Regenerative agriculture investing focuses on enhancing soil health and ecosystem biodiversity through practices like cover cropping, rotational grazing, and minimal tillage, offering sustainable returns by restoring land productivity. Organic farmland investing centers on lands certified free from synthetic inputs, catering to the growing demand for organic produce and providing stable market growth driven by health-conscious consumers. Explore the distinct benefits and potential risks of both strategies to optimize your agricultural investment portfolio.

Why it is important

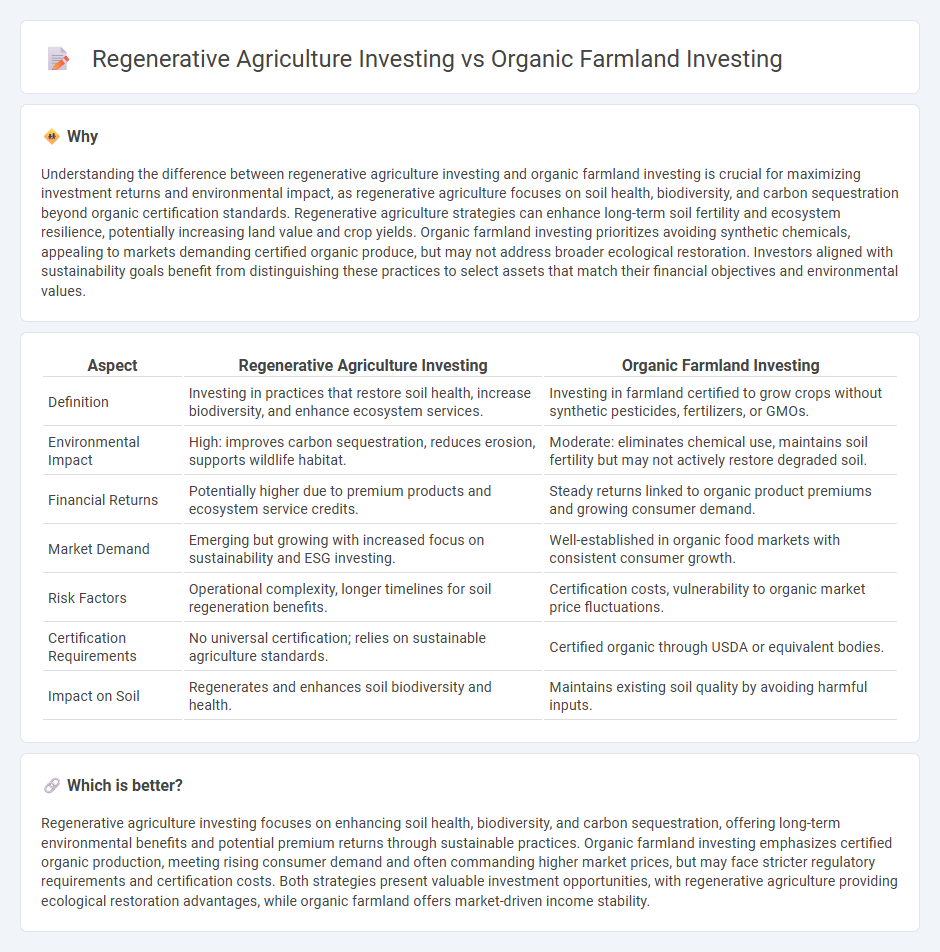

Understanding the difference between regenerative agriculture investing and organic farmland investing is crucial for maximizing investment returns and environmental impact, as regenerative agriculture focuses on soil health, biodiversity, and carbon sequestration beyond organic certification standards. Regenerative agriculture strategies can enhance long-term soil fertility and ecosystem resilience, potentially increasing land value and crop yields. Organic farmland investing prioritizes avoiding synthetic chemicals, appealing to markets demanding certified organic produce, but may not address broader ecological restoration. Investors aligned with sustainability goals benefit from distinguishing these practices to select assets that match their financial objectives and environmental values.

