Vintage luxury handbags funds offer a unique investment opportunity by capitalizing on the enduring demand and rarity of high-end designer bags from brands like Hermes and Chanel. Comic book funds, on the other hand, focus on acquiring valuable and rare editions from iconic series such as Marvel and DC, appealing to collectors and pop culture enthusiasts. Explore the distinct potential and market dynamics of these alternative asset classes to enhance your investment portfolio.

Why it is important

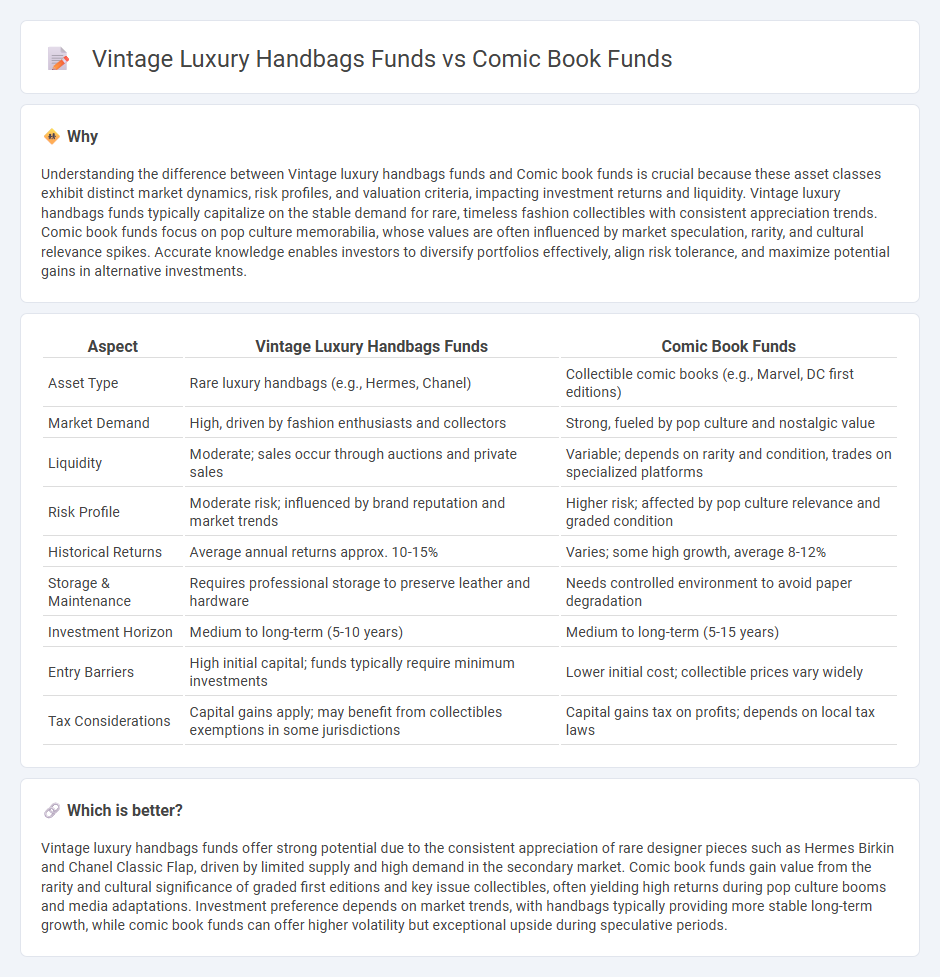

Understanding the difference between Vintage luxury handbags funds and Comic book funds is crucial because these asset classes exhibit distinct market dynamics, risk profiles, and valuation criteria, impacting investment returns and liquidity. Vintage luxury handbags funds typically capitalize on the stable demand for rare, timeless fashion collectibles with consistent appreciation trends. Comic book funds focus on pop culture memorabilia, whose values are often influenced by market speculation, rarity, and cultural relevance spikes. Accurate knowledge enables investors to diversify portfolios effectively, align risk tolerance, and maximize potential gains in alternative investments.

