Digital claim automation leverages artificial intelligence and machine learning to streamline the insurance claims process, reducing manual errors and accelerating settlements. Legacy claim systems rely on outdated, paper-based workflows that often result in delayed processing and higher operational costs. Explore how digital claim automation can transform your insurance operations for increased efficiency and customer satisfaction.

Why it is important

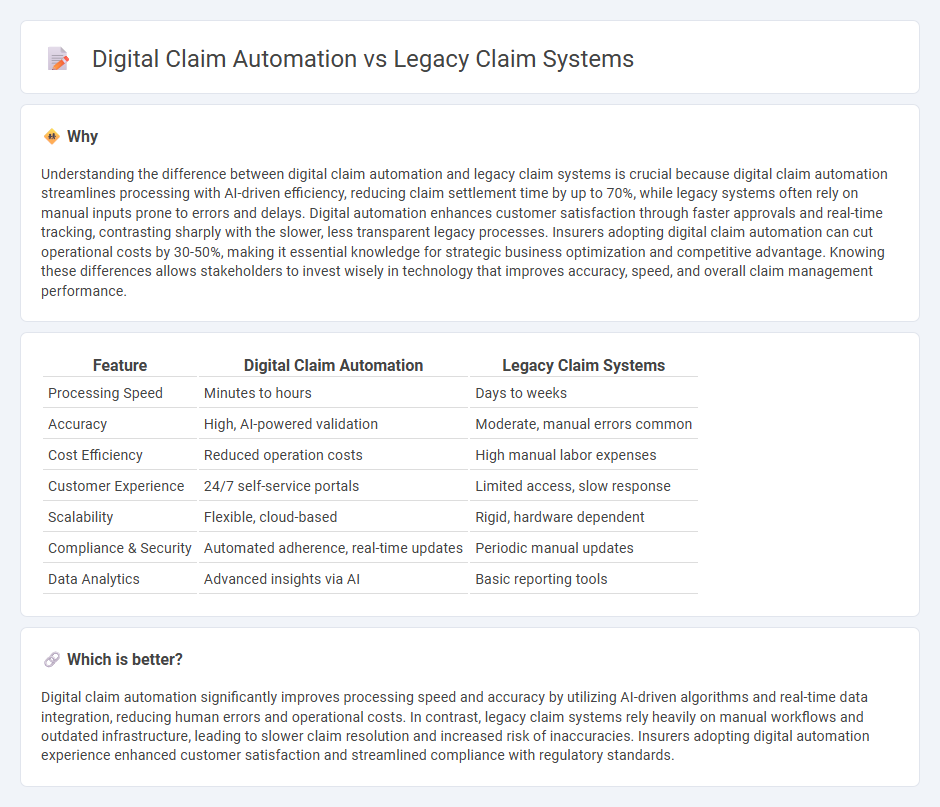

Understanding the difference between digital claim automation and legacy claim systems is crucial because digital claim automation streamlines processing with AI-driven efficiency, reducing claim settlement time by up to 70%, while legacy systems often rely on manual inputs prone to errors and delays. Digital automation enhances customer satisfaction through faster approvals and real-time tracking, contrasting sharply with the slower, less transparent legacy processes. Insurers adopting digital claim automation can cut operational costs by 30-50%, making it essential knowledge for strategic business optimization and competitive advantage. Knowing these differences allows stakeholders to invest wisely in technology that improves accuracy, speed, and overall claim management performance.

Comparison Table

| Feature | Digital Claim Automation | Legacy Claim Systems |

|---|---|---|

| Processing Speed | Minutes to hours | Days to weeks |

| Accuracy | High, AI-powered validation | Moderate, manual errors common |

| Cost Efficiency | Reduced operation costs | High manual labor expenses |

| Customer Experience | 24/7 self-service portals | Limited access, slow response |

| Scalability | Flexible, cloud-based | Rigid, hardware dependent |

| Compliance & Security | Automated adherence, real-time updates | Periodic manual updates |

| Data Analytics | Advanced insights via AI | Basic reporting tools |

Which is better?

Digital claim automation significantly improves processing speed and accuracy by utilizing AI-driven algorithms and real-time data integration, reducing human errors and operational costs. In contrast, legacy claim systems rely heavily on manual workflows and outdated infrastructure, leading to slower claim resolution and increased risk of inaccuracies. Insurers adopting digital automation experience enhanced customer satisfaction and streamlined compliance with regulatory standards.

Connection

Digital claim automation enhances efficiency by integrating with legacy claim systems through APIs and middleware, enabling seamless data exchange and process continuity. Legacy claim systems often store critical historical data, which digital platforms leverage to improve claim accuracy and speed. This connectivity reduces manual errors, accelerates claim processing times, and provides a unified customer experience across insurance claims management.

Key Terms

Manual Processing

Legacy claim systems rely heavily on manual processing, leading to prolonged claim cycles, increased human error, and higher operational costs. Digital claim automation integrates AI and machine learning to streamline workflows, reduce processing time, and improve accuracy by minimizing manual intervention. Discover how transitioning from legacy systems to automated solutions can optimize your claims management.

Workflow Automation

Legacy claim systems often rely on manual processes and fragmented workflows, resulting in slower claim processing and increased errors. Digital claim automation leverages advanced workflow automation tools such as AI-driven rules engines and real-time data integration to streamline end-to-end claims management, enhancing accuracy and speed. Explore how transitioning to digital claim automation can optimize your workflow automation for more efficient and customer-centric claims handling.

Integration Capabilities

Legacy claim systems often struggle with limited integration capabilities, resulting in data silos and inefficient workflows. Digital claim automation platforms leverage APIs and cloud-based technologies to enable seamless integration with multiple data sources, third-party applications, and IoT devices, enhancing real-time processing and accuracy. Explore how advanced integration capabilities in digital claim automation can transform your insurance operations for better efficiency and customer satisfaction.

Source and External Links

Still Using Legacy Claims Systems? Here's What It's Costing You - Legacy claims systems require more manual intervention, leading to higher operational costs, increased human errors, and slower, less transparent claims processing; modernizing systems with automation and AI enhances efficiency, accuracy, and customer satisfaction.

Legacy systems for complicated claim process | Benekiva - Legacy claims systems rely on outdated manual processes, causing inefficiencies, security risks, and poor asset retention, whereas next-gen systems digitize and automate claims workflows to improve speed, accuracy, user experience, and employee retention.

Insurance Legacy System Transformation: Challenges & Trends - Legacy claims systems such as policy administration systems operate in silos, lack automation, personalization, real-time analytics, and robust security, limiting modern business needs and customer engagement; modernization remains limited among insurers despite these challenges.

dowidth.com

dowidth.com