Cyber insurance covers financial losses and liabilities resulting from data breaches, cyberattacks, and IT system failures, protecting businesses against digital risks. Professional indemnity insurance safeguards professionals against claims of negligence, errors, or omissions in the services they provide, ensuring coverage for legal defense and damages. Explore the key differences and benefits of each insurance type to determine the best protection for your business needs.

Why it is important

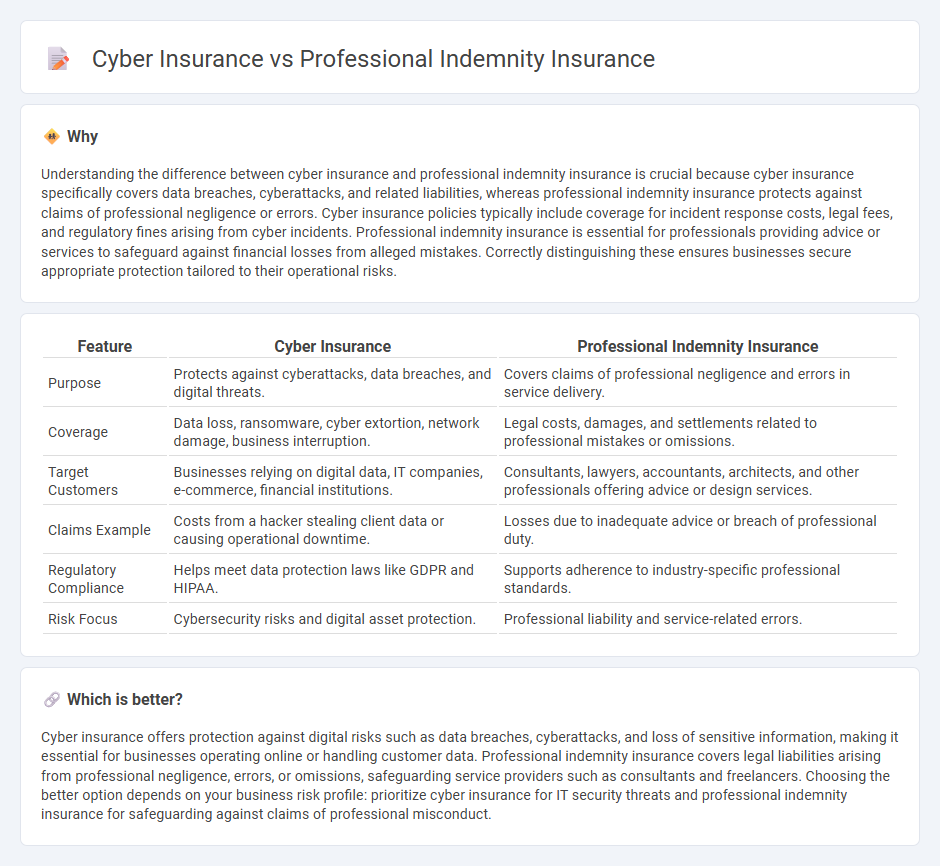

Understanding the difference between cyber insurance and professional indemnity insurance is crucial because cyber insurance specifically covers data breaches, cyberattacks, and related liabilities, whereas professional indemnity insurance protects against claims of professional negligence or errors. Cyber insurance policies typically include coverage for incident response costs, legal fees, and regulatory fines arising from cyber incidents. Professional indemnity insurance is essential for professionals providing advice or services to safeguard against financial losses from alleged mistakes. Correctly distinguishing these ensures businesses secure appropriate protection tailored to their operational risks.

Comparison Table

| Feature | Cyber Insurance | Professional Indemnity Insurance |

|---|---|---|

| Purpose | Protects against cyberattacks, data breaches, and digital threats. | Covers claims of professional negligence and errors in service delivery. |

| Coverage | Data loss, ransomware, cyber extortion, network damage, business interruption. | Legal costs, damages, and settlements related to professional mistakes or omissions. |

| Target Customers | Businesses relying on digital data, IT companies, e-commerce, financial institutions. | Consultants, lawyers, accountants, architects, and other professionals offering advice or design services. |

| Claims Example | Costs from a hacker stealing client data or causing operational downtime. | Losses due to inadequate advice or breach of professional duty. |

| Regulatory Compliance | Helps meet data protection laws like GDPR and HIPAA. | Supports adherence to industry-specific professional standards. |

| Risk Focus | Cybersecurity risks and digital asset protection. | Professional liability and service-related errors. |

Which is better?

Cyber insurance offers protection against digital risks such as data breaches, cyberattacks, and loss of sensitive information, making it essential for businesses operating online or handling customer data. Professional indemnity insurance covers legal liabilities arising from professional negligence, errors, or omissions, safeguarding service providers such as consultants and freelancers. Choosing the better option depends on your business risk profile: prioritize cyber insurance for IT security threats and professional indemnity insurance for safeguarding against claims of professional misconduct.

Connection

Cyber insurance and professional indemnity insurance both protect businesses from financial losses related to professional services, with cyber insurance focusing on data breaches and cyberattacks, while professional indemnity insurance covers claims of negligence or errors in service delivery. Organizations facing cyber risks often require both policies to address the legal liabilities arising from compromised client data and alleged professional mistakes. These insurances collectively mitigate risks associated with digital operations and professional accountability in industries such as IT, finance, and healthcare.

Key Terms

**Professional Indemnity Insurance:**

Professional indemnity insurance safeguards businesses and professionals against claims arising from negligence, errors, or omissions during service delivery, offering financial protection for legal costs and damages. This insurance is essential for consultants, lawyers, accountants, and healthcare providers to maintain trust and credibility with clients. Explore more about how professional indemnity insurance can protect your business reputation and financial stability.

Negligence

Professional indemnity insurance primarily covers claims arising from negligence, errors, or omissions in the provision of professional services, protecting businesses against financial losses due to legal liabilities. Cyber insurance, on the other hand, focuses on risks related to data breaches, cyberattacks, and IT system failures, offering coverage for cyber liability and incident response costs. Explore more to understand how these policies can safeguard your business against negligence-related and cyber-specific risks.

Legal Liability

Professional indemnity insurance primarily covers legal liability arising from claims of negligence, errors, or omissions in professional services, protecting businesses against financial losses and legal defense costs. Cyber insurance focuses on legal liability related to data breaches, cyberattacks, and privacy violations, addressing costs associated with notification, legal fees, and regulatory fines. Explore the distinct legal protections offered by professional indemnity and cyber insurance to determine which best suits your risk profile.

Source and External Links

Professional Indemnity Insurance: What Is It and Why Do You Need It - This article explains how professional indemnity insurance protects professionals against claims of negligence, poor advice, and other errors.

Professional Indemnity Insurance - ABI - Professional indemnity insurance covers the cost of compensating clients for loss or damage resulting from negligent services or advice provided by a business.

Professional Indemnity Insurance | Insureon - This type of insurance protects businesses from financial losses associated with legal action due to errors or mistakes in professional services.

dowidth.com

dowidth.com