Crop insurance protects farmers against financial losses caused by natural disasters, pests, or crop failure, ensuring stability in agricultural income. Travel insurance covers risks related to trip cancellations, medical emergencies, and lost baggage, providing peace of mind for travelers. Explore further to understand which insurance suits your specific needs.

Why it is important

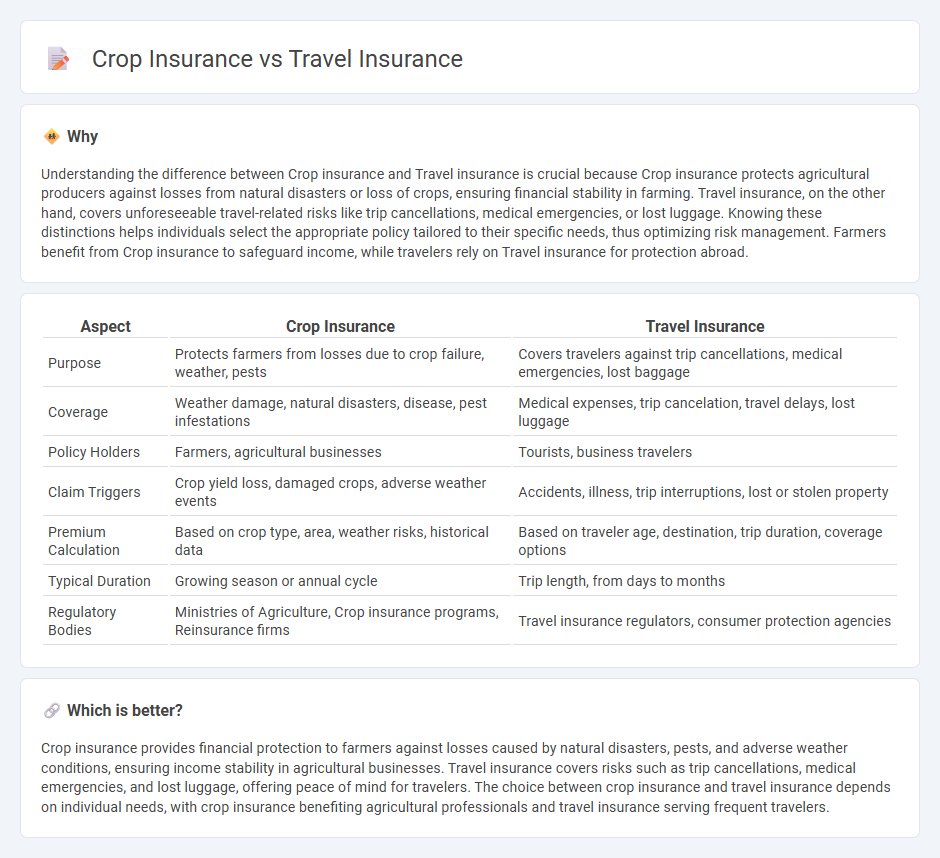

Understanding the difference between Crop insurance and Travel insurance is crucial because Crop insurance protects agricultural producers against losses from natural disasters or loss of crops, ensuring financial stability in farming. Travel insurance, on the other hand, covers unforeseeable travel-related risks like trip cancellations, medical emergencies, or lost luggage. Knowing these distinctions helps individuals select the appropriate policy tailored to their specific needs, thus optimizing risk management. Farmers benefit from Crop insurance to safeguard income, while travelers rely on Travel insurance for protection abroad.

Comparison Table

| Aspect | Crop Insurance | Travel Insurance |

|---|---|---|

| Purpose | Protects farmers from losses due to crop failure, weather, pests | Covers travelers against trip cancellations, medical emergencies, lost baggage |

| Coverage | Weather damage, natural disasters, disease, pest infestations | Medical expenses, trip cancelation, travel delays, lost luggage |

| Policy Holders | Farmers, agricultural businesses | Tourists, business travelers |

| Claim Triggers | Crop yield loss, damaged crops, adverse weather events | Accidents, illness, trip interruptions, lost or stolen property |

| Premium Calculation | Based on crop type, area, weather risks, historical data | Based on traveler age, destination, trip duration, coverage options |

| Typical Duration | Growing season or annual cycle | Trip length, from days to months |

| Regulatory Bodies | Ministries of Agriculture, Crop insurance programs, Reinsurance firms | Travel insurance regulators, consumer protection agencies |

Which is better?

Crop insurance provides financial protection to farmers against losses caused by natural disasters, pests, and adverse weather conditions, ensuring income stability in agricultural businesses. Travel insurance covers risks such as trip cancellations, medical emergencies, and lost luggage, offering peace of mind for travelers. The choice between crop insurance and travel insurance depends on individual needs, with crop insurance benefiting agricultural professionals and travel insurance serving frequent travelers.

Connection

Crop insurance and travel insurance both mitigate financial risks by providing compensation for unforeseen events--crop insurance protects farmers against losses from natural disasters or pest damage, while travel insurance covers travelers against cancellations, medical emergencies, and trip interruptions. Both types of insurance involve risk assessment, premium calculation, and claim processes tailored to specific vulnerabilities in agriculture and travel sectors. Leveraging actuarial data and policy customization, these insurance products safeguard economic stability and personal investments.

Key Terms

**Travel insurance:**

Travel insurance protects against financial losses related to trip cancellations, medical emergencies, and lost luggage, offering coverage for unexpected events during travel. It includes benefits such as trip interruption coverage, emergency medical expenses, and travel delay reimbursements. Discover more about how travel insurance safeguards your journeys and ensures peace of mind.

Trip Cancellation

Trip cancellation coverage in travel insurance reimburses non-refundable expenses when unforeseen events like illness or weather prevent travel, protecting against financial loss. Crop insurance, on the other hand, does not cover trip cancellations but focuses on safeguarding farmers from losses due to crop damage from natural disasters or pests. Explore the distinct benefits and conditions of each insurance type to make informed decisions when planning your trips or managing agricultural risks.

Emergency Medical Coverage

Travel insurance provides emergency medical coverage tailored to travelers, including hospitalization, medical evacuation, and treatment costs abroad. Crop insurance focuses on protecting farmers from financial losses due to weather events, pests, or diseases, typically excluding medical expenses. Discover detailed differences and coverage options to choose the best protection for your needs.

Source and External Links

Travel Insurance - Travelers - Travel insurance helps protect against losses and unexpected events like trip cancellation, medical expenses, and baggage issues with various plans for single or multi-trip coverage, often including options for canceling for any reason.

Travel Guard: Travel Insurance Plans | International ... - Travel insurance plans cover trip cancellation, emergency medical expenses, baggage loss, and more, including 24/7 emergency assistance, with pricing usually 5-7% of trip cost and plans suited for different travel types.

Taking a Trip? Information About Travel Insurance You Should Know - Travel insurance costs 4-10% of trip price and provides coverage for trip cancellation, medical emergencies abroad, and evacuation, but policies vary widely in exclusions and coverage limits, so reading fine print carefully is crucial.

dowidth.com

dowidth.com