Spice trading, an age-old investment method, involves acquiring and selling rare spices with historical high demand and value fluctuations, offering predictable returns rooted in tangible assets. Crowdfunding channels capital from numerous investors into startups or projects, prioritizing innovation and high-growth potential with varying risk profiles. Explore the distinct benefits and risks of spice trading versus crowdfunding to identify which investment aligns best with your financial goals.

Why it is important

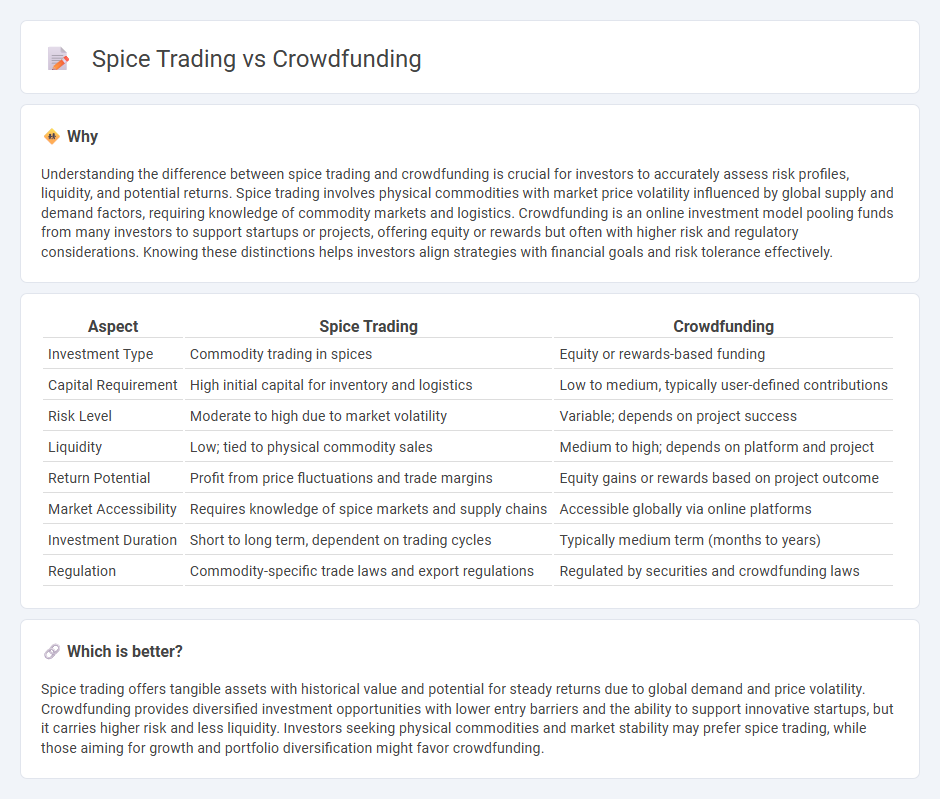

Understanding the difference between spice trading and crowdfunding is crucial for investors to accurately assess risk profiles, liquidity, and potential returns. Spice trading involves physical commodities with market price volatility influenced by global supply and demand factors, requiring knowledge of commodity markets and logistics. Crowdfunding is an online investment model pooling funds from many investors to support startups or projects, offering equity or rewards but often with higher risk and regulatory considerations. Knowing these distinctions helps investors align strategies with financial goals and risk tolerance effectively.

Comparison Table

| Aspect | Spice Trading | Crowdfunding |

|---|---|---|

| Investment Type | Commodity trading in spices | Equity or rewards-based funding |

| Capital Requirement | High initial capital for inventory and logistics | Low to medium, typically user-defined contributions |

| Risk Level | Moderate to high due to market volatility | Variable; depends on project success |

| Liquidity | Low; tied to physical commodity sales | Medium to high; depends on platform and project |

| Return Potential | Profit from price fluctuations and trade margins | Equity gains or rewards based on project outcome |

| Market Accessibility | Requires knowledge of spice markets and supply chains | Accessible globally via online platforms |

| Investment Duration | Short to long term, dependent on trading cycles | Typically medium term (months to years) |

| Regulation | Commodity-specific trade laws and export regulations | Regulated by securities and crowdfunding laws |

Which is better?

Spice trading offers tangible assets with historical value and potential for steady returns due to global demand and price volatility. Crowdfunding provides diversified investment opportunities with lower entry barriers and the ability to support innovative startups, but it carries higher risk and less liquidity. Investors seeking physical commodities and market stability may prefer spice trading, while those aiming for growth and portfolio diversification might favor crowdfunding.

Connection

Spice trading, historically one of the earliest global investment ventures, paved the way for today's innovative crowdfunding platforms by demonstrating the potential of pooled resources to finance high-risk opportunities. Crowdfunding leverages collective investment, much like spice trade caravans combined capital from various merchants to fund long-distance voyages and distribution networks. Both models exemplify decentralized investment strategies that reduce individual risk while enabling access to lucrative, often uncharted, markets.

Key Terms

Platform

Crowdfunding platforms like Kickstarter prioritize user-friendly interfaces, secure payment processing, and community engagement tools to attract diverse project creators and backers. In contrast, spice trading platforms emphasize real-time market data, quality verification systems, and streamlined logistics management to support efficient commodity exchanges. Explore our detailed analysis to understand which platform suits your investment or trading needs best.

Returns

Crowdfunding offers diversified investment opportunities with potential returns ranging from 5% to 12% annually, driven by startups and real estate projects. Spice trading, a niche commodity market, can yield higher short-term profits due to market volatility but carries significant risks linked to supply chain disruptions and price fluctuations. Explore detailed comparisons to determine which investment strategy aligns best with your financial goals.

Risk

Crowdfunding carries risks such as project failure, fraud, or delays, impacting investor returns due to lack of regulatory oversight compared to traditional financial markets. Spice trading involves market volatility, quality concerns, and geopolitical factors influencing prices and supply chains in an often unregulated sector. Explore the detailed risk profiles and mitigation strategies of both to make informed investment decisions.

Source and External Links

Crowdfunding - Wikipedia - Crowdfunding is the practice of funding a project or venture by raising money online from a large number of people, involving a project initiator, supporters, and a platform to connect them.

What is crowdfunding? Here are four types to know - Stripe - Crowdfunding raises money through the collective effort of individuals via online platforms, allowing startups and projects to gain funding outside traditional financing methods.

Small Business Financing: A Resource Guide: Crowdfunding - Library of Congress - Crowdfunding uses online platforms to collect small contributions from many people through donation, reward, equity-based, or peer-to-peer lending models for various purposes including business financing.

dowidth.com

dowidth.com