Comparison Table

| Aspect | Vintage Luxury Handbags Funds | Comic Book Funds |

|---|---|---|

| Asset Type | Rare luxury handbags (e.g., Hermes, Chanel) | Collectible comic books (e.g., Marvel, DC first editions) |

| Market Demand | High, driven by fashion enthusiasts and collectors | Strong, fueled by pop culture and nostalgic value |

| Liquidity | Moderate; sales occur through auctions and private sales | Variable; depends on rarity and condition, trades on specialized platforms |

| Risk Profile | Moderate risk; influenced by brand reputation and market trends | Higher risk; affected by pop culture relevance and graded condition |

| Historical Returns | Average annual returns approx. 10-15% | Varies; some high growth, average 8-12% |

| Storage & Maintenance | Requires professional storage to preserve leather and hardware | Needs controlled environment to avoid paper degradation |

| Investment Horizon | Medium to long-term (5-10 years) | Medium to long-term (5-15 years) |

| Entry Barriers | High initial capital; funds typically require minimum investments | Lower initial cost; collectible prices vary widely |

| Tax Considerations | Capital gains apply; may benefit from collectibles exemptions in some jurisdictions | Capital gains tax on profits; depends on local tax laws |

Which is better?

Vintage luxury handbags funds offer strong potential due to the consistent appreciation of rare designer pieces such as Hermes Birkin and Chanel Classic Flap, driven by limited supply and high demand in the secondary market. Comic book funds gain value from the rarity and cultural significance of graded first editions and key issue collectibles, often yielding high returns during pop culture booms and media adaptations. Investment preference depends on market trends, with handbags typically providing more stable long-term growth, while comic book funds can offer higher volatility but exceptional upside during speculative periods.

Connection

Vintage luxury handbag funds and comic book funds both capture value through scarcity and cultural significance, leveraging niche collectibles as alternative assets. These funds exploit market trends driven by rarity, provenance, and passionate collector communities, which can lead to substantial appreciation over time. Investment strategies in both sectors emphasize expert authentication, condition grading, and market timing to maximize returns.

Key Terms

Authenticity Verification

Comic book funds leverage blockchain technology and expert grading services such as CGC to ensure authenticity verification, reducing risks of counterfeits and enhancing investor confidence. Vintage luxury handbag funds rely heavily on physical inspections by certified authentication experts alongside provenance documentation to verify legitimacy and condition, safeguarding against replicas in a high-value market. Explore how advancements in authenticity verification are shaping investment strategies in niche collectibles.

Market Liquidity

Comic book funds benefit from a niche but growing market with increasing investor interest, offering moderate liquidity through specialty auctions and private sales. Vintage luxury handbag funds leverage a highly active and established resale market, driven by platforms like The RealReal and Vestiaire Collective, providing higher liquidity and quicker transaction cycles. Explore further insights into how these asset classes compare in market depth and liquidity dynamics.

Condition Grading

Condition grading plays a crucial role in both comic book funds and vintage luxury handbag funds, directly impacting asset valuation and investor returns. Comic book funds rely heavily on standardized grading scales like CGC, where factors such as page quality or cover integrity define market value, whereas vintage luxury handbag funds focus on the authenticity and preservation of materials, including leather condition and hardware wear. Explore this detailed comparison to better understand how condition grading influences investment strategies in these niche markets.

Source and External Links

Crowdfundr - Crowdfundr offers a free platform for comic crowdfunding, supporting creators with tools to fund their projects efficiently.

Comic Book Legal Defense Fund - The CBLDF is a non-profit dedicated to protecting the First Amendment rights of comics creators, publishers, and retailers.

MMC Arts Grant - The MMC Arts Grant provides small financial assistance to comic book creators for self-publishing costs, encouraging learning and development in the process.

dowidth.com

dowidth.com