Drone insurance protects against damages, liability, and loss related to unmanned aerial vehicles used in commercial operations, while business interruption insurance covers income loss and ongoing expenses when a business is temporarily unable to operate due to insured events such as natural disasters or equipment failures. Understanding the distinctions between these policies helps businesses mitigate specific risks associated with drone usage and operational disruptions. Explore more about how these insurance types safeguard your business assets and continuity.

Why it is important

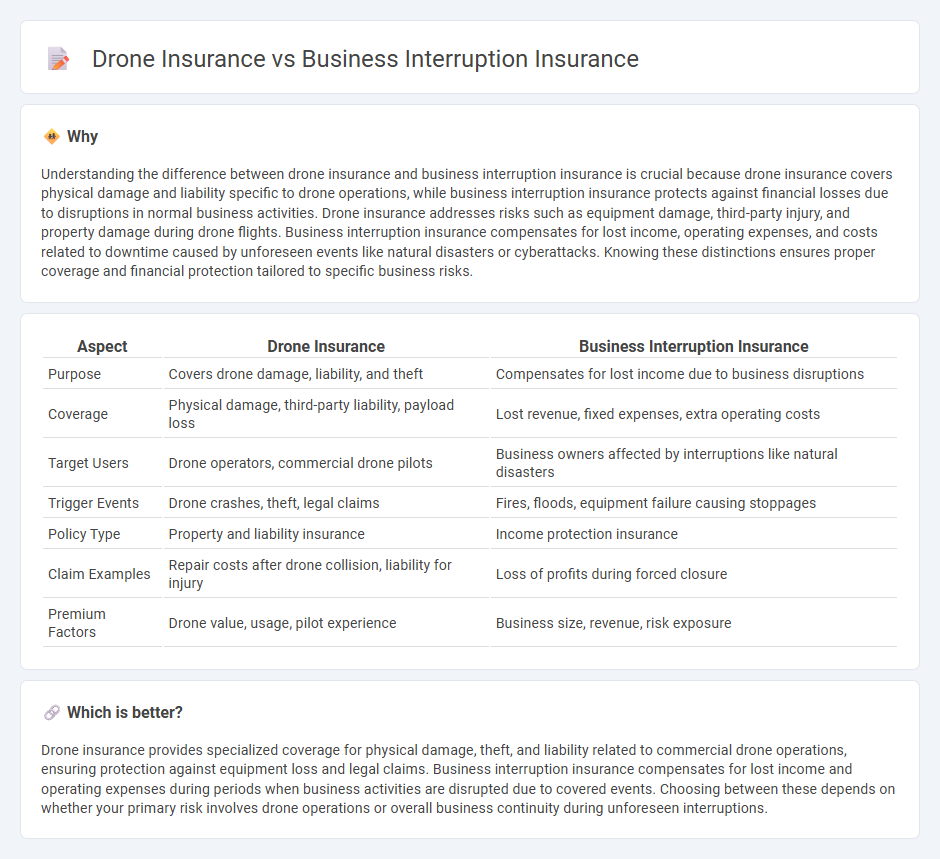

Understanding the difference between drone insurance and business interruption insurance is crucial because drone insurance covers physical damage and liability specific to drone operations, while business interruption insurance protects against financial losses due to disruptions in normal business activities. Drone insurance addresses risks such as equipment damage, third-party injury, and property damage during drone flights. Business interruption insurance compensates for lost income, operating expenses, and costs related to downtime caused by unforeseen events like natural disasters or cyberattacks. Knowing these distinctions ensures proper coverage and financial protection tailored to specific business risks.

Comparison Table

| Aspect | Drone Insurance | Business Interruption Insurance |

|---|---|---|

| Purpose | Covers drone damage, liability, and theft | Compensates for lost income due to business disruptions |

| Coverage | Physical damage, third-party liability, payload loss | Lost revenue, fixed expenses, extra operating costs |

| Target Users | Drone operators, commercial drone pilots | Business owners affected by interruptions like natural disasters |

| Trigger Events | Drone crashes, theft, legal claims | Fires, floods, equipment failure causing stoppages |

| Policy Type | Property and liability insurance | Income protection insurance |

| Claim Examples | Repair costs after drone collision, liability for injury | Loss of profits during forced closure |

| Premium Factors | Drone value, usage, pilot experience | Business size, revenue, risk exposure |

Which is better?

Drone insurance provides specialized coverage for physical damage, theft, and liability related to commercial drone operations, ensuring protection against equipment loss and legal claims. Business interruption insurance compensates for lost income and operating expenses during periods when business activities are disrupted due to covered events. Choosing between these depends on whether your primary risk involves drone operations or overall business continuity during unforeseen interruptions.

Connection

Drone insurance mitigates risks related to drone operations, covering damages, liability, and accidents that can disrupt business activities. Business interruption insurance compensates for income loss during operational downtime, which may result from drone incidents causing property damage or legal liabilities. Integrating both policies ensures comprehensive protection for businesses relying on drone technology, minimizing financial risks from drone-related disruptions.

Key Terms

**Business Interruption Insurance:**

Business Interruption Insurance covers lost income and operating expenses when unforeseen events like natural disasters or equipment failures disrupt business operations. It ensures financial stability during downtime by compensating for revenue loss and ongoing costs, helping businesses recover and maintain cash flow. Explore how Business Interruption Insurance can safeguard your company's resilience during unexpected closures.

Loss of Income

Business interruption insurance covers loss of income during periods when normal operations are halted due to covered events like natural disasters or property damage. Drone insurance primarily focuses on third-party liability and physical damage to the drone but may include coverage for income loss if the drone is integral to business operations. Explore detailed policy options to understand how each insurance type protects your revenue streams.

Period of Restoration

Business interruption insurance typically covers loss of income during the period of restoration after a covered event, ensuring financial stability while operations resume. Drone insurance focuses on liability, hull damage, and sometimes loss of income, but the period of restoration may be shorter or defined differently depending on policy specifics. Explore detailed comparisons to understand how each insurance addresses restoration timelines for optimal coverage.

Source and External Links

Business Interruption Insurance: Coverage, Quotes & Policies - Business interruption insurance helps replace lost income and expenses if a business temporarily shuts down due to a covered peril like fire, theft, or natural disasters, and is often bundled with property insurance or available as a standalone policy.

Business interruption insurance and coverage basics - Chubb - This insurance covers operating expenses and lost income when a business cannot operate normally due to physical damage from a covered peril and can include costs such as payroll, taxes, and rent during closure.

Insurance Topics | Business Interruption & Business Owner Policy - Business interruption insurance can include contingent business interruption for supply chain disruptions and extended business interruption covering income loss after property repair, with premiums varying by risk factors like location and industry.

dowidth.com

dowidth.com