Whale watching shares represent a niche market investment attracting eco-conscious investors seeking exposure to sustainable tourism, often characterized by higher volatility and growth potential. Blue-chip stocks, conversely, are shares of well-established companies with stable earnings, reliable dividends, and a proven track record, appealing to risk-averse investors seeking long-term wealth preservation. Explore the comparative benefits and risks of whale watching shares versus blue-chip stocks to tailor your investment portfolio effectively.

Why it is important

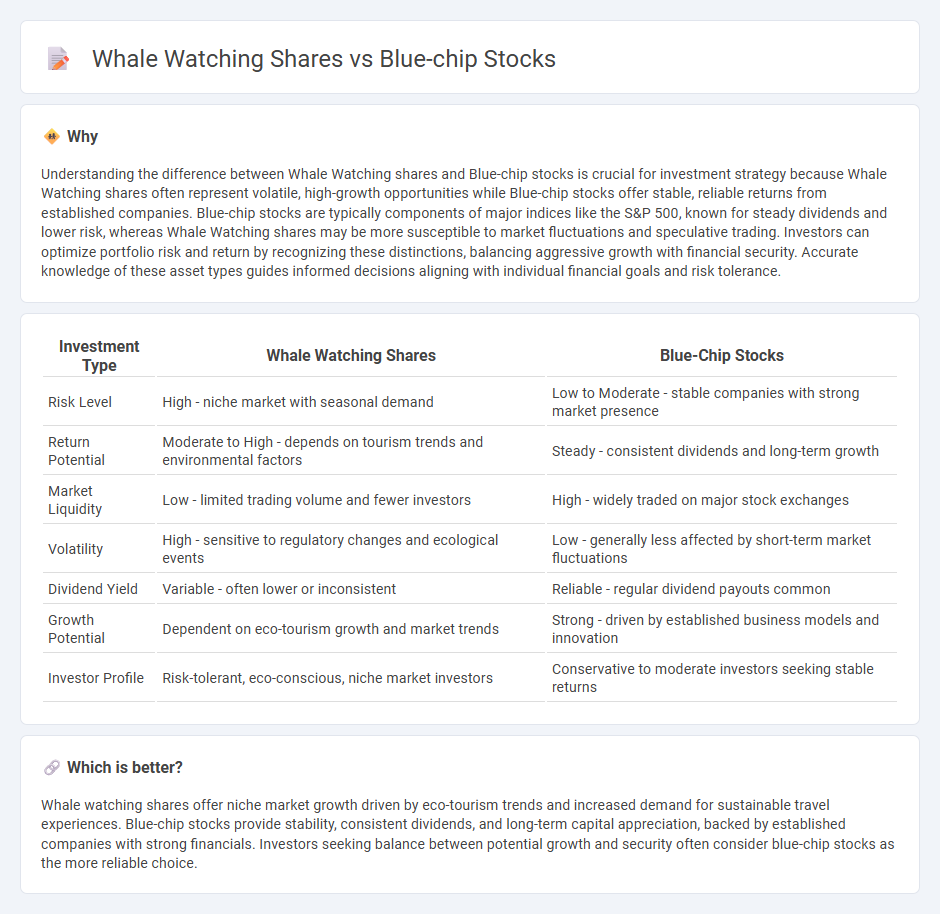

Understanding the difference between Whale Watching shares and Blue-chip stocks is crucial for investment strategy because Whale Watching shares often represent volatile, high-growth opportunities while Blue-chip stocks offer stable, reliable returns from established companies. Blue-chip stocks are typically components of major indices like the S&P 500, known for steady dividends and lower risk, whereas Whale Watching shares may be more susceptible to market fluctuations and speculative trading. Investors can optimize portfolio risk and return by recognizing these distinctions, balancing aggressive growth with financial security. Accurate knowledge of these asset types guides informed decisions aligning with individual financial goals and risk tolerance.

Comparison Table

| Investment Type | Whale Watching Shares | Blue-Chip Stocks |

|---|---|---|

| Risk Level | High - niche market with seasonal demand | Low to Moderate - stable companies with strong market presence |

| Return Potential | Moderate to High - depends on tourism trends and environmental factors | Steady - consistent dividends and long-term growth |

| Market Liquidity | Low - limited trading volume and fewer investors | High - widely traded on major stock exchanges |

| Volatility | High - sensitive to regulatory changes and ecological events | Low - generally less affected by short-term market fluctuations |

| Dividend Yield | Variable - often lower or inconsistent | Reliable - regular dividend payouts common |

| Growth Potential | Dependent on eco-tourism growth and market trends | Strong - driven by established business models and innovation |

| Investor Profile | Risk-tolerant, eco-conscious, niche market investors | Conservative to moderate investors seeking stable returns |

Which is better?

Whale watching shares offer niche market growth driven by eco-tourism trends and increased demand for sustainable travel experiences. Blue-chip stocks provide stability, consistent dividends, and long-term capital appreciation, backed by established companies with strong financials. Investors seeking balance between potential growth and security often consider blue-chip stocks as the more reliable choice.

Connection

Whale watching shares represent a niche tourism investment with potential for growth linked to environmental trends and eco-conscious consumer behavior, attracting investors seeking sustainable opportunities. Blue-chip stocks, known for their stability and strong market presence, often include companies that invest in or promote sustainable tourism and conservation initiatives, indirectly supporting sectors like whale watching. The connection lies in diversifying a portfolio by combining high-growth niche markets with stable, well-established stocks, balancing risk and tapping into evolving market demands.

Key Terms

Market Capitalization

Blue-chip stocks represent large, established companies with high market capitalization, offering stability and consistent returns, while whale watching shares typically belong to smaller, niche companies with lower market capitalization and higher volatility. Investors prioritize blue-chip stocks for long-term growth and reliability, whereas whale watching shares attract those seeking growth potential in specialized tourism sectors. Explore detailed comparisons and investment strategies to understand which aligns best with your financial goals.

Institutional Investors

Blue-chip stocks, characterized by established companies with reliable earnings and consistent dividends, attract institutional investors seeking stability and long-term growth. In contrast, whale watching shares represent niche market opportunities with potential high returns but greater volatility, appealing to investors willing to embrace sector-specific risks. Explore detailed insights comparing institutional strategies in blue-chip stocks and emerging niche investments for informed decisions.

Stock Volatility

Blue-chip stocks typically exhibit lower volatility, characterized by stable earnings and consistent dividend payouts, making them reliable for conservative investors. Whale watching shares, often emerging in niche tourism sectors, tend to show higher volatility due to seasonal demand fluctuations and regulatory changes affecting eco-tourism. Explore detailed analyses and historical data trends to understand the risk and reward profiles of these investment options.

Source and External Links

7 Best-Performing Blue-Chip Stocks for July 2025 - Blue-chip stocks come from well-known, established companies with large market capitalizations, strong growth history, often paying dividends, and are commonly part of major market indexes like the S&P 500 or Dow Jones Industrial Average.

Understanding blue-chip stocks: what they are and why you should care - These stocks represent shares in financially stable, reliable companies such as Microsoft, Berkshire Hathaway, Procter & Gamble, and Exxon Mobil, known for their consistent performance and often for paying dividends.

Blue chip (stock market) - The term "blue chip" for stocks originated from poker chips and refers to shares of companies with a national reputation for quality, reliability, and profitability through both good and bad economic times.

dowidth.com

dowidth.com