Comparison Table

| Aspect | Regenerative Agriculture Investing | Organic Farmland Investing |

|---|---|---|

| Definition | Investing in practices that restore soil health, increase biodiversity, and enhance ecosystem services. | Investing in farmland certified to grow crops without synthetic pesticides, fertilizers, or GMOs. |

| Environmental Impact | High: improves carbon sequestration, reduces erosion, supports wildlife habitat. | Moderate: eliminates chemical use, maintains soil fertility but may not actively restore degraded soil. |

| Financial Returns | Potentially higher due to premium products and ecosystem service credits. | Steady returns linked to organic product premiums and growing consumer demand. |

| Market Demand | Emerging but growing with increased focus on sustainability and ESG investing. | Well-established in organic food markets with consistent consumer growth. |

| Risk Factors | Operational complexity, longer timelines for soil regeneration benefits. | Certification costs, vulnerability to organic market price fluctuations. |

| Certification Requirements | No universal certification; relies on sustainable agriculture standards. | Certified organic through USDA or equivalent bodies. |

| Impact on Soil | Regenerates and enhances soil biodiversity and health. | Maintains existing soil quality by avoiding harmful inputs. |

Which is better?

Regenerative agriculture investing focuses on enhancing soil health, biodiversity, and carbon sequestration, offering long-term environmental benefits and potential premium returns through sustainable practices. Organic farmland investing emphasizes certified organic production, meeting rising consumer demand and often commanding higher market prices, but may face stricter regulatory requirements and certification costs. Both strategies present valuable investment opportunities, with regenerative agriculture providing ecological restoration advantages, while organic farmland offers market-driven income stability.

Connection

Regenerative agriculture investing and organic farmland investing share a focus on sustainable land management practices that enhance soil health, biodiversity, and carbon sequestration. Both investment strategies prioritize long-term environmental benefits alongside financial returns, attracting investors seeking impact-driven portfolios. Integrating regenerative techniques with organic certification standards strengthens resilience and promotes ecological balance, increasing the value and productivity of agricultural assets.

Key Terms

Certification Standards

Organic farmland investing relies heavily on certification standards such as USDA Organic or EU Organic to ensure compliance with strict regulations governing pesticide use, soil health, and biodiversity conservation. Regenerative agriculture investing often incorporates certifications like Regenerative Organic Certification (ROC) or Savory Institute's Land to Market program, emphasizing ecosystem restoration, carbon sequestration, and social fairness beyond organic requirements. Explore these certification standards in detail to understand how they impact investment strategies and sustainable agriculture outcomes.

Soil Health

Investing in organic farmland prioritizes the avoidance of synthetic chemicals to maintain soil fertility, emphasizing natural nutrient cycles and biodiversity. Regenerative agriculture investing goes further by actively enhancing soil health through practices like cover cropping, no-till farming, and carbon sequestration, which improve soil structure, increase organic matter, and boost ecosystem resilience. Explore more to understand how these investment strategies impact long-term soil vitality and agricultural sustainability.

Return on Investment (ROI)

Organic farmland investing typically offers steady returns through premium crop prices and sustainable practices that enhance soil health, reducing input costs over time. Regenerative agriculture investing often provides higher ROI potential by restoring ecosystems, increasing biodiversity, and improving long-term land productivity, attracting impact-conscious investors. Explore detailed comparisons of ROI metrics and environmental benefits to make informed investment decisions.

Source and External Links

Organic Farming: The Next Big Investment Opportunity - Nature's Path - Investing in organic farmland involves buying land and leasing it to farmers who transition it into organic production, with a focus on long-term land stewardship and lease agreements that allow farmers stability and potential ownership over time, supporting both profitability and sustainability.

Organic Farm Investments- Home - Organic farmland investing offers portfolio diversification by investing in tangible, eco-friendly assets with premium pricing potential, aiming for high returns while supporting safe and sustainable farming methods.

SLM Partners makes first investment in organic farming in USA - SLM Partners invests in organic farmland by acquiring properties, leasing them to expert organic farmers, and supporting the transition to certified organic production through long-term flexible leases focused on environmental benefits and soil regeneration.

dowidth.com

dowidth.com