Invisible insurance seamlessly integrates protection into everyday transactions, offering coverage without requiring active user management, while on-demand insurance provides flexible, real-time policies activated as needed for specific risks or time periods. Both models leverage technology to enhance customer experience, with invisible insurance focusing on convenience and on-demand insurance prioritizing control and customization. Explore how these innovative insurance solutions can redefine your approach to risk management.

Why it is important

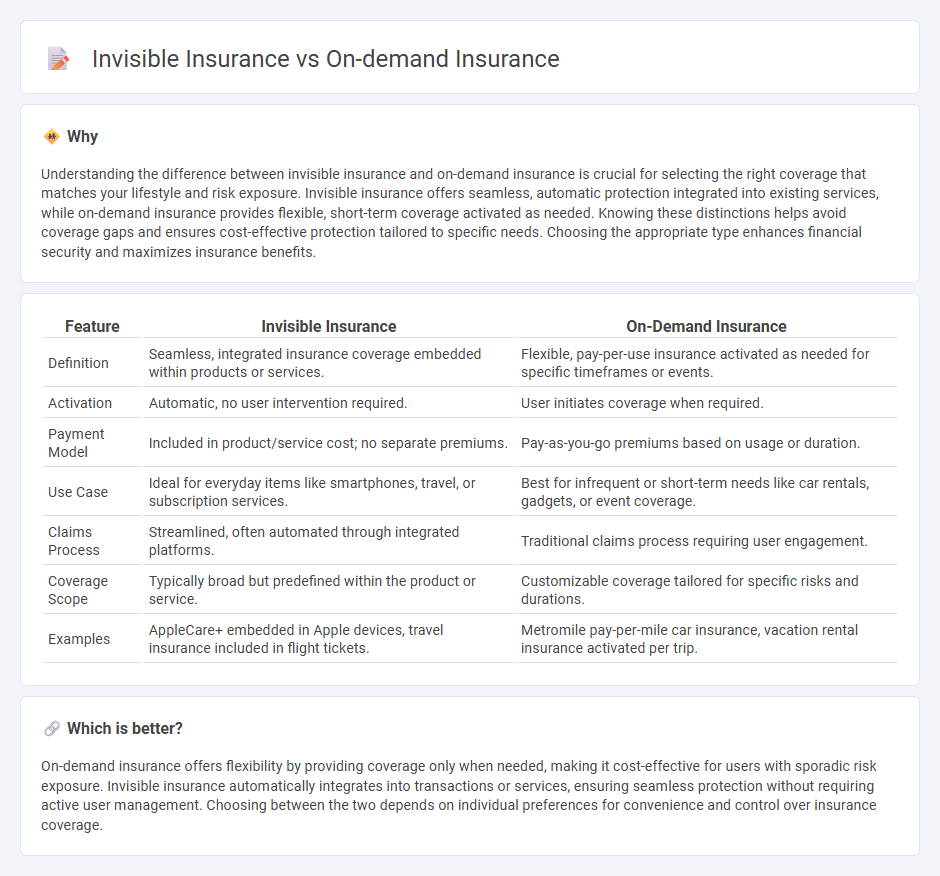

Understanding the difference between invisible insurance and on-demand insurance is crucial for selecting the right coverage that matches your lifestyle and risk exposure. Invisible insurance offers seamless, automatic protection integrated into existing services, while on-demand insurance provides flexible, short-term coverage activated as needed. Knowing these distinctions helps avoid coverage gaps and ensures cost-effective protection tailored to specific needs. Choosing the appropriate type enhances financial security and maximizes insurance benefits.

Comparison Table

| Feature | Invisible Insurance | On-Demand Insurance |

|---|---|---|

| Definition | Seamless, integrated insurance coverage embedded within products or services. | Flexible, pay-per-use insurance activated as needed for specific timeframes or events. |

| Activation | Automatic, no user intervention required. | User initiates coverage when required. |

| Payment Model | Included in product/service cost; no separate premiums. | Pay-as-you-go premiums based on usage or duration. |

| Use Case | Ideal for everyday items like smartphones, travel, or subscription services. | Best for infrequent or short-term needs like car rentals, gadgets, or event coverage. |

| Claims Process | Streamlined, often automated through integrated platforms. | Traditional claims process requiring user engagement. |

| Coverage Scope | Typically broad but predefined within the product or service. | Customizable coverage tailored for specific risks and durations. |

| Examples | AppleCare+ embedded in Apple devices, travel insurance included in flight tickets. | Metromile pay-per-mile car insurance, vacation rental insurance activated per trip. |

Which is better?

On-demand insurance offers flexibility by providing coverage only when needed, making it cost-effective for users with sporadic risk exposure. Invisible insurance automatically integrates into transactions or services, ensuring seamless protection without requiring active user management. Choosing between the two depends on individual preferences for convenience and control over insurance coverage.

Connection

Invisible insurance seamlessly integrates coverage into everyday purchases and services, allowing users to be insured without active involvement or awareness. On-demand insurance provides flexible, real-time policies activated only when needed, enhancing user control and cost efficiency. Both models leverage digital platforms and APIs to deliver personalized, frictionless protection aligned with consumer behavior and needs.

Key Terms

Flexibility

On-demand insurance offers policyholders the ability to activate coverage precisely when needed, providing unparalleled flexibility for short-term or specific events. Invisible insurance seamlessly integrates into everyday transactions or products, ensuring continuous protection without manual intervention or policy management. Explore the distinct advantages of both models to determine which flexible insurance solution best fits your lifestyle.

Automation

On-demand insurance offers real-time coverage activated by users for specific needs, leveraging automated digital platforms to streamline purchase and claims processes. Invisible insurance integrates seamlessly into everyday transactions through automated algorithms, providing effortless coverage without user intervention. Explore how automation revolutionizes risk management by blending convenience and protection.

User Experience

On-demand insurance offers users flexibility and control by allowing coverage activation precisely when needed, enhancing convenience and cost-efficiency. Invisible insurance integrates seamlessly into everyday transactions, providing protection without disrupting the user's experience or requiring active management. Explore the key differences in user experience to determine which model suits your needs best.

Source and External Links

The Ins and Outs of On-Demand Insurance - On-demand insurance allows consumers to purchase coverage as needed, typically through digital platforms like mobile apps, providing flexibility and specificity not found in traditional insurance models.

On-Demand Insurance Market Size & Share Report, 2030 - The global on-demand insurance market is expected to grow at a compound annual growth rate of 21.2%, driven by digital platforms and transparent policies.

What Is On-Demand Insurance? - On-demand insurance offers policyholders the flexibility to turn coverage on and off, paying only for active policies, often managed through smartphones or devices.

dowidth.com

dowidth.com