Flood insurance integration provides essential protection against property damage caused by flooding, typically covering residential and commercial properties in high-risk areas. Event cancellation insurance integration safeguards financial investments by covering losses from canceled or postponed events due to unforeseen circumstances, such as extreme weather or public safety concerns. Explore how integrating these specialized insurance options can enhance risk management strategies and secure your assets effectively.

Why it is important

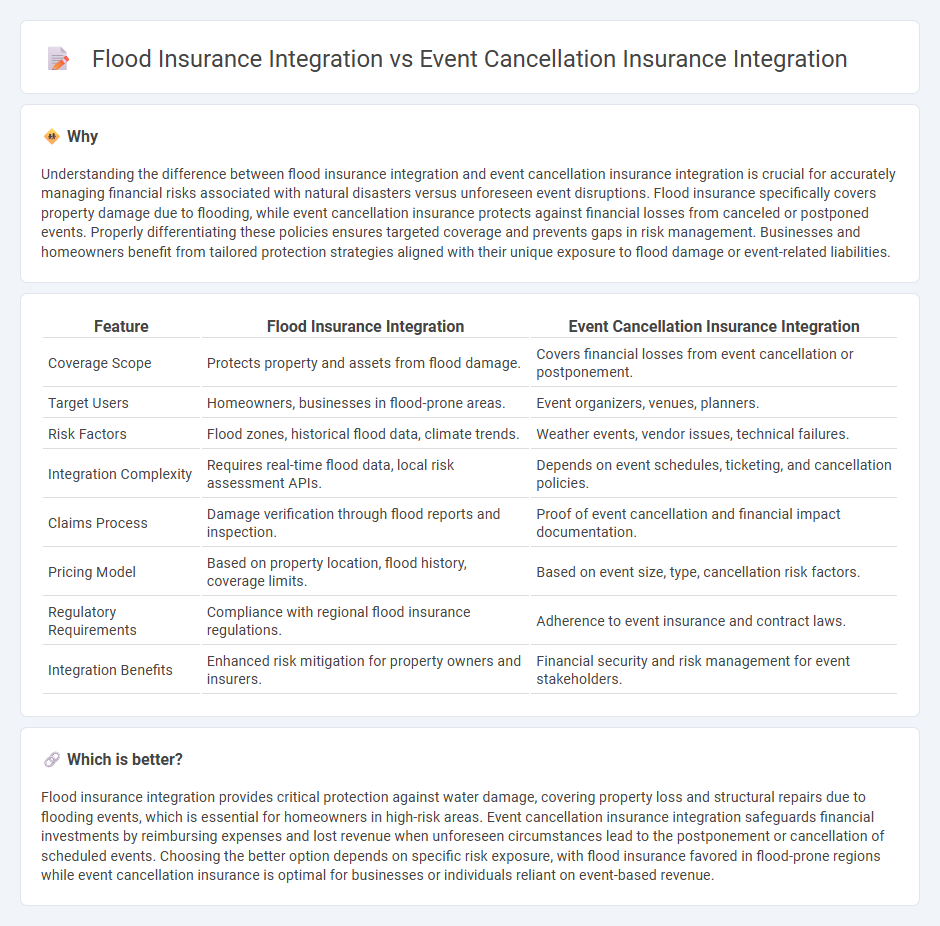

Understanding the difference between flood insurance integration and event cancellation insurance integration is crucial for accurately managing financial risks associated with natural disasters versus unforeseen event disruptions. Flood insurance specifically covers property damage due to flooding, while event cancellation insurance protects against financial losses from canceled or postponed events. Properly differentiating these policies ensures targeted coverage and prevents gaps in risk management. Businesses and homeowners benefit from tailored protection strategies aligned with their unique exposure to flood damage or event-related liabilities.

Comparison Table

| Feature | Flood Insurance Integration | Event Cancellation Insurance Integration |

|---|---|---|

| Coverage Scope | Protects property and assets from flood damage. | Covers financial losses from event cancellation or postponement. |

| Target Users | Homeowners, businesses in flood-prone areas. | Event organizers, venues, planners. |

| Risk Factors | Flood zones, historical flood data, climate trends. | Weather events, vendor issues, technical failures. |

| Integration Complexity | Requires real-time flood data, local risk assessment APIs. | Depends on event schedules, ticketing, and cancellation policies. |

| Claims Process | Damage verification through flood reports and inspection. | Proof of event cancellation and financial impact documentation. |

| Pricing Model | Based on property location, flood history, coverage limits. | Based on event size, type, cancellation risk factors. |

| Regulatory Requirements | Compliance with regional flood insurance regulations. | Adherence to event insurance and contract laws. |

| Integration Benefits | Enhanced risk mitigation for property owners and insurers. | Financial security and risk management for event stakeholders. |

Which is better?

Flood insurance integration provides critical protection against water damage, covering property loss and structural repairs due to flooding events, which is essential for homeowners in high-risk areas. Event cancellation insurance integration safeguards financial investments by reimbursing expenses and lost revenue when unforeseen circumstances lead to the postponement or cancellation of scheduled events. Choosing the better option depends on specific risk exposure, with flood insurance favored in flood-prone regions while event cancellation insurance is optimal for businesses or individuals reliant on event-based revenue.

Connection

Flood insurance integration and event cancellation insurance integration are connected through their role in comprehensive risk management strategies, particularly for businesses and event organizers operating in flood-prone areas. Both types of insurance mitigate financial losses by covering specific risks: flood insurance protects property and assets from water damage, while event cancellation insurance safeguards against revenue loss due to unforeseen interruptions such as natural disasters. Integrating these policies enhances resilience by providing overlapping coverage that addresses multiple aspects of flood-related disruptions.

Key Terms

Covered Perils

Event cancellation insurance integration primarily covers risks such as unforeseen event cancellations due to weather, illness, or vendor no-shows, ensuring financial protection against disruptions. Flood insurance integration targets perils related specifically to flood damage caused by rising water levels, storm surges, or heavy rainfall, addressing property and contents loss. Explore more to understand how each insurance type covers unique perils and benefits your risk management strategy.

Claims Process

Event cancellation insurance integration streamlines claims with rapid validation of event disruptions, relying heavily on contract dates and cancellation notices for quick settlements. Flood insurance integration emphasizes detailed damage assessment, involving inspection reports and weather data to verify flooding impact before claims approval. Explore the distinctions in claims workflows to optimize your insurance integration strategy effectively.

Policy Exclusions

Event cancellation insurance integration excludes risks related to natural disasters like floods, which are covered under flood insurance integration policies. Flood insurance integration specifically addresses water damage and is designed to protect assets from flood-related losses, filling gaps left by event cancellation coverage. Explore the detailed policy exclusions to understand which insurance integration best meets your risk management needs.

Source and External Links

Event Cancellation and Non-Appearance Insurance - Risk Strategies - Offers specialized insurance coverage to protect against financial losses due to event cancellations, including severe weather, venue unavailability, and non-appearance of key speakers.

Event Cancellation Insurance: Don't Shake (the Issues) Off - Discusses the importance and complexity of event cancellation insurance, covering a wide range of risks such as inclement weather and terrorism, depending on the policy terms.

Event Cancellation Insurance - Alive Risk - Provides tailored insurance solutions for various events like festivals and sporting events, covering risks such as adverse weather, venue unavailability, and non-appearance of key persons.

dowidth.com

dowidth.com