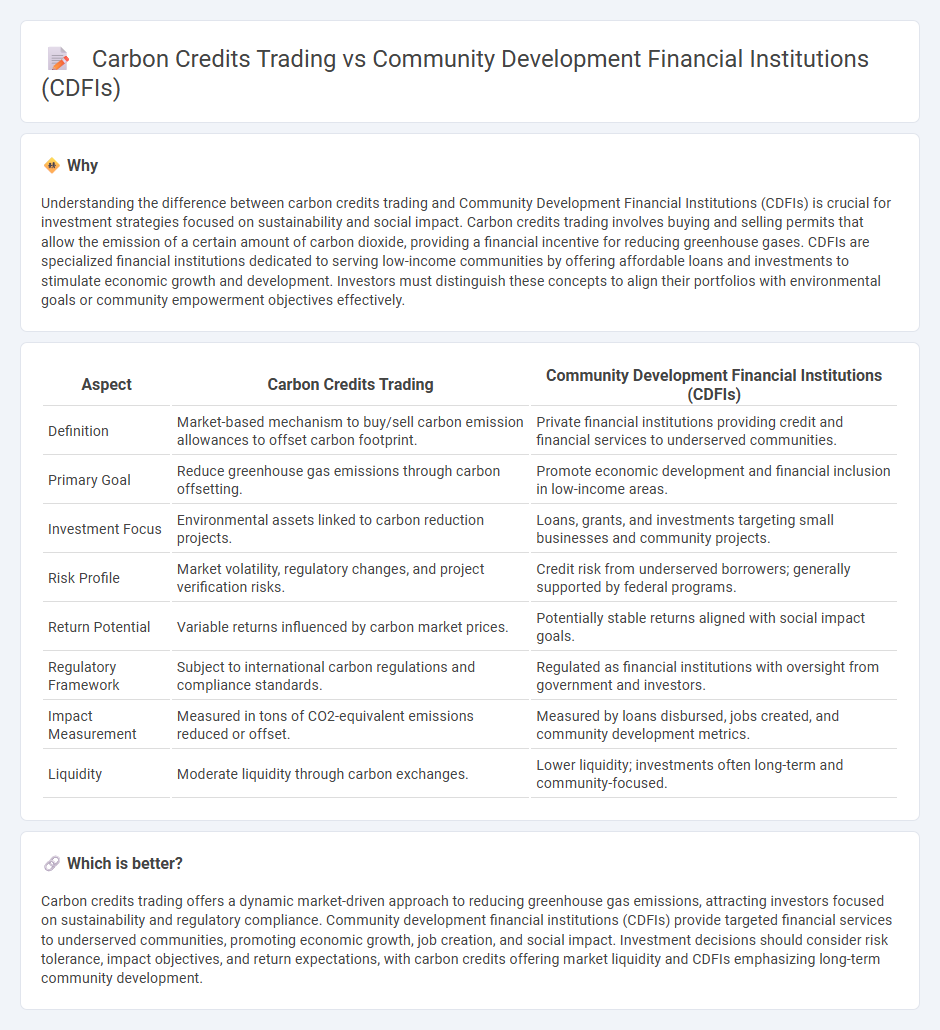

Understanding the difference between carbon credits trading and Community Development Financial Institutions (CDFIs) is crucial for investment strategies focused on sustainability and social impact. Carbon credits trading involves buying and selling permits that allow the emission of a certain amount of carbon dioxide, providing a financial incentive for reducing greenhouse gases. CDFIs are specialized financial institutions dedicated to serving low-income communities by offering affordable loans and investments to stimulate economic growth and development. Investors must distinguish these concepts to align their portfolios with environmental goals or community empowerment objectives effectively.

