Cyber risk underwriting involves evaluating the potential cyber threats and vulnerabilities of businesses to determine appropriate coverage and premiums, focusing on data breaches, ransomware, and system failures. Reinsurance underwriting, on the other hand, assesses risks transferred by primary insurers to mitigate large-scale losses, emphasizing exposure aggregation and capital management across multiple policies. Explore the nuances between these underwriting practices to enhance your risk management strategy.

Why it is important

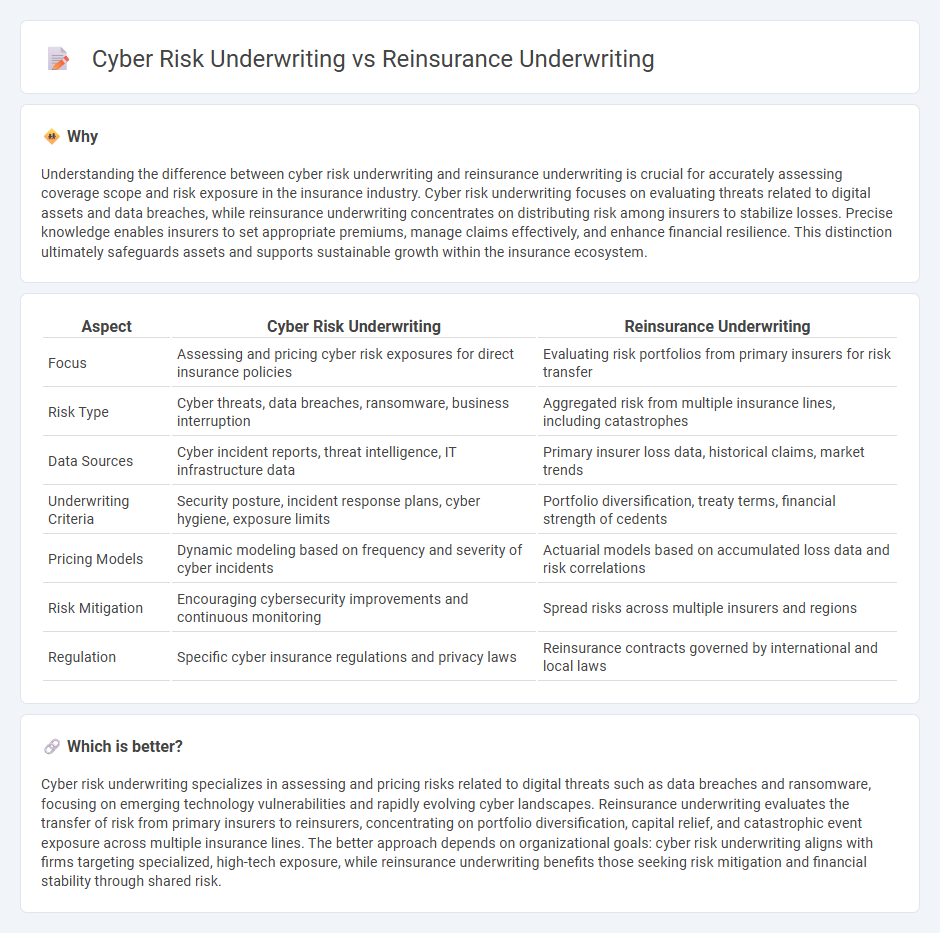

Understanding the difference between cyber risk underwriting and reinsurance underwriting is crucial for accurately assessing coverage scope and risk exposure in the insurance industry. Cyber risk underwriting focuses on evaluating threats related to digital assets and data breaches, while reinsurance underwriting concentrates on distributing risk among insurers to stabilize losses. Precise knowledge enables insurers to set appropriate premiums, manage claims effectively, and enhance financial resilience. This distinction ultimately safeguards assets and supports sustainable growth within the insurance ecosystem.

