Usage-based insurance (UBI) calculates premiums by tracking actual driving habits through telematics devices, offering personalized rates based on mileage and driving patterns. Behavior-based insurance focuses on assessing factors like speed, braking, and acceleration to reward safer driving behaviors with lower premiums. Explore how these innovative insurance models tailor coverage to individual risk profiles for better cost efficiency.

Why it is important

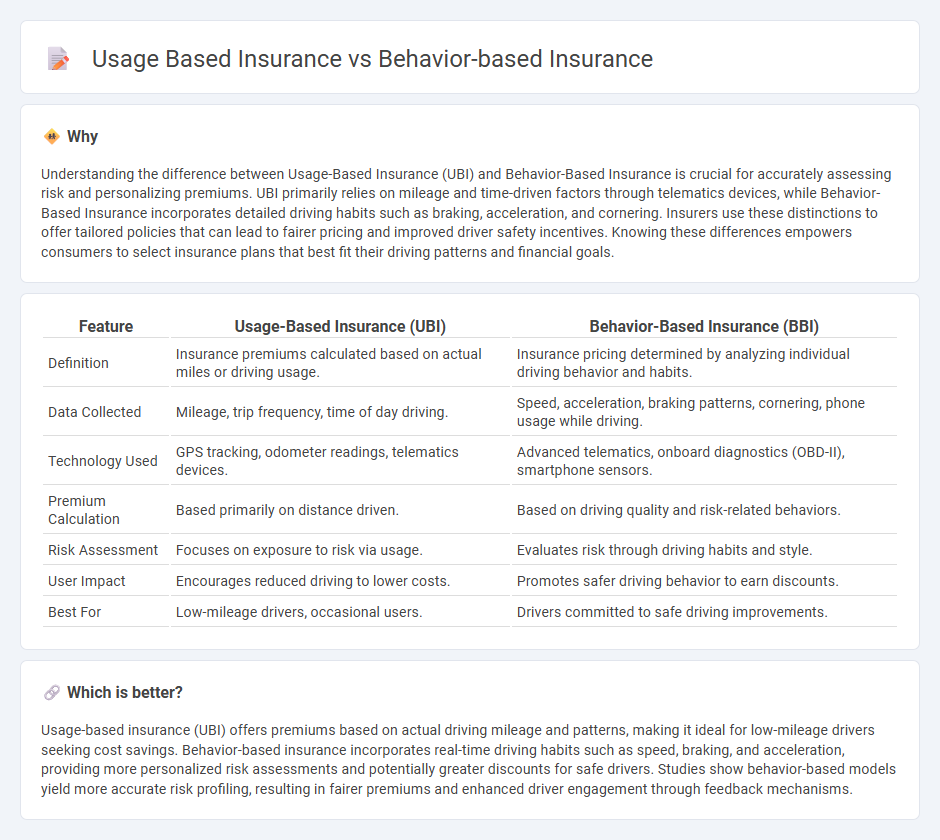

Understanding the difference between Usage-Based Insurance (UBI) and Behavior-Based Insurance is crucial for accurately assessing risk and personalizing premiums. UBI primarily relies on mileage and time-driven factors through telematics devices, while Behavior-Based Insurance incorporates detailed driving habits such as braking, acceleration, and cornering. Insurers use these distinctions to offer tailored policies that can lead to fairer pricing and improved driver safety incentives. Knowing these differences empowers consumers to select insurance plans that best fit their driving patterns and financial goals.

Comparison Table

| Feature | Usage-Based Insurance (UBI) | Behavior-Based Insurance (BBI) |

|---|---|---|

| Definition | Insurance premiums calculated based on actual miles or driving usage. | Insurance pricing determined by analyzing individual driving behavior and habits. |

| Data Collected | Mileage, trip frequency, time of day driving. | Speed, acceleration, braking patterns, cornering, phone usage while driving. |

| Technology Used | GPS tracking, odometer readings, telematics devices. | Advanced telematics, onboard diagnostics (OBD-II), smartphone sensors. |

| Premium Calculation | Based primarily on distance driven. | Based on driving quality and risk-related behaviors. |

| Risk Assessment | Focuses on exposure to risk via usage. | Evaluates risk through driving habits and style. |

| User Impact | Encourages reduced driving to lower costs. | Promotes safer driving behavior to earn discounts. |

| Best For | Low-mileage drivers, occasional users. | Drivers committed to safe driving improvements. |

Which is better?

Usage-based insurance (UBI) offers premiums based on actual driving mileage and patterns, making it ideal for low-mileage drivers seeking cost savings. Behavior-based insurance incorporates real-time driving habits such as speed, braking, and acceleration, providing more personalized risk assessments and potentially greater discounts for safe drivers. Studies show behavior-based models yield more accurate risk profiling, resulting in fairer premiums and enhanced driver engagement through feedback mechanisms.

Connection

Usage-Based Insurance (UBI) and Behavior-Based Insurance (BBI) are interconnected as both models rely on telematics data to assess driving patterns and determine premiums. UBI focuses on quantifiable metrics such as mileage, speed, and braking, while BBI analyzes behavioral factors like distraction, acceleration habits, and time of travel. Together, these approaches enable insurers to personalize risk evaluation, promoting safer driving habits and optimizing premium pricing.

Key Terms

Telematics

Behavior-based insurance (BBI) and usage-based insurance (UBI) both leverage telematics technology to collect real-time driving data, but BBI emphasizes driving behaviors such as speed, acceleration, and braking patterns, while UBI focuses primarily on mileage and time driven. Telematics devices transmit detailed information enabling insurers to customize premiums based on individual risk profiles, promoting safer driving habits and cost savings. Discover how telematics transforms insurance models by improving accuracy and customer engagement.

Driving Patterns

Behavior-based insurance evaluates policy premiums by analyzing drivers' habits, such as acceleration, braking, and cornering, to assess risk more accurately. Usage-based insurance primarily tracks mileage and time of use, offering discounts for lower exposure on the road. Explore detailed comparisons to understand which model best fits your driving profile and insurance needs.

Pay-How-You-Drive (PHYD) vs. Pay-As-You-Drive (PAYD)

Behavior-based insurance emphasizes driving habits such as speed, braking patterns, and acceleration to tailor premiums, while usage-based insurance calculates costs primarily on mileage driven. Pay-How-You-Drive (PHYD) models analyze real-time driving behavior to reward safer drivers with lower rates, whereas Pay-As-You-Drive (PAYD) adjusts premiums based on the distance traveled, encouraging reduced vehicle use. Explore these innovative insurance models to understand how personalized strategies can optimize your coverage and savings.

Source and External Links

Behavior-Based Insurance: Role In Transforming Health Plans - This article discusses how behavior-based insurance uses observed behaviors to adjust premiums and policy terms, transforming health and life plans with personalized risk assessments.

Behavioral Insurance Reshapes Risk Models - Behavioral insurance continuously tracks risk data and makes behavioral interventions, leading to personalized premiums based on monitored behaviors in various insurance types.

Comparing UBI and BBI Insurance Models - This comparison highlights how behavior-based insurance (BBI) focuses on driver behavior, offering more accurate risk assessments and refined pricing models through telematics data.

dowidth.com

dowidth.com