Weather index insurance provides payouts based on specific weather parameters such as rainfall or temperature measured at a reliable weather station, reducing the need for field loss assessments. Area yield insurance compensates farmers for losses based on the average crop yield within a defined geographic area, reflecting collective production outcomes rather than individual field losses. Explore the differences between these insurance types to determine which solution best protects agricultural investments.

Why it is important

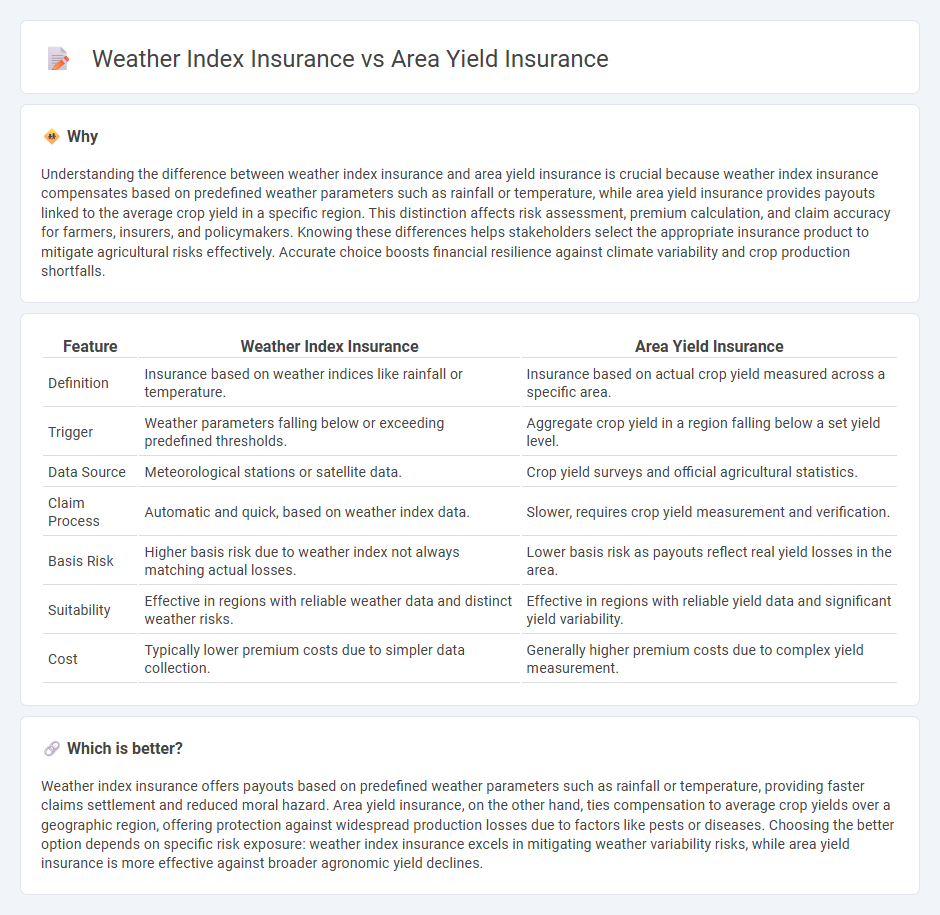

Understanding the difference between weather index insurance and area yield insurance is crucial because weather index insurance compensates based on predefined weather parameters such as rainfall or temperature, while area yield insurance provides payouts linked to the average crop yield in a specific region. This distinction affects risk assessment, premium calculation, and claim accuracy for farmers, insurers, and policymakers. Knowing these differences helps stakeholders select the appropriate insurance product to mitigate agricultural risks effectively. Accurate choice boosts financial resilience against climate variability and crop production shortfalls.

Comparison Table

| Feature | Weather Index Insurance | Area Yield Insurance |

|---|---|---|

| Definition | Insurance based on weather indices like rainfall or temperature. | Insurance based on actual crop yield measured across a specific area. |

| Trigger | Weather parameters falling below or exceeding predefined thresholds. | Aggregate crop yield in a region falling below a set yield level. |

| Data Source | Meteorological stations or satellite data. | Crop yield surveys and official agricultural statistics. |

| Claim Process | Automatic and quick, based on weather index data. | Slower, requires crop yield measurement and verification. |

| Basis Risk | Higher basis risk due to weather index not always matching actual losses. | Lower basis risk as payouts reflect real yield losses in the area. |

| Suitability | Effective in regions with reliable weather data and distinct weather risks. | Effective in regions with reliable yield data and significant yield variability. |

| Cost | Typically lower premium costs due to simpler data collection. | Generally higher premium costs due to complex yield measurement. |

Which is better?

Weather index insurance offers payouts based on predefined weather parameters such as rainfall or temperature, providing faster claims settlement and reduced moral hazard. Area yield insurance, on the other hand, ties compensation to average crop yields over a geographic region, offering protection against widespread production losses due to factors like pests or diseases. Choosing the better option depends on specific risk exposure: weather index insurance excels in mitigating weather variability risks, while area yield insurance is more effective against broader agronomic yield declines.

Connection

Weather index insurance and area yield insurance are both innovative risk management tools designed to protect farmers against agricultural losses caused by adverse weather conditions and poor crop yields. Weather index insurance pays out based on predefined weather parameters such as rainfall or temperature levels, while area yield insurance compensates for reduced crop production in a specific region, reflecting average yield losses. These insurance types complement each other by addressing weather-related risks through different but correlated mechanisms, enhancing financial stability for agricultural producers.

Key Terms

Area Yield Index

Area yield insurance provides payouts based on actual average crop yields within a specified region, protecting farmers against widespread low yields due to factors like drought or pests. Weather index insurance, on the other hand, triggers payouts based on specific weather parameters such as rainfall or temperature indexes, without requiring individual farm loss assessments. Explore the benefits and limitations of Area Yield Index insurance to understand how it can mitigate agricultural risks effectively.

Weather Index

Weather index insurance compensates farmers based on predetermined weather parameters such as rainfall levels or temperature thresholds rather than actual crop loss, reducing the need for on-site loss assessment. This type of insurance offers faster claim processing and lower administrative costs compared to area yield insurance, which relies on average crop yields within a specific area and often involves delayed payouts. Explore how weather index insurance can provide targeted risk protection tailored to specific climatic conditions and enhance financial resilience against weather variability.

Basis Risk

Area yield insurance indemnifies farmers based on average regional crop yields, offering protection against widespread production losses but exposing them to basis risk if individual farm losses diverge from area averages. Weather index insurance compensates policyholders according to predefined weather metrics like rainfall or temperature deviations, reducing moral hazard and administrative costs, but can suffer from basis risk when local weather conditions differ from the index measurements. Explore further to understand how minimizing basis risk enhances the effectiveness of agricultural insurance products.

Source and External Links

Crop - Federal Products - Area Yield Protection - Farmers Mutual Hail - Area Yield Protection (AYP) is a county-based insurance product that indemnifies producers if the final county yield falls below a trigger yield, offering protection against widespread production losses at the county level and subsidized by the Federal Crop Insurance Corporation (FCIC).

Area Yield Protection Plans (AYP) - ProAg - AYP coverage is based on county yield experience rather than individual farm yield, paying indemnities when the county's final yield is below the expected trigger yield, which means individual farmers might not receive payments even if their own yields are low.

Area Risk Protection Insurance - Rabo AgriFinance - Area Yield Protection insures against county-wide yield losses with coverage levels between 65% and 90%, paying indemnities if county average yields drop below chosen trigger levels, and is complemented by Area Revenue Protection that includes price risk.

dowidth.com

dowidth.com