Cyber insurance protects businesses from financial losses due to data breaches, cyberattacks, and other technology-related risks, while workers' compensation insurance covers medical expenses and lost wages for employees injured on the job. Both types of insurance serve critical roles in risk management but address entirely different aspects of business protection. Explore the key differences and benefits of cyber insurance and workers' compensation insurance to determine the right coverage for your company.

Why it is important

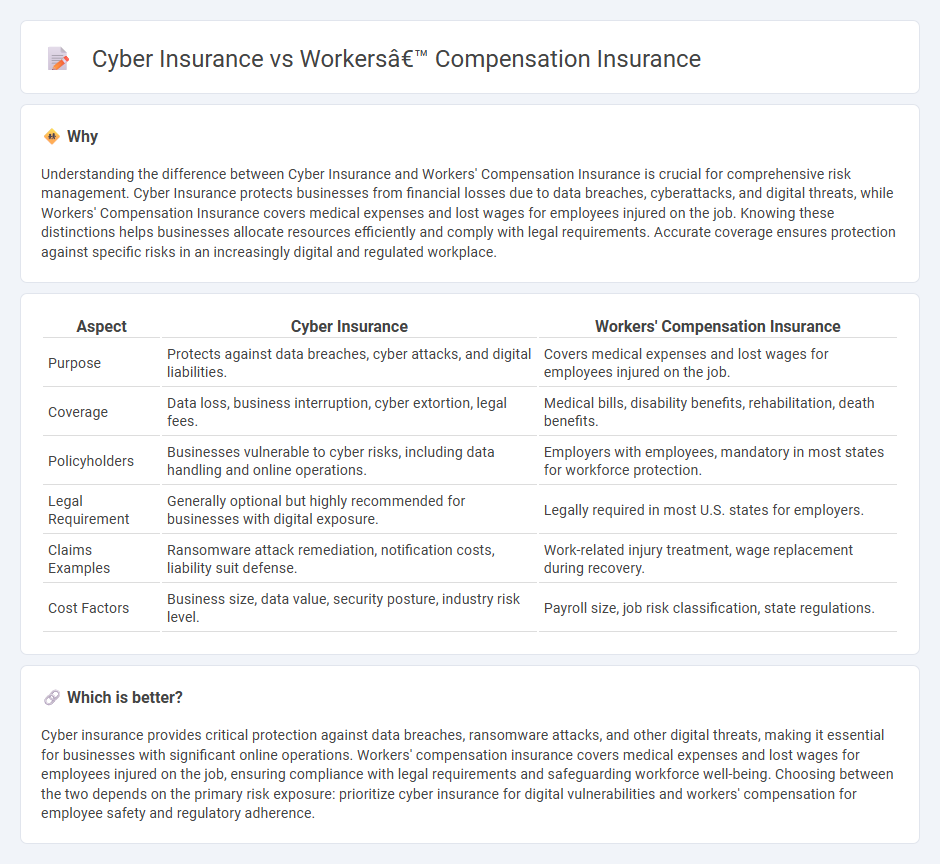

Understanding the difference between Cyber Insurance and Workers' Compensation Insurance is crucial for comprehensive risk management. Cyber Insurance protects businesses from financial losses due to data breaches, cyberattacks, and digital threats, while Workers' Compensation Insurance covers medical expenses and lost wages for employees injured on the job. Knowing these distinctions helps businesses allocate resources efficiently and comply with legal requirements. Accurate coverage ensures protection against specific risks in an increasingly digital and regulated workplace.

Comparison Table

| Aspect | Cyber Insurance | Workers' Compensation Insurance |

|---|---|---|

| Purpose | Protects against data breaches, cyber attacks, and digital liabilities. | Covers medical expenses and lost wages for employees injured on the job. |

| Coverage | Data loss, business interruption, cyber extortion, legal fees. | Medical bills, disability benefits, rehabilitation, death benefits. |

| Policyholders | Businesses vulnerable to cyber risks, including data handling and online operations. | Employers with employees, mandatory in most states for workforce protection. |

| Legal Requirement | Generally optional but highly recommended for businesses with digital exposure. | Legally required in most U.S. states for employers. |

| Claims Examples | Ransomware attack remediation, notification costs, liability suit defense. | Work-related injury treatment, wage replacement during recovery. |

| Cost Factors | Business size, data value, security posture, industry risk level. | Payroll size, job risk classification, state regulations. |

Which is better?

Cyber insurance provides critical protection against data breaches, ransomware attacks, and other digital threats, making it essential for businesses with significant online operations. Workers' compensation insurance covers medical expenses and lost wages for employees injured on the job, ensuring compliance with legal requirements and safeguarding workforce well-being. Choosing between the two depends on the primary risk exposure: prioritize cyber insurance for digital vulnerabilities and workers' compensation for employee safety and regulatory adherence.

Connection

Cyber insurance and workers' compensation insurance intersect through the protection they offer against employee-related risks, with cyber insurance covering data breaches involving employee information and workers' compensation covering injuries sustained in the workplace. Both policies mitigate financial losses from incidents that disrupt business operations, emphasizing risk management in employee safety and data security. Effective integration of these insurances enhances comprehensive coverage for businesses facing evolving cyber threats and workplace hazards.

Key Terms

**Workers’ Compensation Insurance:**

Workers' compensation insurance provides essential coverage for employees injured or becoming ill due to job-related activities, ensuring medical expenses and wage replacement are covered. This insurance protects businesses from costly lawsuits and compliance penalties by meeting state-mandated requirements for workplace injury claims. Explore how workers' compensation insurance safeguards your workforce and business continuity.

Medical Benefits

Workers' compensation insurance primarily covers medical benefits related to workplace injuries or illnesses, including hospital stays, surgeries, rehabilitation, and ongoing medical care necessary for recovery. Cyber insurance, on the other hand, generally does not cover medical benefits but focuses on liabilities like data breaches, cyberattacks, and associated financial losses, including legal fees and notification costs. Explore more to understand how these insurances serve distinct needs and protect against different risks.

Wage Replacement

Workers' compensation insurance primarily provides wage replacement and medical benefits for employees injured on the job, ensuring financial stability during recovery. Cyber insurance covers losses related to data breaches, ransomware, and cyberattacks, but does not offer wage replacement for affected employees. Discover more about how these insurance types protect your business and workforce effectively.

Source and External Links

What is Workers' Compensation Insurance? - This webpage provides an overview of workers' compensation insurance, including its purpose, benefits, and how its costs are determined.

Workers' Compensation Requirements - This webpage outlines the requirements for workers' compensation insurance in California, including the need for a valid certificate of insurance or self-insurance for contractors.

Workers' Compensation - This webpage explains the necessity of workers' compensation insurance for all businesses with employees in Colorado and discusses the benefits and requirements for employers.

dowidth.com

dowidth.com