Comparison Table

| Aspect | Carbon Credits Trading | Community Development Financial Institutions (CDFIs) |

|---|---|---|

| Definition | Market-based mechanism to buy/sell carbon emission allowances to offset carbon footprint. | Private financial institutions providing credit and financial services to underserved communities. |

| Primary Goal | Reduce greenhouse gas emissions through carbon offsetting. | Promote economic development and financial inclusion in low-income areas. |

| Investment Focus | Environmental assets linked to carbon reduction projects. | Loans, grants, and investments targeting small businesses and community projects. |

| Risk Profile | Market volatility, regulatory changes, and project verification risks. | Credit risk from underserved borrowers; generally supported by federal programs. |

| Return Potential | Variable returns influenced by carbon market prices. | Potentially stable returns aligned with social impact goals. |

| Regulatory Framework | Subject to international carbon regulations and compliance standards. | Regulated as financial institutions with oversight from government and investors. |

| Impact Measurement | Measured in tons of CO2-equivalent emissions reduced or offset. | Measured by loans disbursed, jobs created, and community development metrics. |

| Liquidity | Moderate liquidity through carbon exchanges. | Lower liquidity; investments often long-term and community-focused. |

Which is better?

Carbon credits trading offers a dynamic market-driven approach to reducing greenhouse gas emissions, attracting investors focused on sustainability and regulatory compliance. Community development financial institutions (CDFIs) provide targeted financial services to underserved communities, promoting economic growth, job creation, and social impact. Investment decisions should consider risk tolerance, impact objectives, and return expectations, with carbon credits offering market liquidity and CDFIs emphasizing long-term community development.

Connection

Carbon credits trading supports environmental sustainability by enabling businesses to offset their carbon emissions through verified projects, many of which receive funding from Community Development Financial Institutions (CDFIs). CDFIs provide crucial capital to local organizations and green enterprises that generate carbon credits, promoting economic growth while addressing climate change. This connection fosters a dual impact investment, combining environmental benefits with social and community development goals.

Key Terms

Social Impact

Community Development Financial Institutions (CDFIs) prioritize social impact by providing affordable financing and support to underserved communities, fostering economic growth and reducing inequality. Carbon credits trading primarily addresses environmental sustainability by incentivizing emissions reductions but may lack direct social benefits for local communities. Explore how combining CDFIs' social focus with carbon trading mechanisms can enhance holistic community and environmental outcomes.

Emissions Reduction

Community Development Financial Institutions (CDFIs) specialize in providing financial services and investments to underserved communities, fostering economic growth while supporting sustainable projects that contribute to emissions reduction. Carbon credits trading involves the buying and selling of permits that allow companies to emit a certain amount of greenhouse gases, directly incentivizing the reduction of carbon footprints through market mechanisms. Explore how these distinct approaches complement each other in achieving impactful emissions reduction strategies.

Regulatory Compliance

Community Development Financial Institutions (CDFIs) operate under rigorous regulatory frameworks established by the U.S. Department of the Treasury, ensuring compliance with banking laws and standards focused on economic development and underserved communities. Carbon credits trading adheres to market regulations such as those outlined by the Clean Development Mechanism under the Kyoto Protocol and regional entities like the EU Emissions Trading System, emphasizing transparency, verification, and environmental claim integrity. Explore the evolving compliance landscapes of CDFIs and carbon credits trading to understand their distinct regulatory challenges and opportunities.

Source and External Links

Community development financial institution - Wikipedia - Community Development Financial Institutions (CDFIs) are certified financial institutions that provide credit and financial services to underserved markets and populations, including community development banks, credit unions, loan funds, and venture capital funds, primarily in the USA, aimed at community development and accountability to their local communities.

What is a CDFI? - OFN - Opportunity Finance Network - CDFIs are specialized lenders focusing on providing fair and responsible financing to under-resourced rural, urban, and Native communities, offering financial education, business coaching, and affordable loans to support small businesses, homeownership, job creation, and community development.

Community Development Financial Institutions Fund: Home - The CDFI Fund, part of the U.S. Department of the Treasury, certifies and supports CDFIs by investing federal and private capital to empower economically distressed communities, fostering sustainable economic growth and opportunity through market-based finance.

dowidth.com

dowidth.com