Cyber risk insurance provides coverage against losses from data breaches, cyberattacks, and digital threats, safeguarding businesses from financial and reputational damage. Product liability insurance protects manufacturers and sellers from claims related to injuries or damages caused by their products, covering legal costs and settlements. Explore the key differences and benefits of these insurance types to determine the best protection for your business risks.

Why it is important

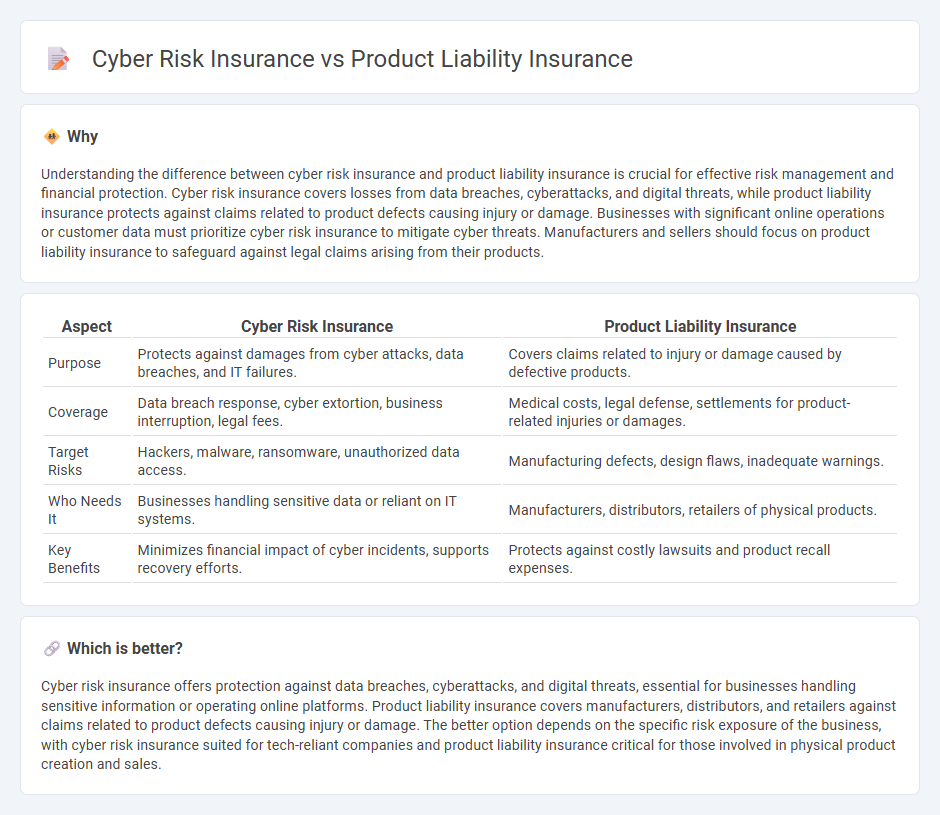

Understanding the difference between cyber risk insurance and product liability insurance is crucial for effective risk management and financial protection. Cyber risk insurance covers losses from data breaches, cyberattacks, and digital threats, while product liability insurance protects against claims related to product defects causing injury or damage. Businesses with significant online operations or customer data must prioritize cyber risk insurance to mitigate cyber threats. Manufacturers and sellers should focus on product liability insurance to safeguard against legal claims arising from their products.

Comparison Table

| Aspect | Cyber Risk Insurance | Product Liability Insurance |

|---|---|---|

| Purpose | Protects against damages from cyber attacks, data breaches, and IT failures. | Covers claims related to injury or damage caused by defective products. |

| Coverage | Data breach response, cyber extortion, business interruption, legal fees. | Medical costs, legal defense, settlements for product-related injuries or damages. |

| Target Risks | Hackers, malware, ransomware, unauthorized data access. | Manufacturing defects, design flaws, inadequate warnings. |

| Who Needs It | Businesses handling sensitive data or reliant on IT systems. | Manufacturers, distributors, retailers of physical products. |

| Key Benefits | Minimizes financial impact of cyber incidents, supports recovery efforts. | Protects against costly lawsuits and product recall expenses. |

Which is better?

Cyber risk insurance offers protection against data breaches, cyberattacks, and digital threats, essential for businesses handling sensitive information or operating online platforms. Product liability insurance covers manufacturers, distributors, and retailers against claims related to product defects causing injury or damage. The better option depends on the specific risk exposure of the business, with cyber risk insurance suited for tech-reliant companies and product liability insurance critical for those involved in physical product creation and sales.

Connection

Cyber risk insurance and product liability insurance intersect in managing risks related to product failures involving digital components or software vulnerabilities. When a product's software causes data breaches or cyberattacks, cyber risk insurance covers the financial impact of cyber incidents, while product liability insurance addresses damages from defective or unsafe products. Together, these policies provide comprehensive coverage for manufacturers facing both technological risks and legal claims arising from cyber-related product malfunctions.

Key Terms

**Product Liability Insurance:**

Product liability insurance protects manufacturers, distributors, and retailers against claims arising from injuries or damages caused by defective products, covering legal fees, settlements, and judgments. It is essential for businesses involved in designing, producing, or selling physical goods to mitigate risks related to product failures or safety issues. Explore more to understand how product liability insurance safeguards your business assets and reputation.

Defective Products

Product liability insurance covers claims arising from injuries or damages caused by defective products, protecting manufacturers and sellers against financial losses linked to product flaws. Cyber risk insurance, however, addresses threats like data breaches, hacking, and cyber-attacks, not typically covering physical harm from product defects. Explore detailed differences and coverage options to choose the right protection for your business risks.

Legal Defense Costs

Product liability insurance primarily covers legal defense costs arising from claims related to bodily injury or property damage caused by a defective product. Cyber risk insurance covers legal defense expenses associated with data breaches, cyberattacks, and privacy violations, often including costs for forensic investigations and regulatory fines. Explore detailed comparisons to understand which policy best safeguards your business's legal defenses.

Source and External Links

Product Liability Insurance Guide for Small Businesses - This guide outlines how product liability insurance protects businesses from claims related to product defects, design flaws, and marketing errors that lead to customer harm.

Product Liability Insurance Explained - This document explains the importance of product liability insurance in protecting businesses from claims due to manufacturing flaws, design defects, and inadequate warnings.

Product Liability Insurance - This resource provides information on how product liability insurance covers businesses against claims of harm or damage caused by their products, including legal fees and medical care.

dowidth.com

dowidth.com