Collectibles investment involves acquiring rare and tangible assets such as art, coins, or vintage cars, which can appreciate in value based on rarity and market demand. Angel investing focuses on providing capital to early-stage startups in exchange for equity, often yielding high returns but with significant risk linked to business success. Explore the advantages and risks of each investment type to make an informed decision.

Why it is important

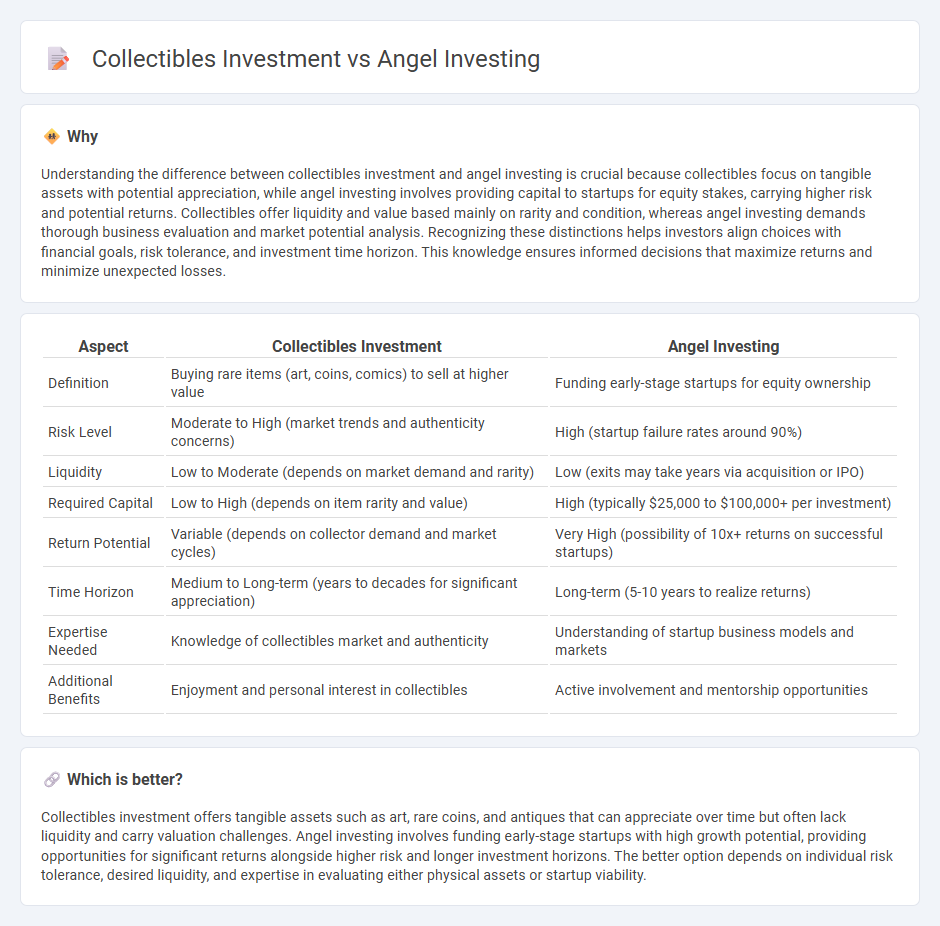

Understanding the difference between collectibles investment and angel investing is crucial because collectibles focus on tangible assets with potential appreciation, while angel investing involves providing capital to startups for equity stakes, carrying higher risk and potential returns. Collectibles offer liquidity and value based mainly on rarity and condition, whereas angel investing demands thorough business evaluation and market potential analysis. Recognizing these distinctions helps investors align choices with financial goals, risk tolerance, and investment time horizon. This knowledge ensures informed decisions that maximize returns and minimize unexpected losses.

Comparison Table

| Aspect | Collectibles Investment | Angel Investing |

|---|---|---|

| Definition | Buying rare items (art, coins, comics) to sell at higher value | Funding early-stage startups for equity ownership |

| Risk Level | Moderate to High (market trends and authenticity concerns) | High (startup failure rates around 90%) |

| Liquidity | Low to Moderate (depends on market demand and rarity) | Low (exits may take years via acquisition or IPO) |

| Required Capital | Low to High (depends on item rarity and value) | High (typically $25,000 to $100,000+ per investment) |

| Return Potential | Variable (depends on collector demand and market cycles) | Very High (possibility of 10x+ returns on successful startups) |

| Time Horizon | Medium to Long-term (years to decades for significant appreciation) | Long-term (5-10 years to realize returns) |

| Expertise Needed | Knowledge of collectibles market and authenticity | Understanding of startup business models and markets |

| Additional Benefits | Enjoyment and personal interest in collectibles | Active involvement and mentorship opportunities |

Which is better?

Collectibles investment offers tangible assets such as art, rare coins, and antiques that can appreciate over time but often lack liquidity and carry valuation challenges. Angel investing involves funding early-stage startups with high growth potential, providing opportunities for significant returns alongside higher risk and longer investment horizons. The better option depends on individual risk tolerance, desired liquidity, and expertise in evaluating either physical assets or startup viability.

Connection

Collectibles investment and angel investing are connected through their shared emphasis on high-risk, high-reward opportunities that require specialized knowledge and passion. Both investment types rely on thorough market research and expert insight to identify undervalued assets or promising startups that can yield significant returns. Diversification in a portfolio that includes collectibles and angel investments can provide unique growth potential outside traditional financial markets.

Key Terms

Equity (Angel Investing)

Angel investing involves providing capital to early-stage startups in exchange for equity shares, offering potential high returns through company growth and eventual exits. Collectibles investment typically focuses on tangible assets like art, coins, or rare items, which may appreciate in value but lack the equity stakes and active involvement associated with startups. Explore the advantages and risks of equity-based angel investing to make informed decisions about your investment portfolio.

Valuation (Angel Investing)

Angel investing valuation centers on assessing startup potential through metrics like market size, revenue projections, and competitive advantage, often relying on discounted cash flow (DCF) and comparable company analysis. Unlike collectibles, where value is influenced by rarity, condition, and market demand, angel investors evaluate financial models and growth scalability to estimate equity worth. Explore detailed valuation methods and decision frameworks to optimize your angel investing strategy.

Rarity (Collectibles Investment)

Rarity in collectibles investment drives value through scarcity, historical significance, and unique characteristics that create high demand among niche collectors. Unlike angel investing where the focus is on business potential and growth trajectory, collectibles' worth depends largely on limited availability and authenticity verified by experts. Explore the impact of rarity on long-term returns and portfolio diversification in collectibles investment.

Source and External Links

Understanding angel financing and investing - Angel investing involves wealthy individuals providing capital to startups in exchange for equity or convertible debt, often helping founders bridge early funding gaps and offering mentorship and network support.

Angel Investors - Angel investors are wealthy individuals who use their own net worth to fund small business ventures and startups, typically expecting a return on investment around 30% and looking for an exit via acquisition or public offering.

Demystifying Angel Investing - Angel investing can generate higher returns than traditional investments and tax advantages, while allowing investors to impact local economies by funding early-stage startups and building financial legacies.

dowidth.com

dowidth.com