Natural catastrophe bonds transfer risk from insurers to capital markets by providing funds for payouts when specified disaster losses occur, supporting financial stability after hurricanes or earthquakes. Aggregate stop-loss insurance protects companies from exceeding a predetermined total claims amount within a period, capping potential losses and managing risk exposure more predictably. Explore the differences in risk management strategies and financial mechanisms between these insurance tools.

Why it is important

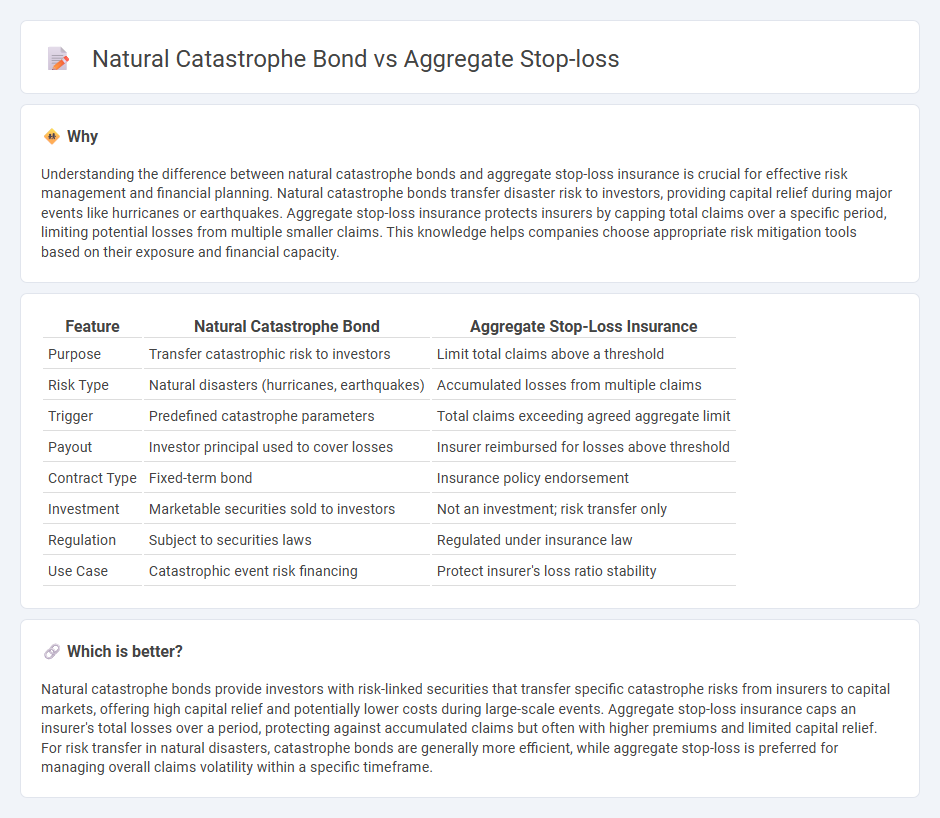

Understanding the difference between natural catastrophe bonds and aggregate stop-loss insurance is crucial for effective risk management and financial planning. Natural catastrophe bonds transfer disaster risk to investors, providing capital relief during major events like hurricanes or earthquakes. Aggregate stop-loss insurance protects insurers by capping total claims over a specific period, limiting potential losses from multiple smaller claims. This knowledge helps companies choose appropriate risk mitigation tools based on their exposure and financial capacity.

Comparison Table

| Feature | Natural Catastrophe Bond | Aggregate Stop-Loss Insurance |

|---|---|---|

| Purpose | Transfer catastrophic risk to investors | Limit total claims above a threshold |

| Risk Type | Natural disasters (hurricanes, earthquakes) | Accumulated losses from multiple claims |

| Trigger | Predefined catastrophe parameters | Total claims exceeding agreed aggregate limit |

| Payout | Investor principal used to cover losses | Insurer reimbursed for losses above threshold |

| Contract Type | Fixed-term bond | Insurance policy endorsement |

| Investment | Marketable securities sold to investors | Not an investment; risk transfer only |

| Regulation | Subject to securities laws | Regulated under insurance law |

| Use Case | Catastrophic event risk financing | Protect insurer's loss ratio stability |

Which is better?

Natural catastrophe bonds provide investors with risk-linked securities that transfer specific catastrophe risks from insurers to capital markets, offering high capital relief and potentially lower costs during large-scale events. Aggregate stop-loss insurance caps an insurer's total losses over a period, protecting against accumulated claims but often with higher premiums and limited capital relief. For risk transfer in natural disasters, catastrophe bonds are generally more efficient, while aggregate stop-loss is preferred for managing overall claims volatility within a specific timeframe.

Connection

Natural catastrophe bonds transfer risk from insurers to capital markets, providing coverage against large-scale disasters. Aggregate stop-loss insurance sets a limit on total claims an insurer must pay, protecting against excessive losses over a period. Both mechanisms serve to manage and mitigate large, unpredictable insurance claims by spreading or capping financial risk.

Key Terms

Attachment Point

Aggregate stop-loss insurance triggers coverage once total claims exceed a predetermined attachment point, typically set as a percentage of earned premiums or expected losses. Natural catastrophe bonds activate payouts when insured losses surpass a specified attachment point linked to modeled catastrophe scenarios, providing capital relief for extreme events. Explore more about how these financial instruments differ in risk thresholds and capital management strategies.

Payout Trigger

Aggregate stop-loss insurance triggers payouts when policyholder's total claims exceed a specified threshold during the policy period, providing coverage for accumulated losses across multiple claims. Natural catastrophe bonds (cat bonds) activate payouts based on predefined parametric triggers such as wind speed, earthquake magnitude, or hurricane category, independent of actual losses. Explore detailed comparisons on payout triggers to understand which instrument aligns better with your risk management strategy.

Reinsurance

Aggregate stop-loss insurance provides reinsurance by covering total losses exceeding a specified retention during a policy period, offering financial protection against accumulated claims. Natural catastrophe bonds transfer risk to capital markets, allowing insurers to raise funds for catastrophic events through investor-funded securities, which pay out when predefined disaster triggers occur. Explore the distinct risk management strategies and benefits of each reinsurance solution to optimize your catastrophe risk portfolio.

Source and External Links

Aggregate Stop-Loss Insurance - Aggregate stop-loss insurance protects employers by covering total claims that exceed anticipated amounts, often added to employer insurance policies for medical, dental, and other benefits.

What Is Aggregate Stop-Loss Insurance? - This insurance is designed to protect employers with self-funded plans by limiting financial exposure to unexpectedly high total claims during a contract period.

Stop-Loss Excess Insurance - Aggregate stop-loss provides a ceiling on total eligible expenses an employer must pay, offering protection against higher-than-expected overall claims during a plan period.

dowidth.com

dowidth.com