Comparison Table

| Aspect | Cyber Risk Underwriting | Reinsurance Underwriting |

|---|---|---|

| Focus | Assessing and pricing cyber risk exposures for direct insurance policies | Evaluating risk portfolios from primary insurers for risk transfer |

| Risk Type | Cyber threats, data breaches, ransomware, business interruption | Aggregated risk from multiple insurance lines, including catastrophes |

| Data Sources | Cyber incident reports, threat intelligence, IT infrastructure data | Primary insurer loss data, historical claims, market trends |

| Underwriting Criteria | Security posture, incident response plans, cyber hygiene, exposure limits | Portfolio diversification, treaty terms, financial strength of cedents |

| Pricing Models | Dynamic modeling based on frequency and severity of cyber incidents | Actuarial models based on accumulated loss data and risk correlations |

| Risk Mitigation | Encouraging cybersecurity improvements and continuous monitoring | Spread risks across multiple insurers and regions |

| Regulation | Specific cyber insurance regulations and privacy laws | Reinsurance contracts governed by international and local laws |

Which is better?

Cyber risk underwriting specializes in assessing and pricing risks related to digital threats such as data breaches and ransomware, focusing on emerging technology vulnerabilities and rapidly evolving cyber landscapes. Reinsurance underwriting evaluates the transfer of risk from primary insurers to reinsurers, concentrating on portfolio diversification, capital relief, and catastrophic event exposure across multiple insurance lines. The better approach depends on organizational goals: cyber risk underwriting aligns with firms targeting specialized, high-tech exposure, while reinsurance underwriting benefits those seeking risk mitigation and financial stability through shared risk.

Connection

Cyber risk underwriting involves assessing the potential financial losses from cyber threats, requiring insurers to evaluate complex data on cyber vulnerabilities and attack probabilities. Reinsurance underwriting supports this process by providing insurers with risk transfer solutions, helping to mitigate the impact of large-scale cyber incidents through shared financial responsibility. The integration of both underwriting types enhances overall risk management, ensuring resilience against cyber-related losses in insurance portfolios.

Key Terms

**Reinsurance Underwriting:**

Reinsurance underwriting evaluates large-scale risk portfolios by analyzing the financial stability of primary insurers, catastrophic event exposures, and loss probability models to determine adequate coverage terms and pricing. It requires expertise in diverse sectors such as property, casualty, and life insurance, emphasizing risk aggregation and capital management to ensure insurer solvency during extreme loss events. Explore detailed methodologies and risk assessment criteria in reinsurance underwriting to enhance your risk mitigation strategies.

Treaty

Reinsurance underwriting for treaty contracts involves evaluating aggregated risks from multiple primary policies to provide broad coverage and financial stability for insurers. Cyber risk underwriting in treaty reinsurance specifically focuses on assessing potential losses from cyber threats, data breaches, and systemic vulnerabilities, requiring advanced modeling of cyber event frequency and severity. Explore detailed distinctions and critical criteria in treaty reinsurance underwriting for cyber risks to enhance portfolio resilience and risk management.

Ceding Company

Reinsurance underwriting assesses the risk transfer from ceding companies to reinsurers, focusing on portfolio risk diversification, financial stability, and claims volatility mitigation. Cyber risk underwriting for ceding companies specifically evaluates exposure to data breaches, cyberattacks, and related liabilities, demanding detailed analysis of IT infrastructure, security protocols, and incident response capabilities. Explore how these underwriting disciplines shape risk management strategies tailored to the unique demands of ceding companies.

Source and External Links

Underwriting & claims - Insurers - Reinsurance underwriting involves using automated solutions to speed up and optimize the risk assessment process, enabling quick decisions, higher acceptance rates, reduced costs, and expanded sales channels.

Reinsurance Underwriting - Reinsurance underwriting requires strong broker relationships and negotiation skills to manage market pressures and involves careful long-term risk and profitability assessment, often including actuarial and business analysis.

What do underwriters do? - In reinsurance, underwriting entails assessing the risk to decide whether to accept it and write contracts, negotiating contract terms, and supporting clients throughout the process.

dowidth.com

dowidth.com