Climate risk insurance protects businesses and individuals from financial losses caused by extreme weather events such as hurricanes, floods, and droughts, offering vital coverage in the face of increasing climate volatility. Event cancellation insurance covers the costs and losses associated with canceling or postponing events due to unforeseen circumstances like natural disasters, pandemics, or other disruptions. Explore the unique benefits and applications of these insurance types to safeguard your assets and plans effectively.

Why it is important

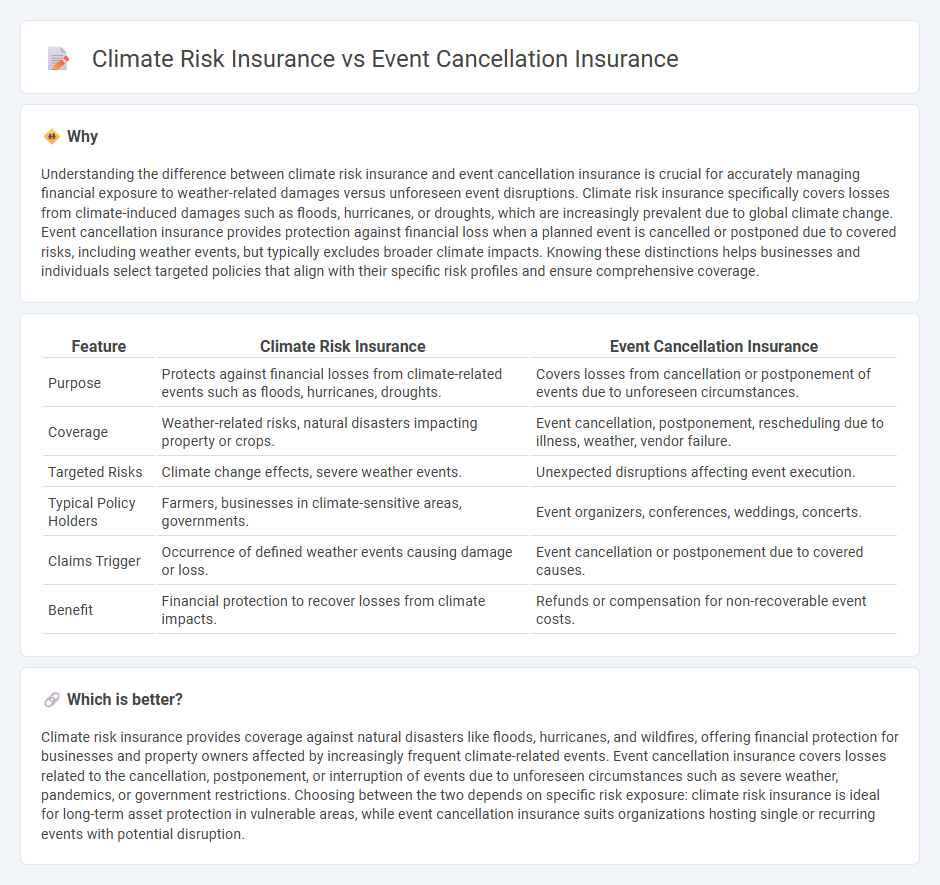

Understanding the difference between climate risk insurance and event cancellation insurance is crucial for accurately managing financial exposure to weather-related damages versus unforeseen event disruptions. Climate risk insurance specifically covers losses from climate-induced damages such as floods, hurricanes, or droughts, which are increasingly prevalent due to global climate change. Event cancellation insurance provides protection against financial loss when a planned event is cancelled or postponed due to covered risks, including weather events, but typically excludes broader climate impacts. Knowing these distinctions helps businesses and individuals select targeted policies that align with their specific risk profiles and ensure comprehensive coverage.

Comparison Table

| Feature | Climate Risk Insurance | Event Cancellation Insurance |

|---|---|---|

| Purpose | Protects against financial losses from climate-related events such as floods, hurricanes, droughts. | Covers losses from cancellation or postponement of events due to unforeseen circumstances. |

| Coverage | Weather-related risks, natural disasters impacting property or crops. | Event cancellation, postponement, rescheduling due to illness, weather, vendor failure. |

| Targeted Risks | Climate change effects, severe weather events. | Unexpected disruptions affecting event execution. |

| Typical Policy Holders | Farmers, businesses in climate-sensitive areas, governments. | Event organizers, conferences, weddings, concerts. |

| Claims Trigger | Occurrence of defined weather events causing damage or loss. | Event cancellation or postponement due to covered causes. |

| Benefit | Financial protection to recover losses from climate impacts. | Refunds or compensation for non-recoverable event costs. |

Which is better?

Climate risk insurance provides coverage against natural disasters like floods, hurricanes, and wildfires, offering financial protection for businesses and property owners affected by increasingly frequent climate-related events. Event cancellation insurance covers losses related to the cancellation, postponement, or interruption of events due to unforeseen circumstances such as severe weather, pandemics, or government restrictions. Choosing between the two depends on specific risk exposure: climate risk insurance is ideal for long-term asset protection in vulnerable areas, while event cancellation insurance suits organizations hosting single or recurring events with potential disruption.

Connection

Climate risk insurance and event cancellation insurance are interconnected through their shared function of mitigating financial losses caused by unpredictable environmental events. Climate risk insurance provides coverage against damages from natural disasters such as floods, hurricanes, and wildfires, which can directly impact scheduled events. Event cancellation insurance often includes protection for cancellations due to weather-related disruptions, making both policies essential for comprehensive risk management in event planning and disaster preparedness.

Key Terms

**Event Cancellation Insurance:**

Event cancellation insurance protects organizers from financial losses due to unforeseen interruptions such as natural disasters, pandemics, or logistical failures, covering expenses like venue bookings, vendor fees, and prepaid marketing costs. Unlike climate risk insurance, which offers broader protection against long-term weather-related impacts on assets and investments, event cancellation insurance specifically addresses short-term disruptions to scheduled events. Discover how event cancellation insurance can safeguard your plans against unpredictable disruptions and ensure financial stability.

Non-Appearance

Event cancellation insurance covers losses due to unforeseen cancellations, including non-appearance of key participants, ensuring financial protection for organizers. Climate risk insurance addresses weather-related events that can cause non-appearance by impacting accessibility or safety, offering tailored coverage for climate-induced disruptions. Discover how these policies safeguard your events against non-appearance risks.

Force Majeure

Event cancellation insurance covers financial losses when unforeseen events like natural disasters trigger Force Majeure clauses, forcing event cancellations or postponements. Climate risk insurance specifically addresses risks related to climate change impacts such as extreme weather events that increase the frequency of Force Majeure occurrences. Explore detailed comparisons and policies to better understand risk mitigation strategies in your sector.

Source and External Links

Event Cancellation and Non-Appearance Insurance - This type of insurance safeguards against financial losses by reimbursing irrecoverable expenses, relocation costs, lost revenues, and more due to unforeseen events like severe weather or venue unavailability.

Event Cancellation Insurance - Provides comprehensive financial protection for trade and professional associations against cancellation, postponement, or disruption due to various risks including adverse weather and venue damage.

Wedding & Special Event Insurance - Offers event cancellation insurance starting at $130, covering non-refundable deposits, cancellation fees, and other losses due to unforeseen circumstances like extreme weather or vendor bankruptcy.

dowidth.com

dowidth.com