Telematics insurance utilizes real-time data collected through GPS and onboard devices to monitor driving habits such as speed, acceleration, and braking patterns, enabling personalized premiums based on actual road behavior. Behavior-based insurance also focuses on individual driving habits but relies on broader behavioral analytics and risk assessment models beyond just telematics data. Discover how these innovative insurance models transform risk evaluation and pricing to save money and improve safety.

Why it is important

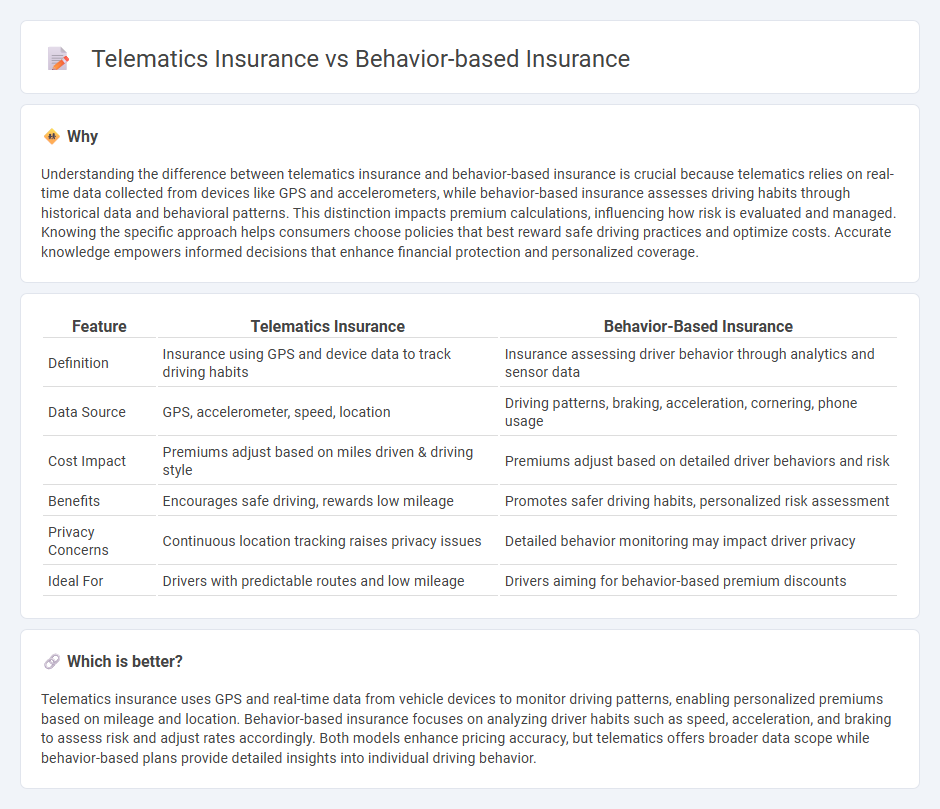

Understanding the difference between telematics insurance and behavior-based insurance is crucial because telematics relies on real-time data collected from devices like GPS and accelerometers, while behavior-based insurance assesses driving habits through historical data and behavioral patterns. This distinction impacts premium calculations, influencing how risk is evaluated and managed. Knowing the specific approach helps consumers choose policies that best reward safe driving practices and optimize costs. Accurate knowledge empowers informed decisions that enhance financial protection and personalized coverage.

Comparison Table

| Feature | Telematics Insurance | Behavior-Based Insurance |

|---|---|---|

| Definition | Insurance using GPS and device data to track driving habits | Insurance assessing driver behavior through analytics and sensor data |

| Data Source | GPS, accelerometer, speed, location | Driving patterns, braking, acceleration, cornering, phone usage |

| Cost Impact | Premiums adjust based on miles driven & driving style | Premiums adjust based on detailed driver behaviors and risk |

| Benefits | Encourages safe driving, rewards low mileage | Promotes safer driving habits, personalized risk assessment |

| Privacy Concerns | Continuous location tracking raises privacy issues | Detailed behavior monitoring may impact driver privacy |

| Ideal For | Drivers with predictable routes and low mileage | Drivers aiming for behavior-based premium discounts |

Which is better?

Telematics insurance uses GPS and real-time data from vehicle devices to monitor driving patterns, enabling personalized premiums based on mileage and location. Behavior-based insurance focuses on analyzing driver habits such as speed, acceleration, and braking to assess risk and adjust rates accordingly. Both models enhance pricing accuracy, but telematics offers broader data scope while behavior-based plans provide detailed insights into individual driving behavior.

Connection

Telematics insurance leverages real-time data from devices installed in vehicles to monitor driving behavior, enabling insurers to assess risk more accurately. Behavior-based insurance uses this data to personalize premiums and incentivize safer driving habits by rewarding policyholders with lower rates for good performance. This integration enhances risk management, reduces claims costs, and promotes safer roads through data-driven insights.

Key Terms

Risk Assessment

Behavior-based insurance leverages detailed driving data such as speed, braking patterns, and cornering to assess risk more accurately than traditional models. Telematics insurance uses GPS and onboard diagnostics to capture real-time vehicle usage and location, offering dynamic risk evaluation. Explore the differences in risk assessment methodologies to choose the best insurance option for your needs.

Data Collection

Behavior-based insurance relies on collecting data through driver behavior analytics such as braking patterns, acceleration, and mileage to determine premiums, ensuring personalized risk assessment. Telematics insurance uses GPS devices and onboard diagnostics to gather real-time information on location, speed, and vehicle usage, offering a comprehensive view of driving habits. Explore more to understand how each method leverages data collection for customized insurance solutions.

Policy Personalization

Behavior-based insurance leverages individual driving data such as speed, braking patterns, and mileage to tailor premiums that reflect actual risk levels. Telematics insurance employs real-time GPS and sensor technology to monitor driver behavior and vehicle usage for more dynamic policy adjustments. Explore how these advanced data-driven approaches revolutionize policy personalization and offer customized coverage options.

Source and External Links

Behavior-Based Insurance: Role In Transforming Health Plans - SPsoft - Behavior-based insurance (BBI) personalizes premiums and policy terms by analyzing real-time behavioral data such as lifestyle habits, incentivizing healthier behaviors in life and health insurance beyond traditional static models.

Comparing UBI and BBI Insurance Models - SambaSafety - BBI focuses on driving behavior data collected via connected devices to adjust premiums dynamically, rewarding safe driving and allowing insurers to manage and mitigate risk more precisely than traditional insurance methods.

Usage-Based Car Insurance | Progressive - Usage-based insurance (UBI) calculates auto insurance rates based on driving habits like braking, acceleration, and time of driving, using telematics devices or apps, enabling personalized and behavior-driven pricing models akin to BBI.

dowidth.com

dowidth.com